What Are Bonds Or Fixed Income Assets?

Suppose you want to expand the small business you own, but you’re strapped for cash. Yet, you don’t want to sell ownership stakes (i.e., shares), or you’ve already sold all the shares you’re comfortable selling. You could borrow the funds from willing lenders with a commitment to repay with interest, meaning you issue them debt or bonds. Those lenders now own your debt and become bondholders.

Let’s explore how all that works and peek into the world of the fixed income or bond asset class.

Businesses and governments can obtain outside funds by borrowing. They do so by issuing bonds (i.e., selling debt) with a fixed or variable interest, a set payment frequency, and an agreed repayment period to interested lenders. A bond’s interest payment is also called a coupon, and its repayment period is also called its duration.

Bonds reach maturity at the end of their duration. At that time, the borrower, or bond issuer, must return the amount they borrowed, or the principal, back to the lenders or bondholders.

For some bonds, the issuer has the right to pay off or call the debt early and stop making coupon payments to bondholders. These are known as callable or redeemable bonds.

Moreover, a single lender can rarely meet a borrower’s needs. That’s why bonds are usually issued in units, so each lender can buy as many units as they can afford. A bond’s coupon and duration apply equally to each unit sold to the bondholders.

Bond Prices, Inflation And Interest Rates

The price of a bond and the coupon paid to lenders depend on prevailing and anticipated inflation and interest rates and the borrower’s likelihood of default. Default occurs when the bond issuer cannot pay the coupon in line with the payment interval or repay the principal at maturity. As the risk of default (i.e., credit risk) rises, so does the coupon the borrower must offer to entice lenders to buy their riskier bond.

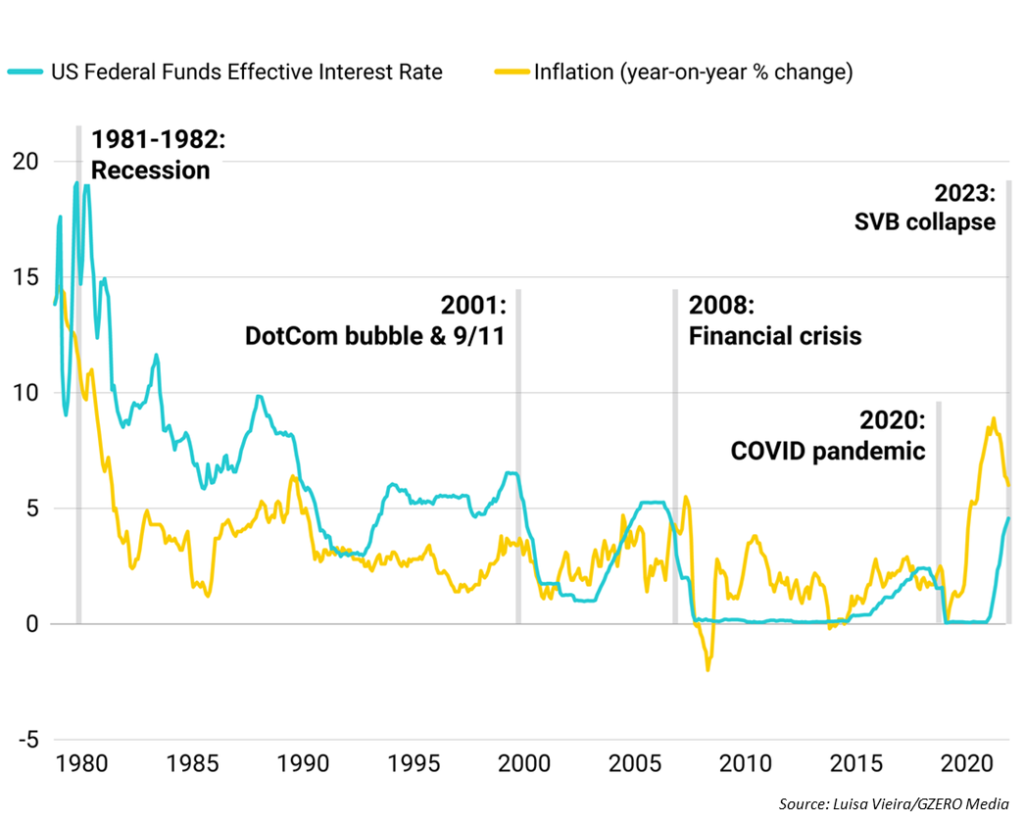

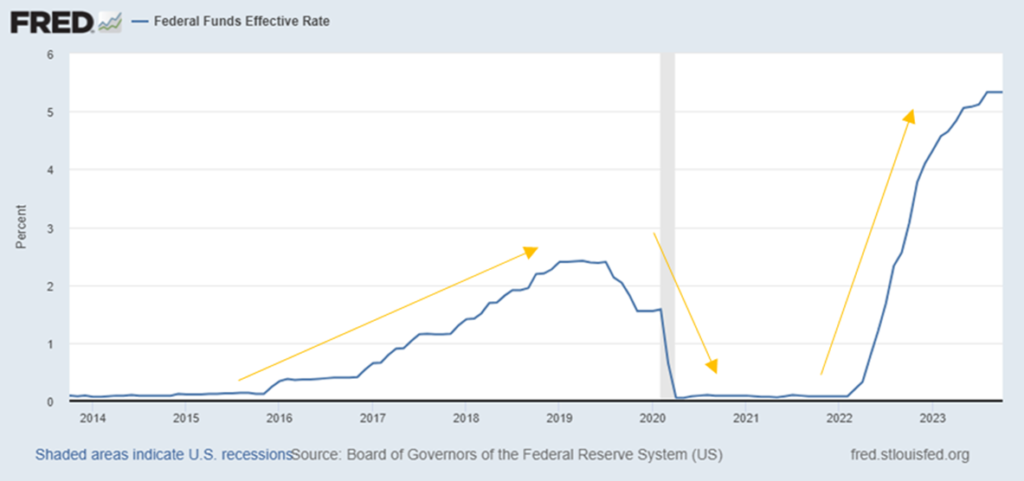

The positive correlation between inflation and interest rates is well established as raising interest rates is central banks’ primary tool to control rising or high inflation. High or rising inflation and interest rates during a bond’s duration means that bondholders’ principal and coupons will be worth less when they receive them in the future.

So, the yield or interest rate on bonds issued in such periods must be high enough to compensate bondholders for the inflation and interest rate risks.

In such times, bond issuers are limited in the asking price they can set for their bonds. That’s because they need to make the bonds more attractive, given the possibility that interest rates will rise during the bond’s duration. Lenders can wait for bonds issued in the future at those higher interest rates instead of buying now, and this lack of demand would further drive down bond prices.

Interest Rates, Bond Prices, And Bond Yields

Bondholders can also resell their bonds to other lenders before maturity. Relative to the bond’s original issue price (i.e., its face value or par), the resale can occur at a:

- Lower price or at a discount to par, and the seller records a capital loss;

- Price equal to par, and the seller recoups the entire principal they invested in the bond, or;

- Higher price or at a premium to par, and the seller records a capital gain.

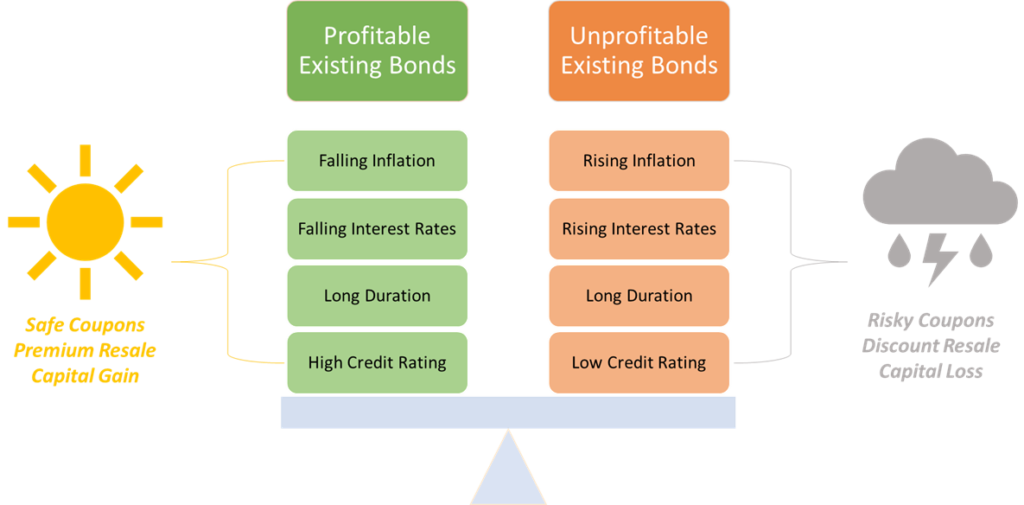

Like the original issue price, the resell price is inversely related to the available interest rates on similar bonds at the time of the resale, and that’s tied to current and expected inflation. So, borrowers or bond sellers sell their bonds at lower prices and offer higher interests or coupons in rising or high inflation and interest rate market phases. The opposite is true in a falling or low inflation and interest rate environment.

Bond Duration, Interest Rate, And Bond Prices

As a rule of thumb, for each percentage rise (or fall) in interest rate, a bond’s price falls (or rises) by the value of its duration expressed as a percentage. So, a 10-year duration bond’s price will fall (or rise) by 10% for each 1% rise (or fall) in interest rates.

This relationship explains why bond issuers pay off redeemable or callable bonds before maturity when inflation and interest rates fall. Bondholders only get the bond’s value at the pre-set call price, which is usually face value, so they get their principal back. But they lose the interest payments for the remaining duration. On the other hand, bond issuers can re-issue the called bonds at a higher price and lower coupon rates.

Default And Creditworthiness

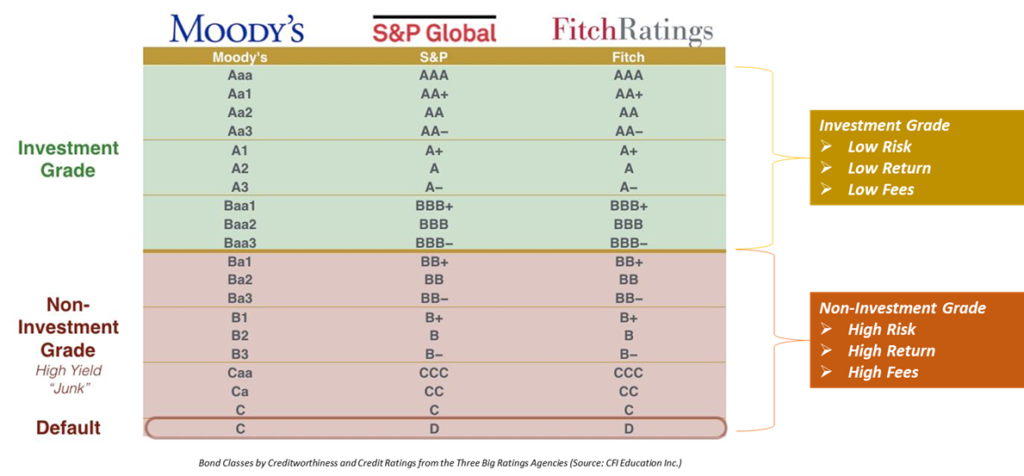

A borrower’s credit risk is summed up in its creditworthiness, like the credit score people get based on their income and loan repayment history. Three leading global credit rating agencies evaluate and publish credit ratings of corporations and governments – Moody’s, Standard & Poor’s (S&P), and Fitch.

For example, Standard & Poor’s rates borrowers on a scale of AAA (strong), A.A. (satisfactory), A (adequate), B (uncertain), C (likely default), and D (in default).

However, these ratings are not faultless, and as John Maxfield wrote for the Motley Fool, “rating agencies are always the last to know” when there’s trouble lurking in a borrower’s books.

For instance, Standard & Poor’s had an ‘A’ credit rating for bonds issued by Lehman Brothers, then the 4th largest U.S. investment bank, when the bank went bankrupt in the 2008 subprime mortgage crisis. Nevertheless, a borrower’s credit rating is essential, and the better it is, the lower the coupon it offers to attract lenders.

Risk And Reward When Investing In Bonds Or Fixed Income

As you probably guessed from the preceding discussion, borrowers’ default is not the only way bondholders can lose money on bonds. That can also happen if borrowers pay their debt early (i.e., call their bonds) or if bondholders resell their bonds at a price below par due to prevailing inflation and interest rates rather than holding them to maturity.

Taking call risk, inflation risk, and interest rate risk with borrowers’ default (or credit risk), it’s clear that although fixed-income assets are significantly less risky than equities, they are not risk-free.

Let’s see how the fixed-income or bond asset class is diced and spliced.

Types Of Fixed Income or Bonds

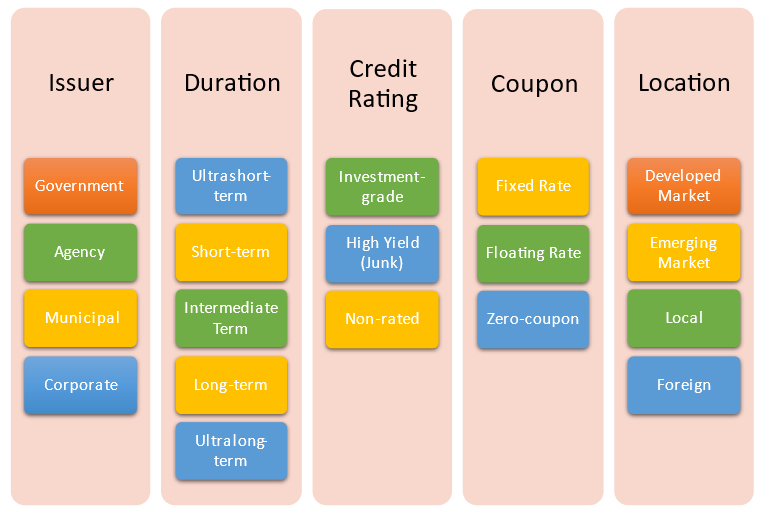

There are five ways bonds can be classified. By:

- Borrower or issuer type;

- Bond duration;

- Borrower creditworthiness;

- Bond coupon type, and;

- Borrower location.

There are four types of bond issuers – national or sovereign governments, government-backed agencies, municipal or local governments, and corporations or businesses in the private sector. Bond durations can be ultrashort, short, intermediate, long, or ultralong term, depending on the number of years to maturity.

Depending on a bond issuer’s credit rating, its bonds are classified as investment-grade, non-investment-grade (high yield or junk), and non-rated bonds. Based on the type of coupon a bond pays, it can be a fixed rate, floating rate, or zero-coupon bond.

Lastly, depending on where a bond issuer is located, its bonds can be developed or emerging markets and local or foreign bonds.

Let’s take a closer look at each of these bond classes.

Classifying Fixed Income Or Bonds By Issuer

Government Bonds

Government (or sovereign) Bonds are issued by Central Banks, like the U.S. Treasury and the Bank of Canada, as Bills with a duration less than or equal to a year, Notes having between one and ten years duration, or Bonds with a duration greater than ten years.

These bonds are backed by the full faith and credit of the issuing governments, and their coupons are serviced by the issuer’s taxation powers, making them the most creditworthy or low-risk but lowest-yielding bonds.

Some notes and bonds, like Canadian Real Return Bonds (RRBs) and U.S. Treasury Inflation-Protected Securities (TIPS), offer inflation protection by altering their principal and coupon rates with changes in the Consumer Price Index and providing a real rate of return.

A remarkable feature of government bonds is that their interest payments are taxable at the federal level but exempt from state and local taxes.

Moreover, some governments also issue small denomination savings bonds to individual investors that pay no coupons but are issued at a discount to their face value and are not subject to state, provincial, or local taxes. The bondholders realize the difference between their discounted price and the face value at maturity, and it acts as a fixed interest over the bond’s duration.

The U.S. Treasury still issues savings bonds like the Series E.E. or I bond. However, the Bank of Canada has stopped doing so. But the Province of Quebec still does.

Agency Bonds

Government-affiliated entities issue agency Bonds. They are either direct obligations of the government or fully guaranteed by the government. Their government backing makes them very creditworthy or low risk but lower yielding.

They offer higher coupons than government bonds while only being marginally riskier. Moreover, agency bonds are exempt from state and local taxes like government bonds.

Canada Mortgage Bonds issued by the Canada Mortgage and Housing Corporation (CMHC) is an example in Canada. Examples in the United States include bonds issued by the Federal National Mortgage Association (FNMA or Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac).

Municipal Bonds

Municipal Bonds (“Munis”) are issued by states, provinces, cities, counties, and other local governments to bankroll daily spending and capital projects like building roads, parks, and schools.

Based on how their principal and coupons are backed, they can be:

- General Obligation bonds – when backed by the taxes the municipality collects from residents;

- Revenue bonds – when backed by the revenue the municipality generates from the capital project (e.g., highway tolls) or;

- Conduit bonds – when backed by a 3rd party on whose behalf the municipality issued the bond (e.g., non-profit colleges or hospitals).

Municipal bond coupons are usually exempt from federal income tax, and they are always exempt from state/local tax if the bondholder lives in the municipality. Considering their tax advantages, municipal bond issuers usually offer lower interest or coupon rates than taxable bonds with similar duration and creditworthiness.

Corporate Bonds

Corporate Bonds are issued by corporations and businesses to raise funds instead of borrowing from banks (at higher interest rates) or issuing new shares (diluting existing shareholders). Companies are usually less creditworthy than governments, government agencies, and municipalities, so corporate bonds offer higher interest rates at higher risk. Moreover, corporate bond coupons are subject to federal and local taxes.

Apple Inc.’s May 2014 bond issuance was an example of a corporate bond. Apple (with AA+ S&P credit rating) issued 1 billion bond units at a 4.45% coupon rate and USD 99.459 face value maturing in 2044 (i.e., 30-year duration). Back then, the U.S. government (with AAA Fitch credit rating) Treasury’s 30-year bond yielded only 3.46%.

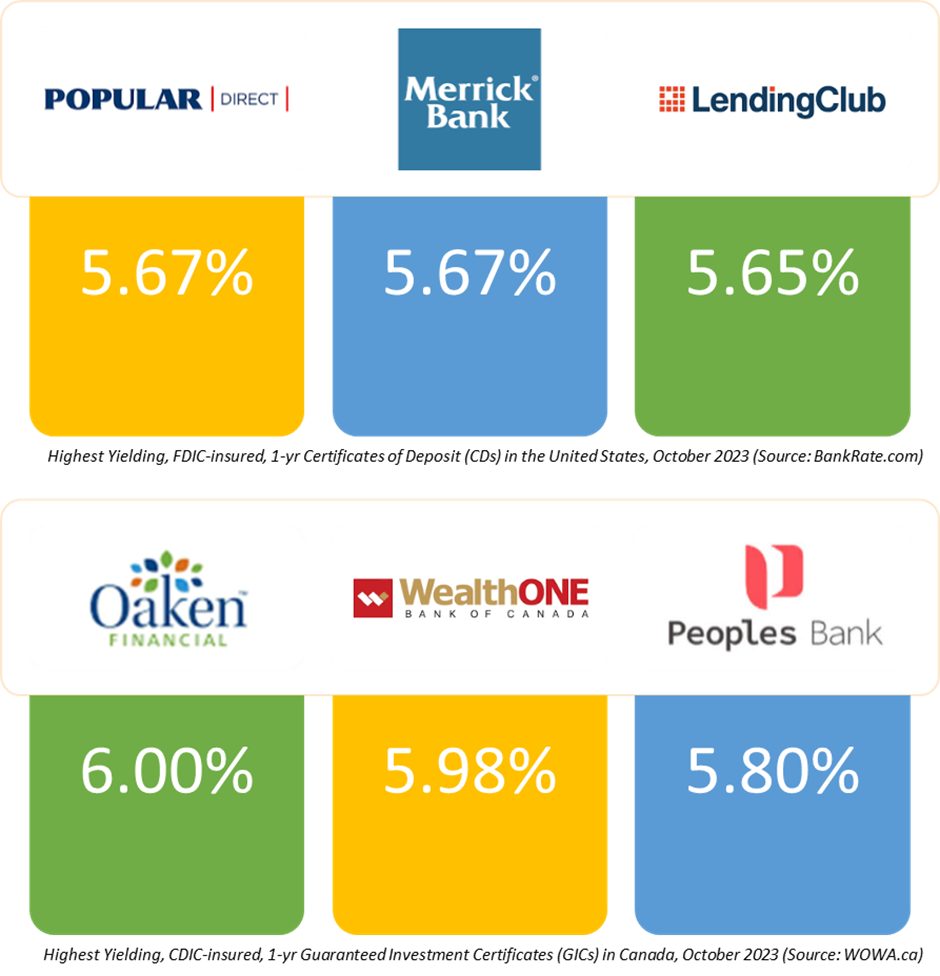

Canadian banks, trust companies, and brokerages issue their depositors Guaranteed Investment Certificates (GICs). In the U.S., banks, credit unions, or brokerages issue depositors Certificates of Deposits (CDs). GICs and CDs are not precisely corporate debt, and their issuers are not government-linked. Still, they offer you guaranteed interest and principal for the opportunity to turn a profit using your deposit.

GICs and CDs are issued with fixed or variable interest rates. Their principals or deposits are usually insured by the Canada Deposit Insurance Corporation (CDIC) or the Federal Deposit Insurance Corporation (FDIC). They are term deposits with a 3-month to 5-year duration and come in three main types – cashable, redeemable, and non-redeemable:

- Cashable ones allow no-penalty, any-time early withdrawals;

- Redeemable ones penalize early withdrawals, and withdrawals are possible only after a holding period;

- Non-redeemable ones do not allow early withdrawals and must be held to maturity.

In October 2023, the highest yielding CDIC-insured, 1-yr duration GICs in Canada were from Oaken Financial, WealthOne Bank of Canada, and Peoples Bank. In the U.S., the top three yielding FDIC-insured, 1-yr duration C.D.s were from Popular Direct, Merrick Bank, and the Lending Club.

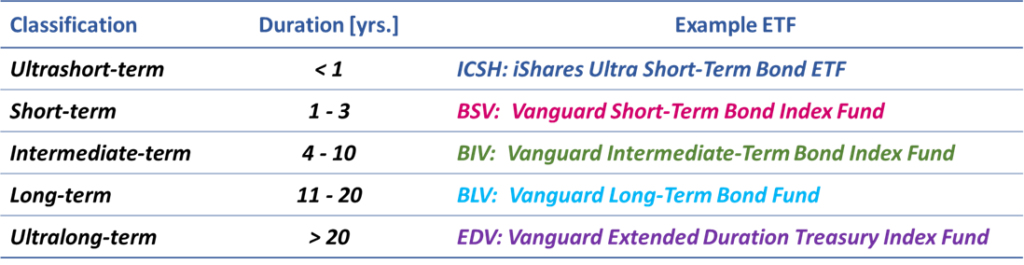

Classifying Fixed Income Or Bonds By Duration

Classifying bonds by duration results in the following:

- Ultrashort-term bonds have a duration of less than one year;

- Short-term bonds have a duration from one to three years;

- Intermediate-term bonds have a duration from four to ten years;

- Long-term bonds have a duration from eleven to twenty years;

- Ultralong-term bonds have a duration of over twenty years.

Any of the bond issuers discussed earlier could issue these bonds. Usually, bonds pay higher interests with increasing duration (i.e., exposure to bond market risks).

We’ve discussed the relationship between bond duration and changes in inflation and interest rates. Let’s see how that looks for bonds of different durations using government-issued bond ETFs as a proxy.

Comparing the bond price and yields of bond ETFs with varying durations over the last decade, we see that falling bond prices and rising bond yields accompany rising interest rates. Also, shorter-duration bonds are best suited to high/rising interest rate environments as their price falls the least while their yield increases quickly.

We can also see that rising bond prices and falling bond yields accompany falling interest rates. And longer duration bonds are best suited to low/falling interest rate environments as their price increases the most while their yield falls slowly.

Classifying Fixed Income Or Bonds By Creditworthiness

Investment-grade bonds are those issued by borrowers to whom the bond market assigns a lower likelihood of default and, as a result, higher credit ratings. Bonds rated Baa and above by Moody’s, or BBB and above by S&P and Fitch, are investment grade.

Since investment-grade bonds have lower default risk, they offer lower coupon rates or yields. Government, agency, general obligation municipal, and some corporate bonds fall into this category.

Non-investment-grade bonds are those issued by borrowers the bond market believes have a higher likelihood of default and, as a result, lower credit ratings. Bonds rated lower than Baa by Moody’s or BBB by S&P and Fitch are non-investment grade. Since non-investment-grade bonds have higher default risk, they offer higher coupon rates or yields. They are commonly called high-yield, speculative, or junk bonds.

Most bonds issued in emerging markets fall into the non-investment-grade category. Some corporate bonds fall into this category in developed markets – usually those issued by startups, capital-intensive firms with high debt-to-equity ratios, and fallen angels. Fallen angels are bond issuers that previously had high credit ratings.

Non-rated bonds are those issued by borrowers whose creditworthiness has not been rated by a reputable credit ratings agency. Revenue and conduit municipal bonds from some states, provinces, cities, and local governments are examples of non-rated bonds.

Classifying Fixed Income Or Bonds By Duration

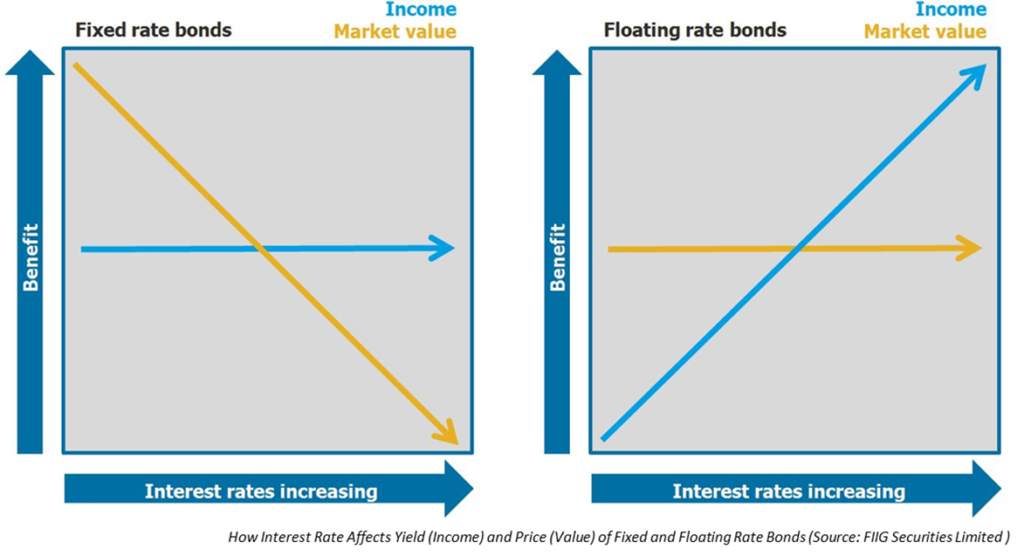

Fixed-rate bonds pay the same interest or coupon throughout their duration. The decreased interest rate risk usually comes with a lower coupon rate. Examples of fixed-rate bonds are U.S. Certificates of Deposit (or CDs) and Canadian Guaranteed Investment Certificates (or GICs).

Floating-rate bonds pay interest or coupons that vary with market interest rates. Interest rate risk is prominent here, so these bonds make sense when lenders expect market interest rates to rise. Examples of floating rate bonds are Real Return Bonds or RRBs in Canada and Treasury Inflation-Protected Securities or TIPS in the U.S., whose coupon rates adjust to the consumer price index or CPI every six months.

Zero-coupon bonds do not pay coupons. Instead, they offer a discounted purchase price relative to the bond’s face value, and the bondholder gets the face value at maturity. The difference between the discounted price and the face value is the bondholder’s total return, which mimics a fixed rate of return over the bond’s duration. Notably, holders of zero-coupon bonds with multi-year durations must pay taxes yearly even though they do not actually receive any income until the bond matures. Examples of zero-coupon bonds are U.S. Treasury bills.

Classifying Fixed Income or Bonds by Issuer’s Location

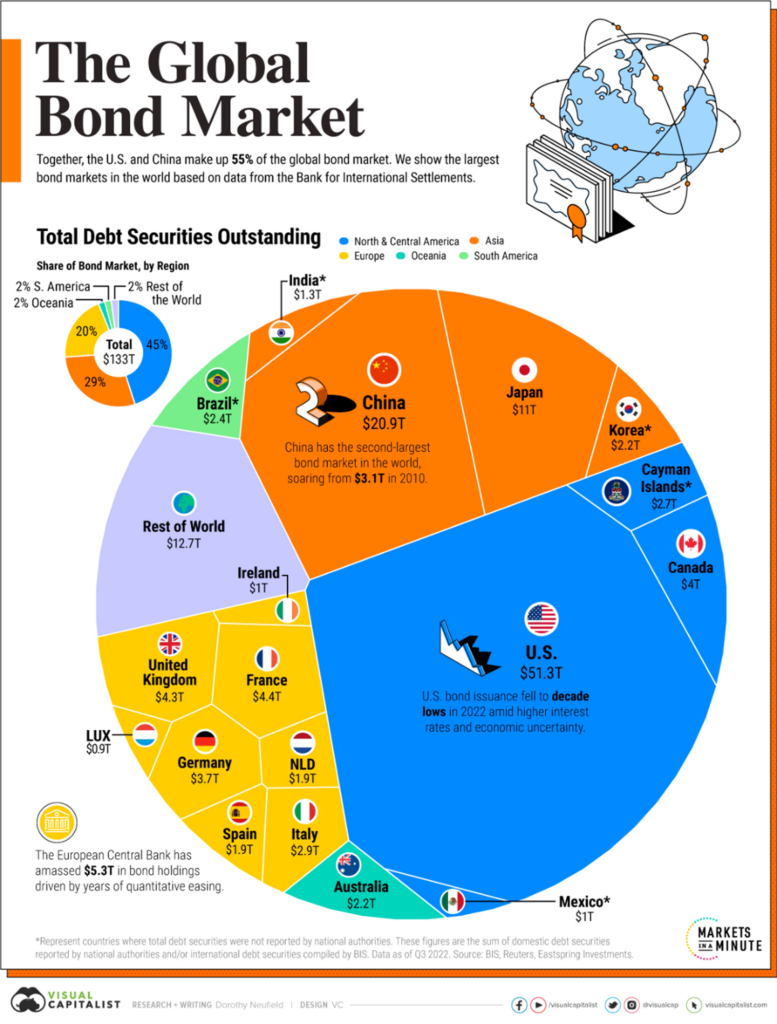

Governments and businesses or corporations issue bonds in countries around the world. As this chart (below) from Visual Capitalist shows, 45% of the global bond market is in the U.S., 29% is in China, and 20% is in the E.U. Suppose your bonds were issued outside your country of residence. In that case, you’ve acquired foreign bonds. Otherwise, you own local bonds.

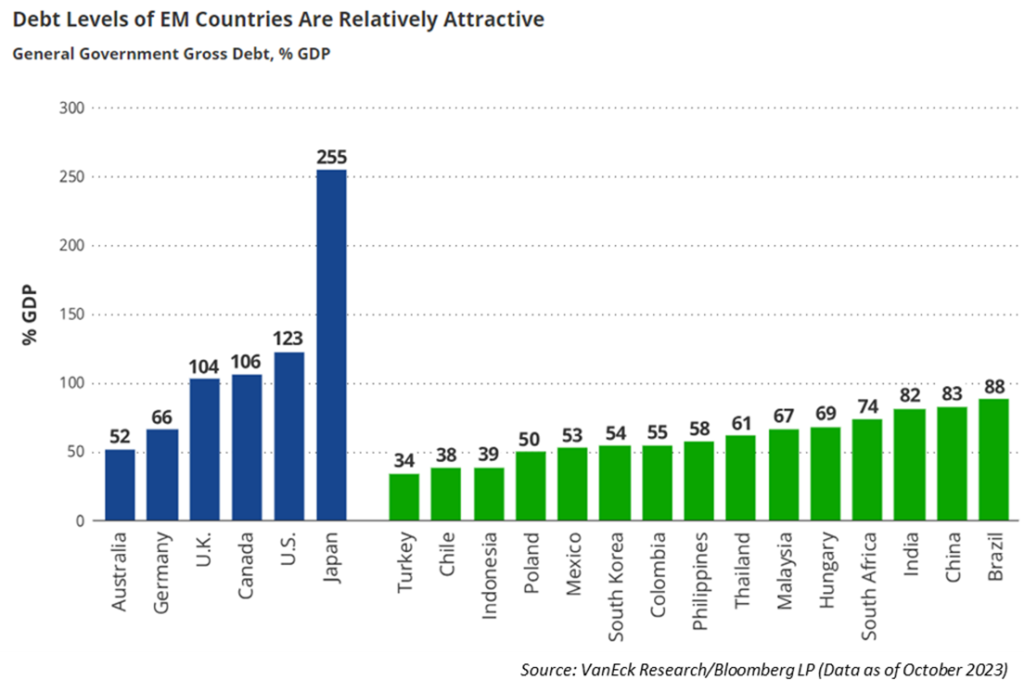

Developed market bond issuers are generally more creditworthy than their emerging market counterparts. However, one reason to be interested in government bonds issued outside of the developed markets is the relatively lower debt-to-GDP ratio of the issuing governments.

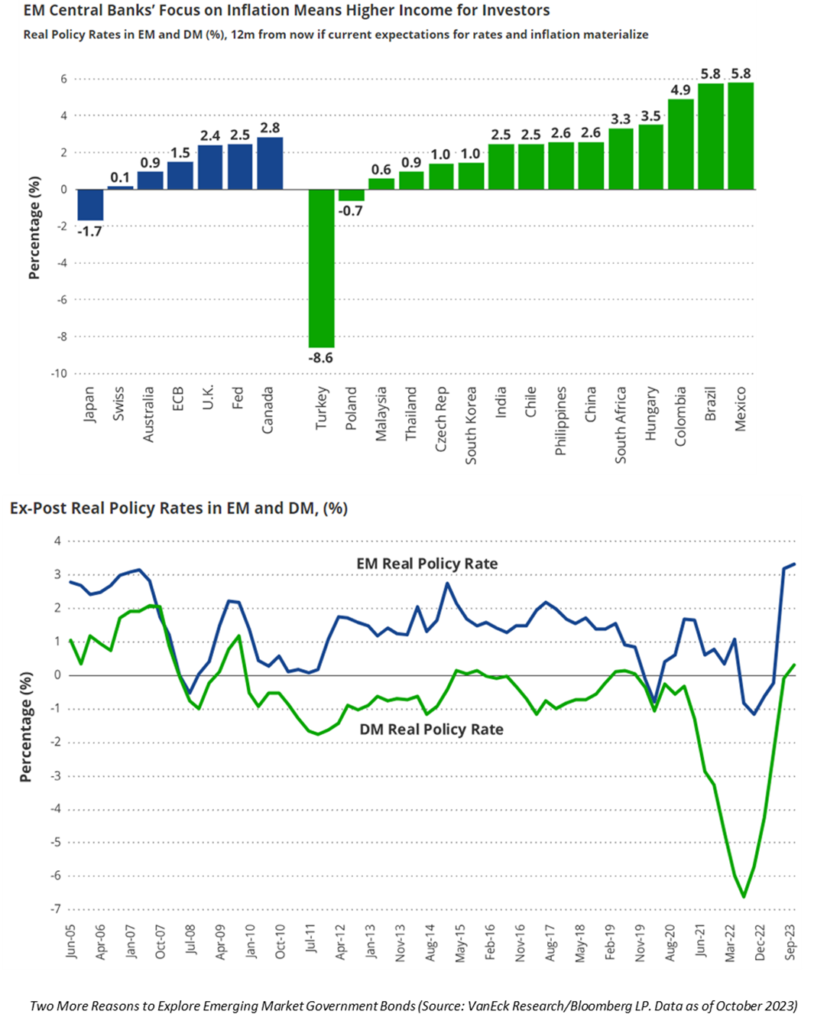

Here are two more reasons to explore emerging market government bonds:

- To start with, looking backward, their real rate of return, accounting for inflation, has been higher than those in developed markets;

- In addition, their interest rates are forecast to remain high or rise further.

Currency risk is a huge factor when looking at emerging market government bonds. Still, there are currency hedges available to blunt that risk.

Right! That does it for bonds or fixed income. You may want to explore equities or stocks, cash and cash equivalents, real estate, commodities, and alternative asset classes.