Real Estate Stocks vs. Physical Property

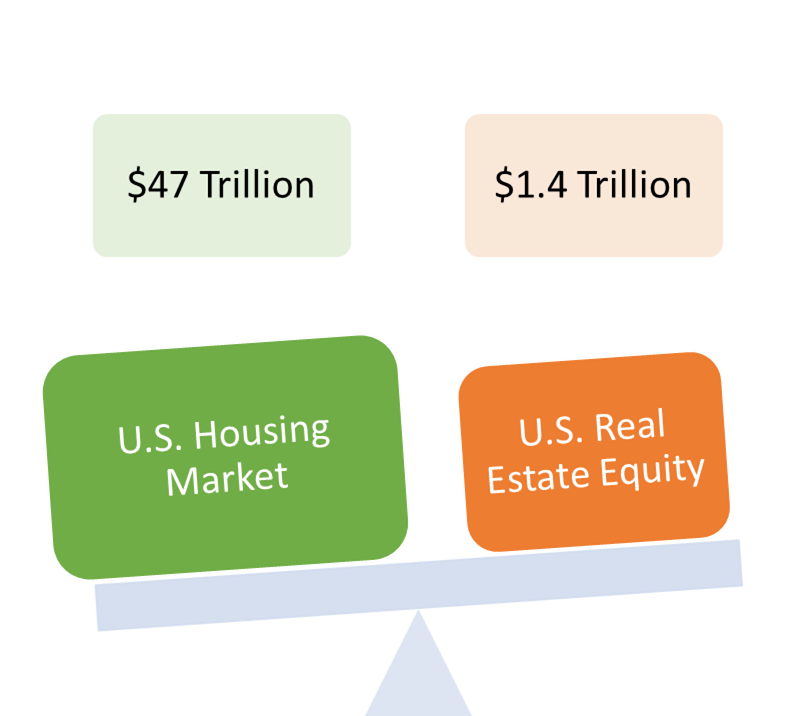

Real estate assets go beyond owning shares in publicly traded real estate businesses. While U.S. financial real estate assets (or the real estate equity sector) were valued at $1.40 trillion in June 2023, the total value of the U.S. housing market (i.e., physical real estate assets of land and permanent structures or improvements, like houses and buildings, that boost the value of raw land) reached an all-time high of USD 47 trillion!

Owning physical real estate assets involves buying a house, rental property, or land. In comparison, owning financial real estate assets involves buying shares of related businesses on the stock market.

Real estate returns come in two forms: regular payments from renters (i.e., rental income) or the surplus of the selling price over the buying price (i.e., capital gains).

Types Of Real Estate Assets

Real estate assets, in the physical and not financial world (i.e., real estate equity sector), fall into five buckets:

- Residential – includes single-family homes, condos, cooperatives, duplexes, townhouses, and multifamily residences;

- Commercial – includes apartment complexes, gas stations, grocery stores, hospitals, hotels, offices, parking facilities, restaurants, shopping centers, stores, and theatres;

- Industrial – includes property used for manufacturing, production, distribution, storage, and research and development;

- Raw land – includes undeveloped property, vacant land, and agricultural lands such as farms, orchards, ranches, and timberland;

- Special-use – includes public-use land like cemeteries, government buildings, libraries, parks, places of worship, and schools.

Factors Influencing Property Valuations

The number of new residential construction or housing starts (U.S. and Canada) is a crucial indicator of the health and direction of the physical real estate market, which is governed by supply and demand.

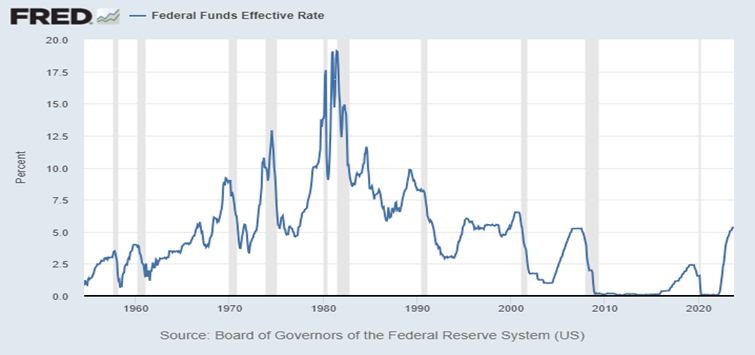

Construction is materials and capital-intensive and usually funded by loans. So, inflation and interest rates significantly impact real estate values, as you can see from the yellow and grey lines on the housing starts and interest rate charts below, both representing recessions.

Rising inflation increases building costs by raising materials and energy prices. It also increases construction workers’ wages, which impacts the overall project cost. Moreover, rising interest rates usually follow rising inflation and increase building projects’ loan costs. These mounting expenses reduce the housing supply and inflate existing and new home values.

Suppose interest rates stay high for too long. It eventually destroys housing demand and cuts existing and new home values as it slows down the overall economy. That’s because an economic slowdown leads to cuts in business borrowing and operations, wages, and jobs. At the same time, it boosts mortgage and rent payment failures or delinquencies, putting a strain on the banking and credit system.

Moreover, location drastically affects real estate values. Factors like employment and crime rates, transport facilities, school quality, municipal services, and property taxes play a huge role in property valuation. Real estate is also illiquid, i.e., it takes time to sell or convert to cash. Also, it often requires debt to buy (i.e., mortgage loans) and is time-consuming and expensive to manage and maintain.

Let’s see how things stand in a few significant economies’ real estate market.

Real Estate Market In The United States And Canada

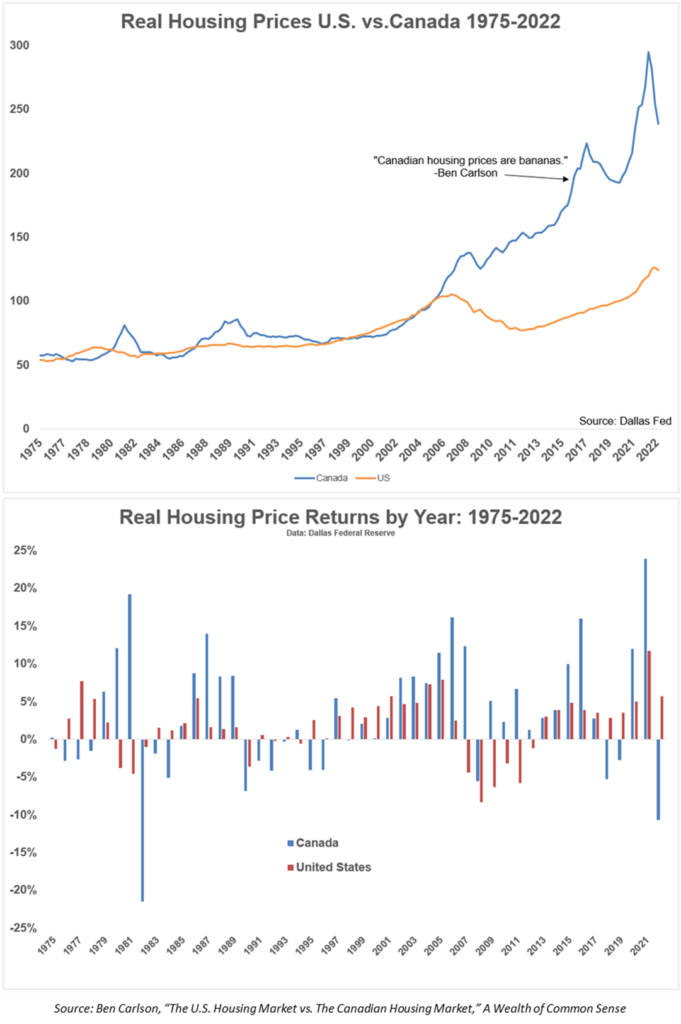

Yes, housing prices surged in the U.S. in the last few years, but have you seen Canada?! These charts by Ben Carlson show that Canadian housing prices have risen 142% since 2005. And that’s after adjusting for inflation. In contrast, real (i.e., accounting for inflation) housing prices in the U.S. have only increased by 26% in the same period, which is pitiful by Canadian standards.

Canadian housing prices would need to collapse by about 40% to get back in line with U.S. real housing price growth. That would be brutal for existing and new homeowners. Moreover, the Canadian housing anomaly is the same year-by-year, where we see more significant gains and losses in Canada compared to the U.S.

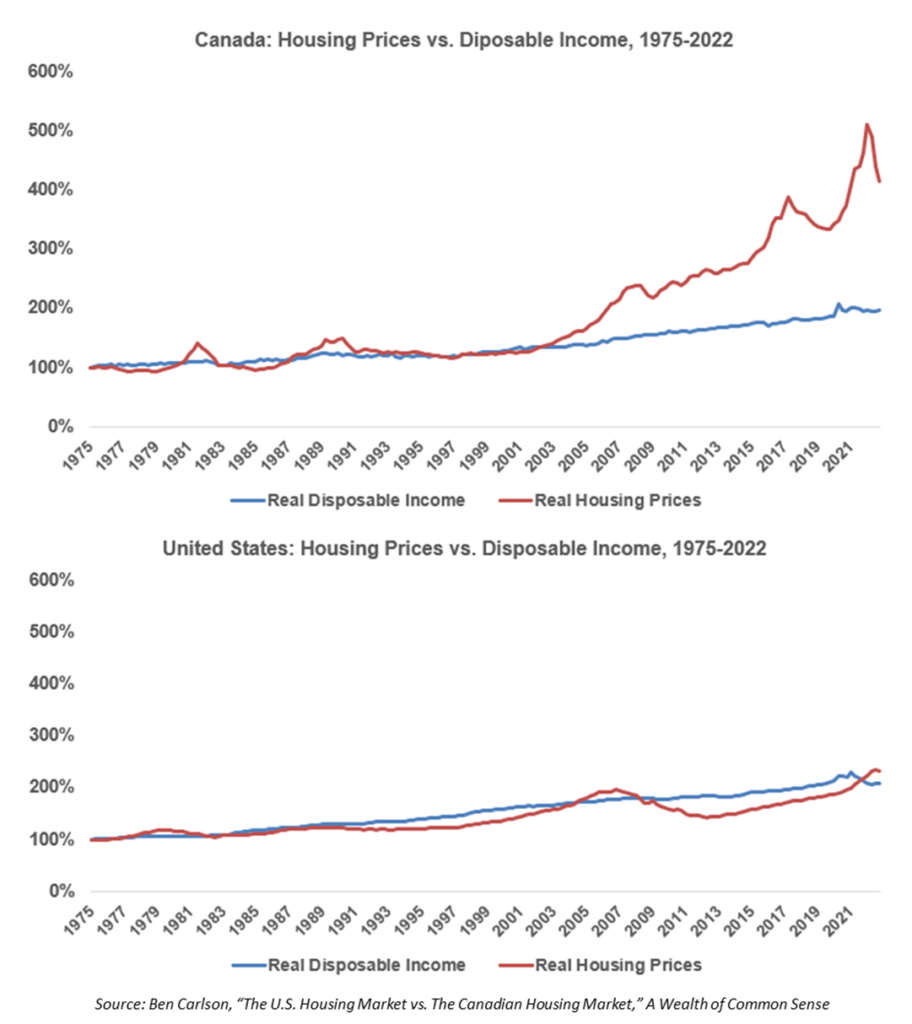

Things get crazier when you pit the real gains in housing prices against the real gains in disposable income since 1975. In the U.S., over the last 50 years, the relationship between incomes and housing prices after accounting for inflation has been close and relatively stable. But the Canadian housing market has gone haywire in the last two decades.

Real Estate Market In Germany (Eurozone)

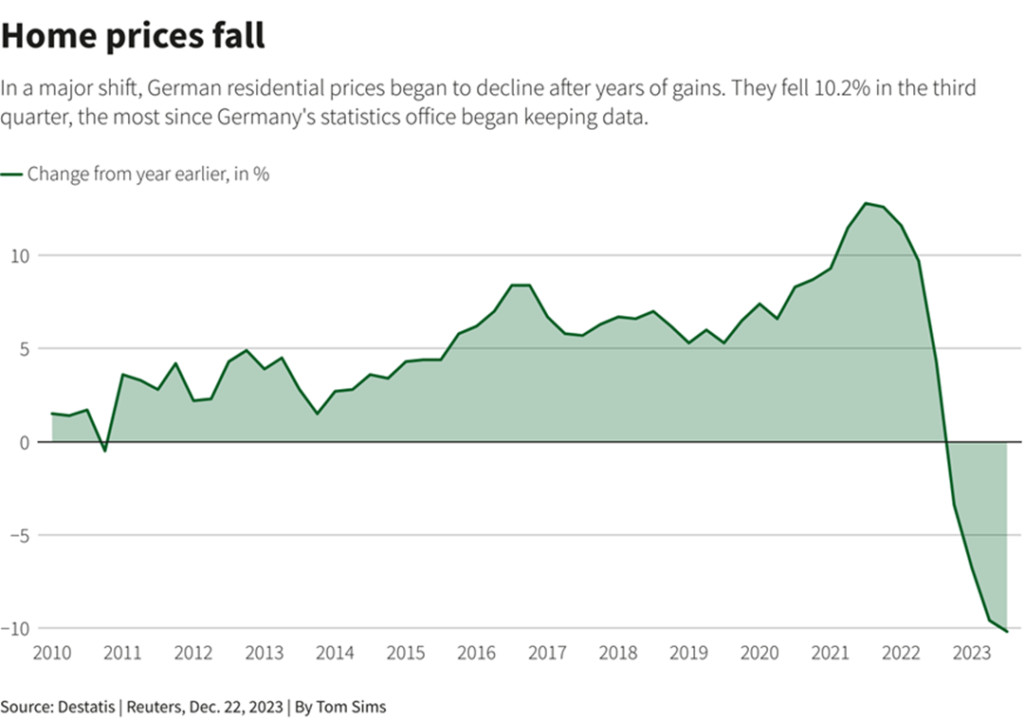

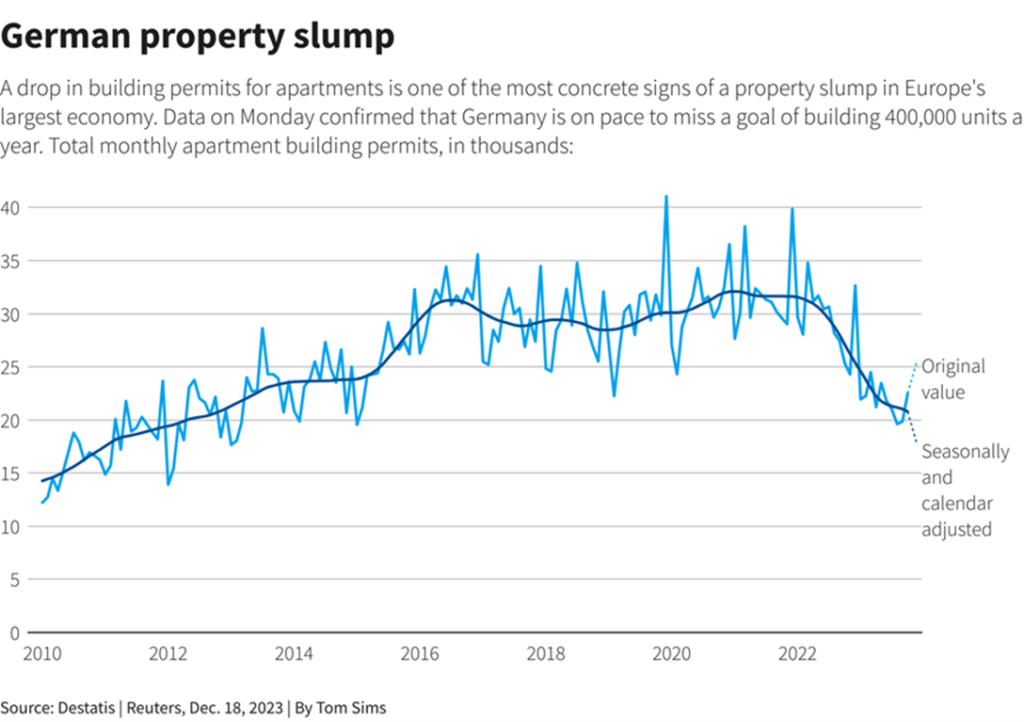

Eurozone interest rates had been near 0% since 2015 but rose rapidly to 4.5% beginning in 2022. One of the results is the bursting of the German residential property bubble, with four consecutive quarters of decline. The last of those quarterly slumps was the most significant since records began in 2000.

The German property crisis has already claimed Austrian property giant Signa. The business had significant operations in Germany and had to file for bankruptcy in November 2023.

As dire as it sounds, this situation may not be a complete disaster for Germany. As more than half of Germans rent, the year-on-year real wage growth is 0.6% (barely positive and is at 2016 levels, but positive nonetheless), and disposable income is healthy and has been rising consistently.

So, many of those renters could step in with their large disposable incomes to buy homes at bargain prices. However, German household debt is 54% of nominal GDP, which could be a showstopper.

Right! That does it for the real estate asset class. You may want to explore equities or stocks, fixed income or bonds, cash and cash equivalents, commodities, and alternative asset classes.