What Are Stocks?

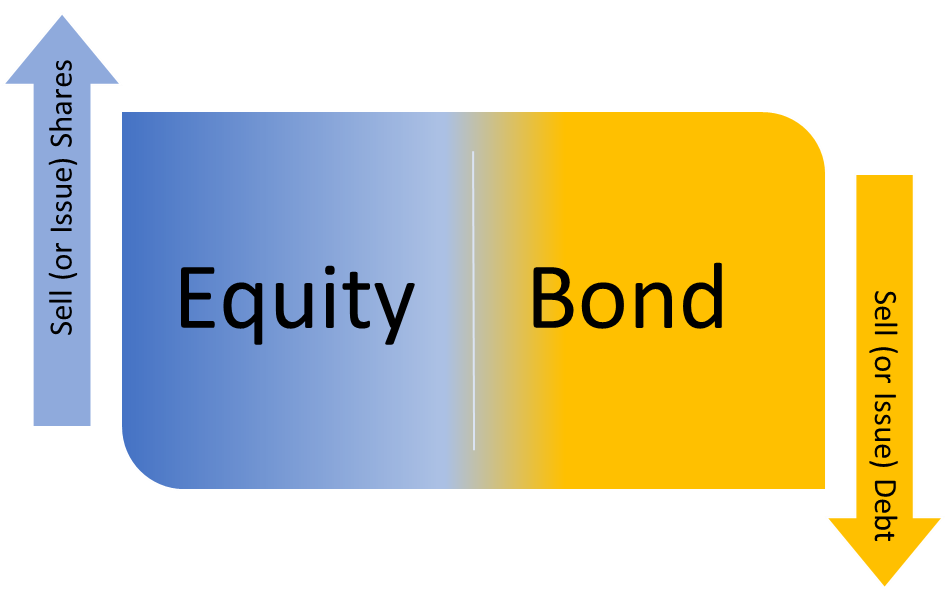

Suppose you own a small business and want to expand, but your ambition outstrips your financial capacity. How do you raise funds? Well, you have two choices. You could:

- Borrow the needed funds from willing lenders with a commitment or bond to repay them with interest, and this means that you issue your lenders debt or bonds or;

- Give up some ownership of the business to keen investors in exchange for the funds, which means you issue your investors equity or stocks.

Let’s explore that second option and peek into the world of the equity asset class.

As the owner of that business, you would list the business on a public stock exchange, like the New York Stock Exchange or the Toronto Stock Exchange. That’s done through an initial public offering, or IPO, which lets you sell slices of ownership in the business to the public.

Those ownership slices are called shares or equity, and the buyers become shareholders or investors in your newly minted, publicly traded company. So, you get the funds you need, the shareholders get a stake in the company in exchange for investing in your vision, and the return on their investment is now linked to the business’s profitability.

Risk And Reward When Investing In Stocks Or Equities

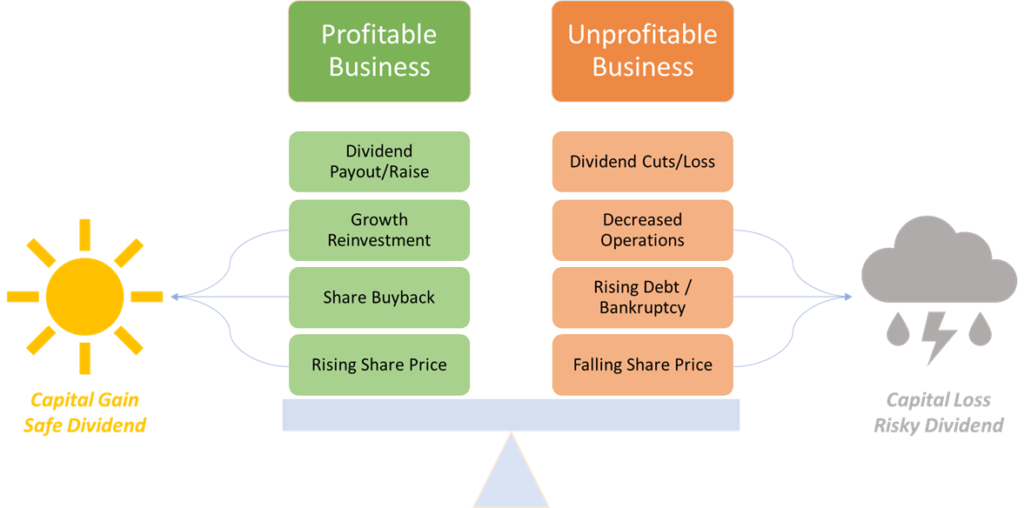

If the business earns a profit, it may pay a portion of that to its shareholders as dividends. Moreover, it could reinvest the profits into growing more value either in-house or by acquiring other businesses. Furthermore, it could buy back some of its shares from the stock market, reducing the supply of tradeable shares and boosting the price of outstanding shares, making its shareholders’ holdings more valuable.

On the other hand, if a business makes a loss, it may cut dividend payments to its shareholders or stop them entirely. It could also be unable to improve or expand operations and acquire assets or other businesses unless it dips into its cash reserves or goes into debt, which could spell more trouble ahead. The same goes for share buybacks. An unprofitable business could do it only by draining cash reserves or borrowing.

The more profitable a business becomes, the more valuable (i.e., in-demand) its shares get in the stock market, which raises its share price. The opposite is true for an increasingly unprofitable business.

So, if long-term shareholders were to sell their shares in a consistently profitable business, they would likely do so at a higher price than they originally paid. In other words, they would gain on their capital or realize a capital gain. So, dividends and capital gains are the two ways to realize an economic benefit from equity assets.

Conversely, if shareholders sell their shares in a consistently unprofitable business, they would likely do so at a lower price than they originally paid. In other words, they would lose part of their capital or realize a capital loss. Moreover, unprofitable businesses eventually go bankrupt, which means total capital loss for shareholders.

As you can see, equity assets are very risky as your principal and return on investment are not guaranteed. Moreover, when a company goes bankrupt, it liquidates its remaining assets by selling them off for cash, and it must settle its debts first before its shareholders get any leftovers.

This point is an excellent segway to talking about the different types of shares and the rights they give to shareholders.

Types Of Shares And Shareholder Rights

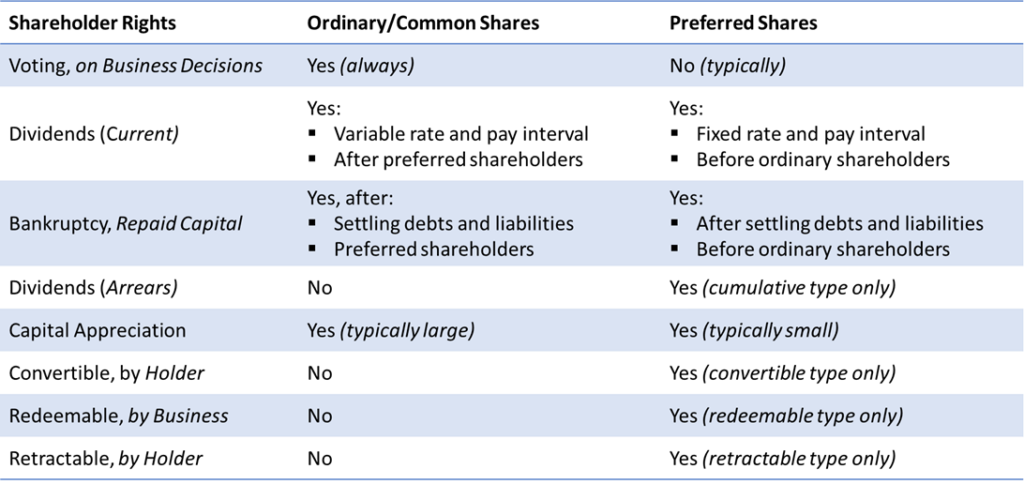

Generally, we have ordinary or common shares and preferred shares. Moreover, preferred shares can be cumulative, convertible, redeemable, or retractable.

Ordinary or common shares grant shareholders voting rights on business decisions. But they come with variable-rate unguaranteed dividends. Also, they have the lowest priority for dividend payment and (in a bankruptcy) capital repayment.

On the other hand, preferred shares do not grant shareholders voting rights on business decisions. However, they grant them fixed-rate guaranteed dividends. Additionally, they have the highest priority for both dividends and (in a bankruptcy) capital repayment.

With cumulative preferred shares, if the business issued dividends but missed paying them in the past, all unpaid dividends accumulate and must be paid to shareholders in the future. On the contrary, with common shares, all missed or unpaid dividends are gone forever.

Common shares usually have more significant capital appreciation or share price growth than preferred shares, where the bulk of the returns are the guaranteed dividends.

With convertible preferred shares, each share is eligible for conversion into a predefined number of common shares at any time the shareholder wants or after a restricted period. Meanwhile, common shares cannot be converted into preferred shares.

For redeemable or callable preferred shares, the business has the right to repurchase the shares from the shareholder at a pre-set price after a pre-set date. On the other hand, common shares belong to the shareholders forever or until they sell them.

With retractable preferred shares, the shareholder has the right to sell the shares back to the company at a pre-set price after a pre-set date. But if they don’t initiate a sale by that date, the business has the right to force them to do so in a hard retraction. In some cases, the business will convert the shares into ordinary shares instead of paying cash to the shareholder in a soft retraction. Conversely, this does not apply to common shares, which the shareholder owns forever or until they sell them.

Let’s see how the equity asset class is further diced and spliced.

Classifying Stocks By Market Sector

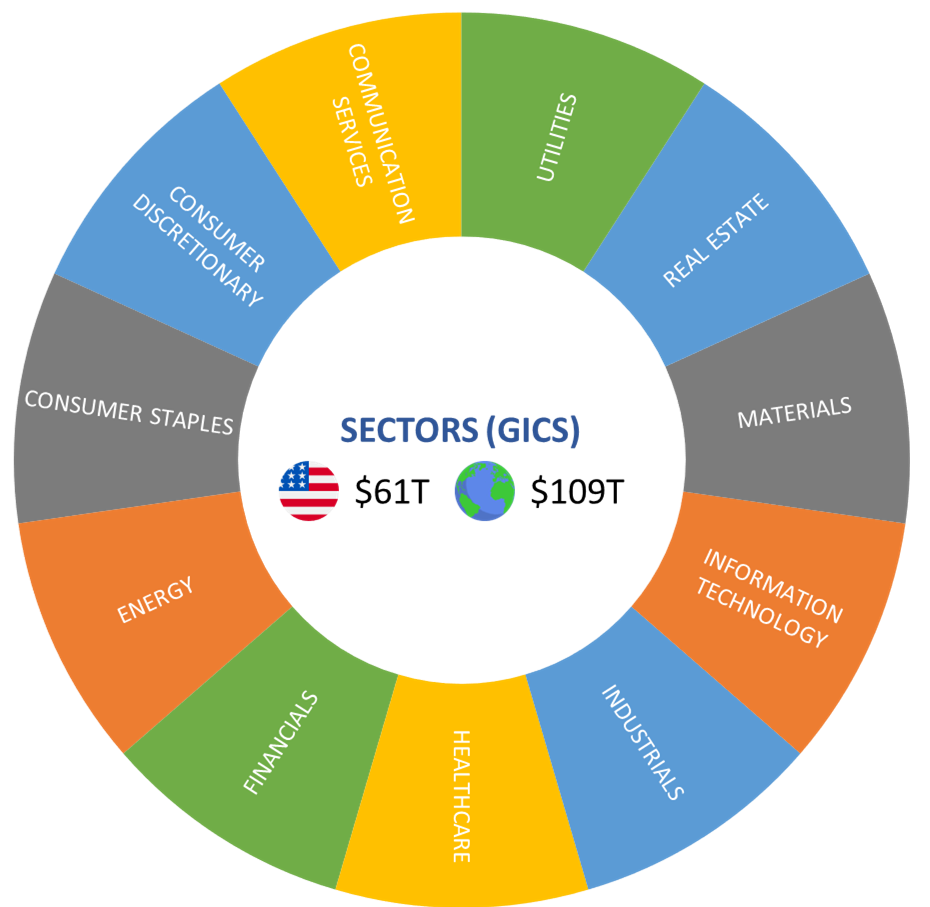

Eleven equity sectors exist per the Global Industry Classification Standard (GICS). They include:

- Communication Services

- Consumer Discretionary (or Consumer Cyclical)

- Consumer Staples (or Consumer Defensive)

- Energy

- Financials

- Healthcare

- Industrials

- Information Technology (or Technology)

- Materials (or Basic Materials)

- Real Estate, and

- Utilities

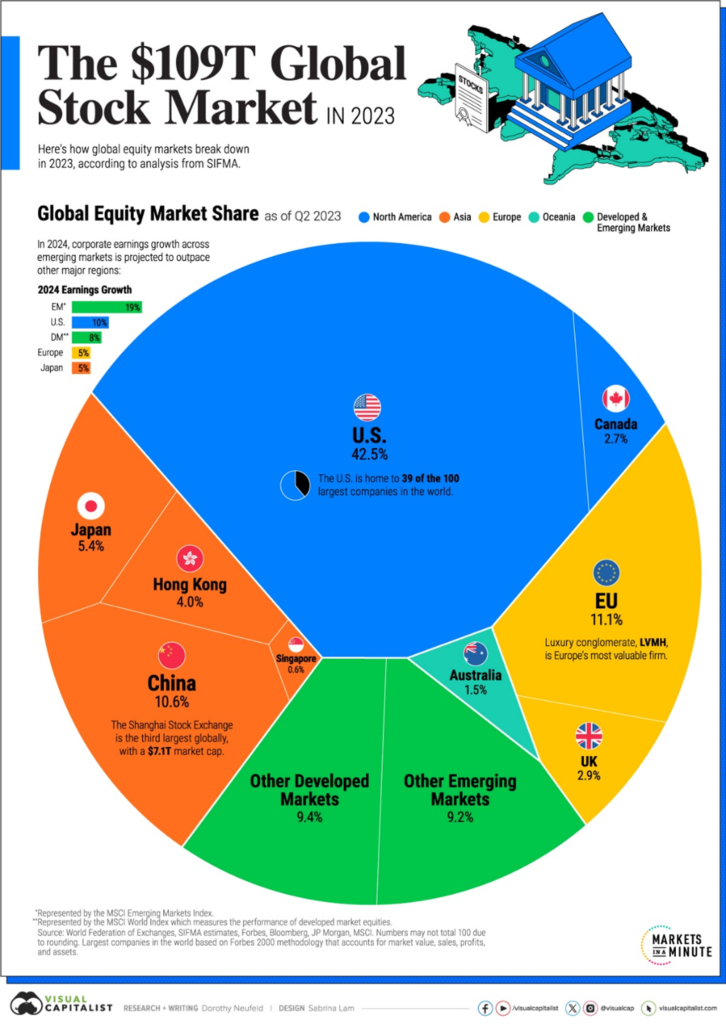

Moreover, the U.S. equity market is the big kahuna, with roughly 60% of the global pie.

These eleven equity sectors can be grouped into defensive, cyclical, and sensitive buckets based on how correlated their performance is with the overall economy.

Equity sectors in the defensive bucket are consumer staples, healthcare, and utilities. Defensive stocks provide consistent dividends and stable earnings regardless of the state of the economy. That’s because there is a constant demand for their products, so they tend to be more stable during different business cycles. This means they have low volatility (or risk), resulting in smaller downsides in economic bursts and upsides in economic booms.

Equity sectors in the cyclical bucket are materials, consumer discretionary, financials, and real estate. Cyclical stocks provide fluctuating dividends and earnings that correlate with the state of the economy. That’s because there is a cyclical demand for their products, with higher demand in economic boom and lower demand in economic burst phases. This means they are more volatile than defensive stocks, with larger downsides in bear markets and upsides in bull markets.

Equity sectors in the sensitive bucket are communication services, energy, industrials, and technology. They are more affected by the economy’s ebb and flow than defensive stocks, but not as much as cyclical stocks.

It’s interesting to note the similarity in the U.S. and global capital allocations to each sector. Still, there is divergence when it comes to:

- Materials and industrials, where the rest of the world allocates more capital than the U.S.;

- Technology and healthcare, where the U.S. allocates more capital than the rest of the world.

Let’s see what defines businesses in each equity sector and identify their largest companies, starting with those in the defensive bucket.

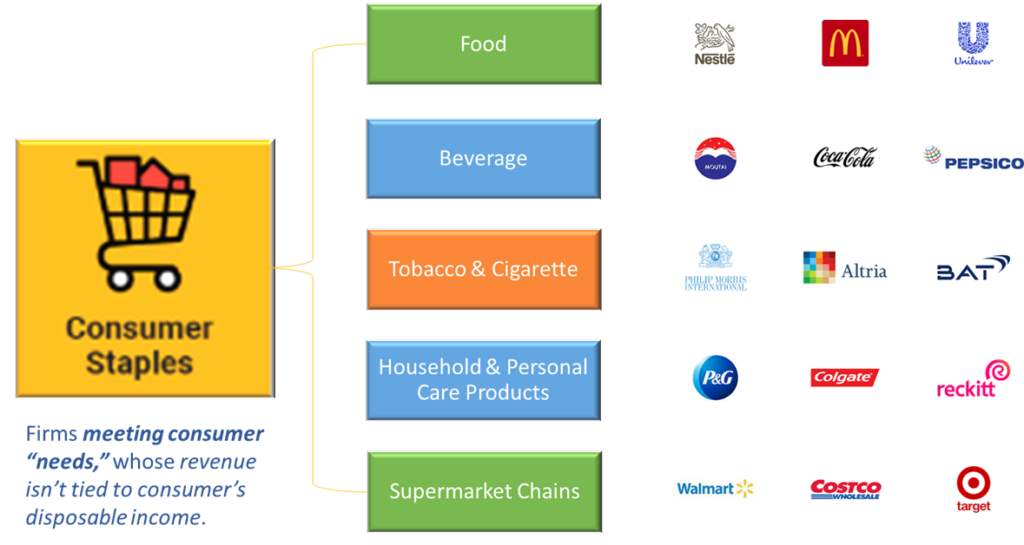

Consumer Staples

The Consumer Staples (or Consumer Defensive) sector includes businesses meeting consumer “needs,” whose revenue is not tied to consumers’ disposable income. The sector covers industries like:

- Food;

- Beverage;

- Tobacco and Cigarette;

- Household and Personal Care Products;

- Supermarket Chains.

Looking into these industries globally, we see that:

- The largest Food companies are Nestlé S.A., McDonald’s Corporation, and Unilever Plc;

- In the Beverage industry, Kweichow Moutai Co. Ltd., The Coca-Cola Company, and PepsiCo Inc. are the biggest businesses;

- Philip Morris International Inc., Altria Group, and British American Tobacco Plc are the leading Tobacco and Cigarette firms;

- In the Household and Personal Care Products industry, The Procter & Gamble Company, the Colgate-Palmolive Company, and Reckitt Benckiser Group Plc are the largest companies;

- Lastly, Walmart Inc., Costco Wholesale Corporation, and Target Corporation run the biggest Supermarket Chains.

Businesses in the consumer staples sector are vulnerable to demographic changes, product trends, price competition, food trends, and competitive marketing. Their valuations are also sensitive to environmental factors, government regulation, the general economy’s health, consumer confidence, and interest rates.

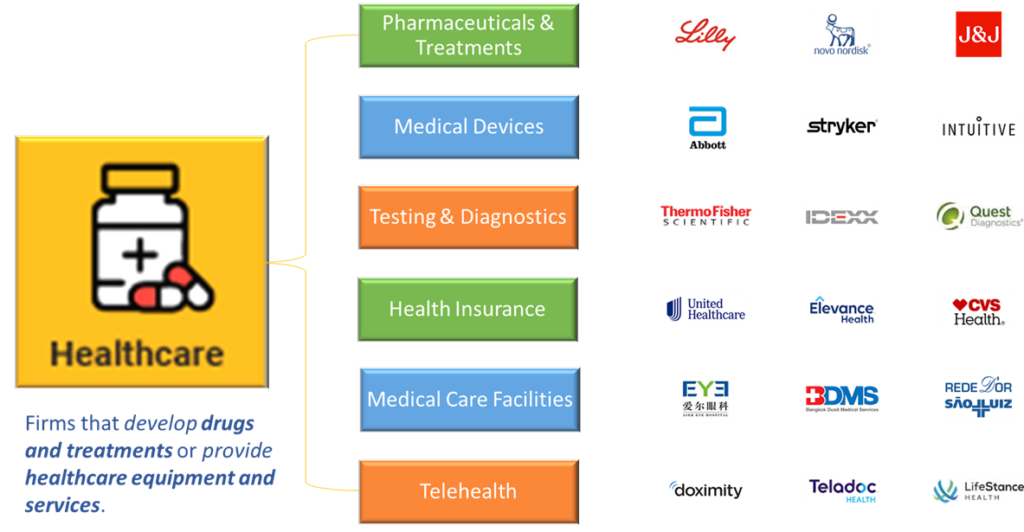

Healthcare

The Healthcare sector covers companies that develop drugs and treatments or provide healthcare equipment and services. The sector includes industries like:

- Pharmaceuticals and Treatments Development;

- Medical Devices Manufacture;

- Testing and Diagnostics;

- Health Insurance;

- Medical Care Facilities;

- Telehealth.

Looking into these industries globally, we see that:

- The largest Pharmaceuticals and Treatments Development firms are Eli Lilly and Company, Novo Nordisk A/S, and Johnson & Johnson;

- Among Medical Devices Manufacturers, Abbott Laboratories, Stryker Corporation, and Intuitive Surgical are the biggest businesses;

- The leading Testing and Diagnostics companies are Thermo Fisher Scientific Inc., IDEXX Laboratories, and Quest Diagnostics;

- The largest Health Insurers are UnitedHealth Group Inc., Elevance Health, and CVS Health;

- AIER Eye Hospital Group Co., Bangkok Dusit Medical Services, and Rede D’Or São Luiz S.A. run the biggest Medical Care Facilities;

- Lastly, the leading Telehealth companies are Doximity, Inc., Teladoc Health, and LifeStance Health Group.

Businesses in the healthcare sector are vulnerable to government regulation, agreed reimbursement rates for newly developed drugs, and the approval of novel products and services. These factors could significantly affect the price and availability of their products and services. Moreover, these firms’ valuations are sensitive to their offerings quickly becoming obsolete and the expiration of their patents.

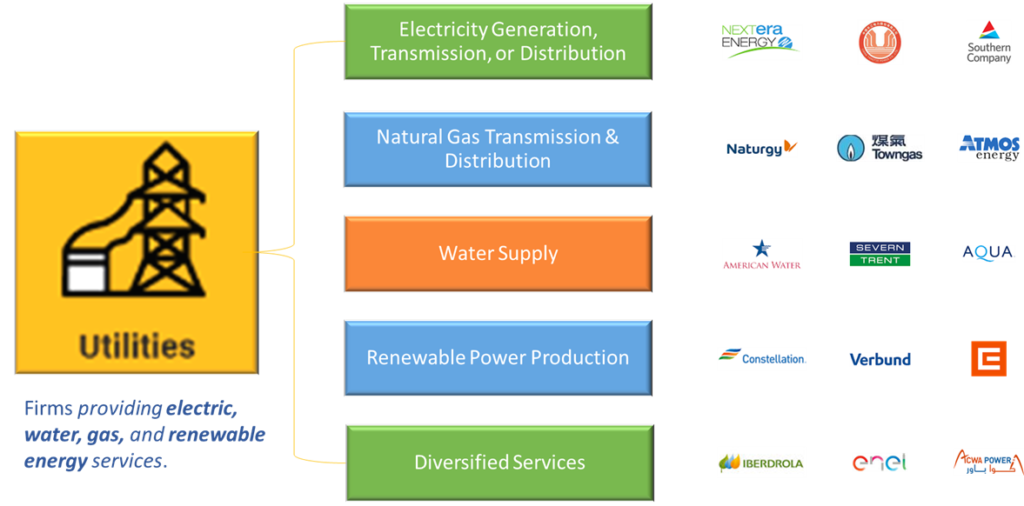

Utilities

The Utilities sector includes companies that provide electric, water, gas, and renewable energy services. The sector covers industries like:

- Electrical Power Generation, Transmission, or Distribution;

- Natural Gas Transmission and Distribution;

- Water Supply;

- Renewable Power Production;

- Diversified Utility.

Looking into these industries globally, we see that:

- The largest Electrical Power Generators, Transmitters, or Distributors are NextEra Energy, Inc., China Yangtze Power Co., and The Southern Company;

- Among Natural Gas Transmitters and Distributors, Naturgy Energy Group, S.A., The Hong Kong and China Gas Company, and Atmos Energy Corporation are the biggest firms;

- American Water Works Company, Severn Trent PLC, and Essential Utilities, Inc. are the largest Water Suppliers;

- The leading Renewable Power Producers are Constellation Energy Corporation, Verbund AG, and CEZ, A.S.;

- Lastly, the largest Diversified Utility companies are Iberdrola, S.A., Enel SpA, and ACWA Power Company.

Businesses in the utilities sector are vulnerable to government regulation, rising borrowing costs (increasing interest rates and excessive debt burden), supply and demand constraints on inputs (i.e., services or fuel), and strict natural resource conservation regimes.

Now, let’s explore the businesses in the cyclical bucket.

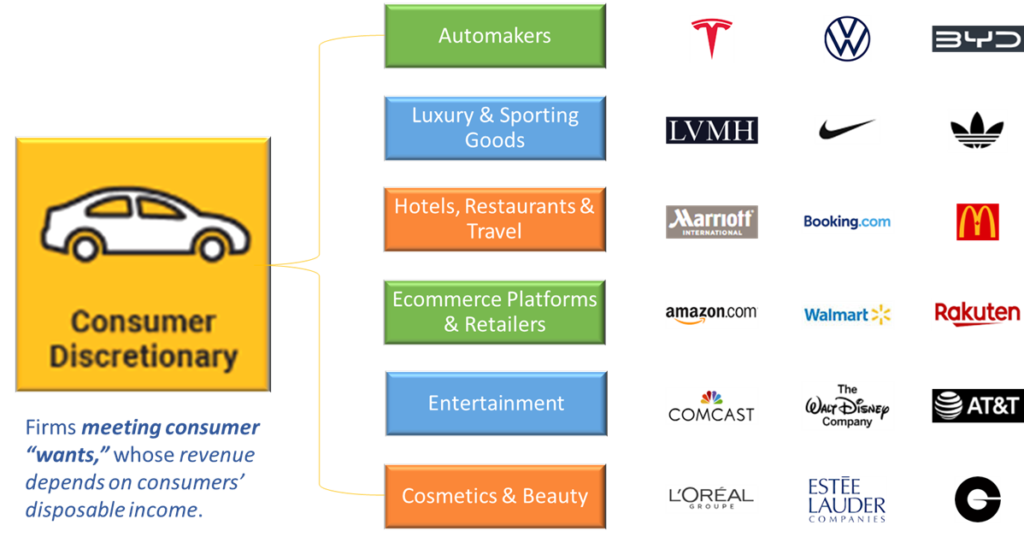

Consumer Discretionary

The Consumer Discretionary (or Consumer Cyclicals) sector includes businesses meeting consumer “wants” whose revenue depends on disposable income. The sector consists of industries like:

- Automotives;

- Luxury and Sporting Goods;

- Hotels, Restaurants and Travel;

- E-commerce and Retail;

- Entertainment;

- Cosmetics and Beauty.

Looking into these industries globally, we see that:

- Tesla, Inc., Volkswagen AG, and BYD Company Limited are the biggest Automakers;

- The largest Luxury and Sporting Goods Makers are Louis Vuitton – Moët Hennessy, NIKE Inc., and Adidas AG;

- Marriott International, McDonald’s Corporation, and Booking Holdings are the leading Hotels, Restaurants and Travel companies;

- The largest E-commerce and Retailer firms are Amazon.com, Inc., Walmart, Inc., and Rakuten Group, Inc.;

- Comcast Corporation, The Walt Disney Company, and AT&T Inc. are the biggest Entertainment firms;

- Lastly, the largest Cosmetics and Beauty firms are L’Oréal S.A., Estée Lauder Companies Inc., and Givaudan S.A.

Businesses in the consumer discretionary sector are vulnerable to the general economy’s health, interest rates, and price competition. Their valuations are also sensitive to consumer confidence, spending, tastes, and demographic changes.

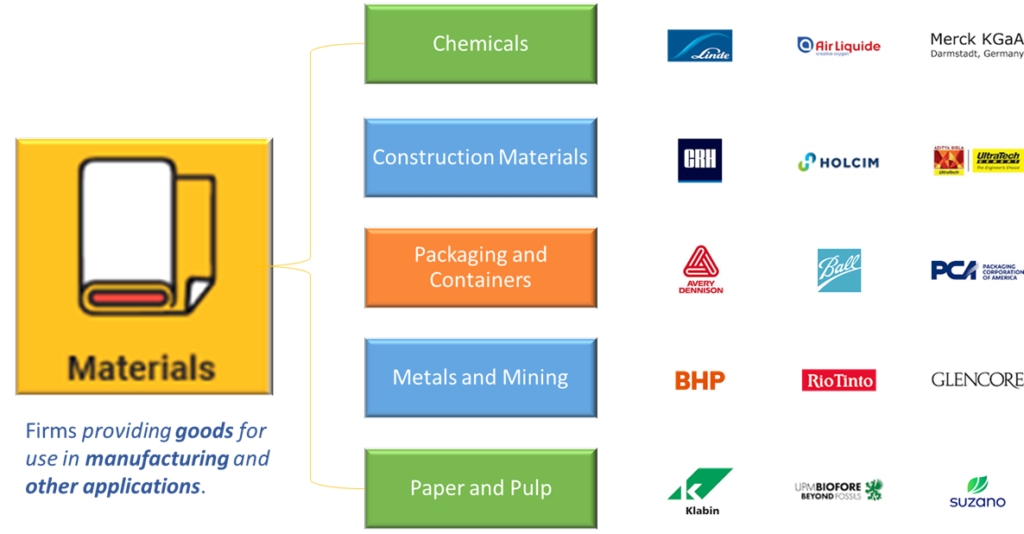

Materials

The Materials (or Basic Materials) sector covers companies providing various goods for manufacturing and other applications. The sector includes industries like:

- Chemicals;

- Construction Materials;

- Packaging and Containers;

- Metals and Mining;

- Paper and Forest Products.

Looking into these industries globally, we see that:

- The largest Chemicals companies are Linde Plc, Air Liquide, and Merck KGaA;

- Cement Roadstone Holding, Holcim S.A., and UltraTech Cement are the biggest Construction Materials businesses;

- The leading Packaging and Containers firms are Avery Dennison Corporation, Ball Corporation, and Packaging Corporation of America;

- BHP Group Ltd, Rio Tinto, and Glencore are the largest Metals and Mining companies, and;

- Lastly, Klabin S.A., UPM-Kymmene, and Suzano S.A. are the biggest Paper and Forest Products firms.

Businesses in the materials sector are vulnerable to commodity prices and price volatility, the strength of the U.S. dollar, import controls, global supply competition, costs related to environmental damage, resource depletion, and mandatory safety and pollution control costs.

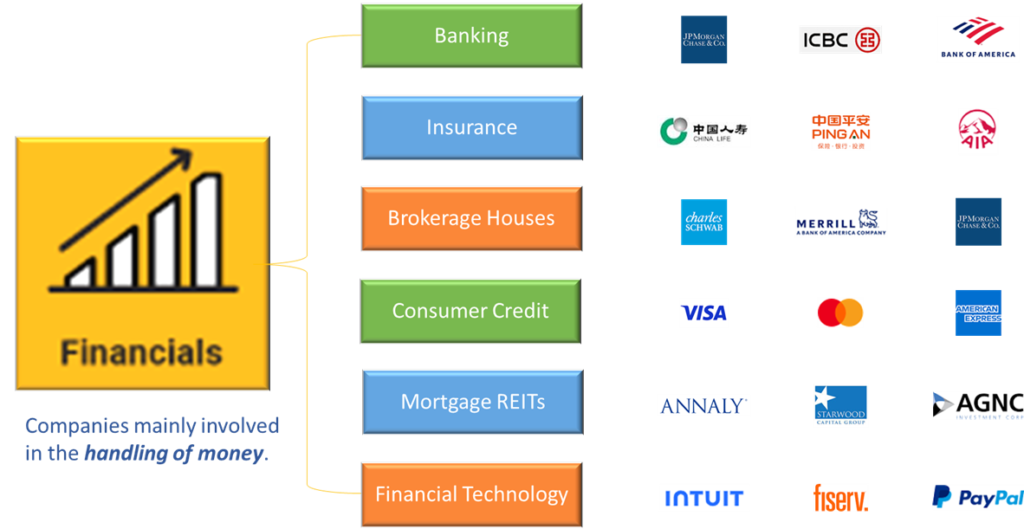

Financials

The Financials (or Financial Services) sector covers companies that mainly handle money. The sector includes industries like:

- Banking;

- Insurance;

- Brokerage;

- Consumer Finance;

- Mortgage-related Real Estate Investment Trusts (REITs);

- Financial Technology or Fintech.

Looking into these industries globally, we see that:

- JPMorgan Chase & Co., Industrial and Commercial Bank of China, and Bank of America are the largest Banks;

- The biggest Insurance firms are China Life Insurance, Ping An Insurance, and AIA Group;

- The Charles Schwab Corporation, Merrill Lynch, and JPMorgan Chase & Co. are the leading Brokerages;

- The biggest Consumer Finance Providers are Visa, Mastercard, and American Express;

- Annaly Capital Management, Starwood Property Trust, and AGNC Investment Corp. are the largest Mortgage-related REITs;

- Lastly, Intuit Inc., Fiserv Inc., and PayPal Holdings Inc. are the biggest Fintech companies.

Businesses in the financial sector are sensitive to wide-ranging government regulation and service segment overlap (and the relatively rapid change it can bring). They are also vulnerable to the availability and cost of capital funds, interest rate changes, corporate and consumer debt defaults, and price competition.

Real Estate

The Real Estate sector includes property developers, managers, and real estate investment trusts (REITs). The sector consists of industries like:

- Property Management;

- Shopping Malls;

- Public Storage;

- Healthcare Facilities;

- Communications Real Estate;

- Digital Infrastructure;

- Industrial Real Estate.

Looking into these industries globally, we see that:

- The largest Property Managers are CBRE Group, Jones Lang LaSalle, and Colliers International Group;

- Simon Property Group, Realty Income Corporation, and Regency Centers Corporation are the biggest Shopping Mall Owners;

- The leading Public Storage Providers are Public Storage, Extra Space Storage, and CubeSmart;

- Welltower Inc., Ventas, and Healthpeak Properties are the largest Healthcare Facility Owners;

- The biggest Communications REITs are American Tower, Crown Castle, and SBA Communications;

- Equinix, Digital Realty Trust, and Iron Mountain are the leading Digital infrastructure REITs;

- Lastly, the largest Industrial REITs are Prologis, Rexford Industrial Realty, and EastGroup Properties.

Businesses in the real estate sector are sensitive to shifts in property values or the overall economy’s health.

Now, let’s explore the businesses in the sensitive bucket.

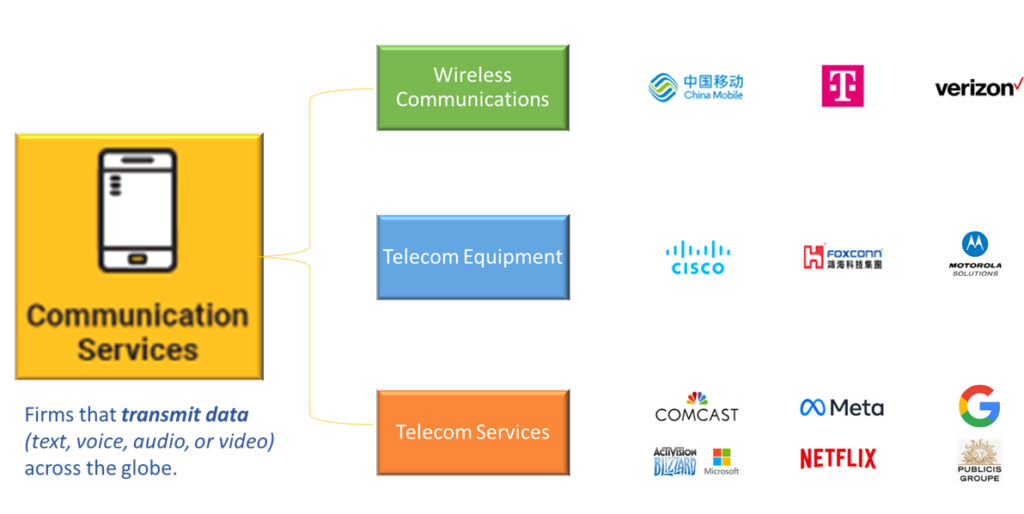

Communications Services

The Communications Services sector covers businesses that transmit data as text, voice, audio, or video across the globe. The sector includes industries like:

- Wireless Communications;

- Telecom Equipment Manufacturing;

- Telecom Services, which covers fields like:

- Internet Services and Traditional T.V.;

- Social Media;

- Internet Search and Digital Advertising;

- Video Games;

- Streaming;

- Traditional Advertising.

Looking into these industries globally, we see that:

- China Mobile Ltd., T-Mobile U.S., Inc., and Verizon Communications Inc. are the largest Wireless Communications firms;

- The biggest Telecom Equipment Manufacturers are Cisco Systems Inc., Foxconn Industrial Internet Co. Ltd., and Motorola Solutions Inc.;

- Lastly, in the Telecom Services industry:

- Comcast Corporation is the largest Internet services and Traditional T.V. company;

- The biggest Social Media business is Meta Platforms Inc. (formerly known as Facebook);

- Alphabet Inc. (or Google) is the leading Internet Search and Digital Advertising firm;

- The largest Video Game Creator is Microsoft’s Activision Blizzard Inc.;

- Netflix Inc. is the biggest Streaming company, and;

- The largest Traditional advertising business is Publicis Groupe S.A.

Businesses in the communication services sector are vulnerable to government regulation, price competition, technological advancements, and the overall economy’s health. They are also sensitive to consumer and business confidence, spending, and shifts in consumer and business requirements and preferences.

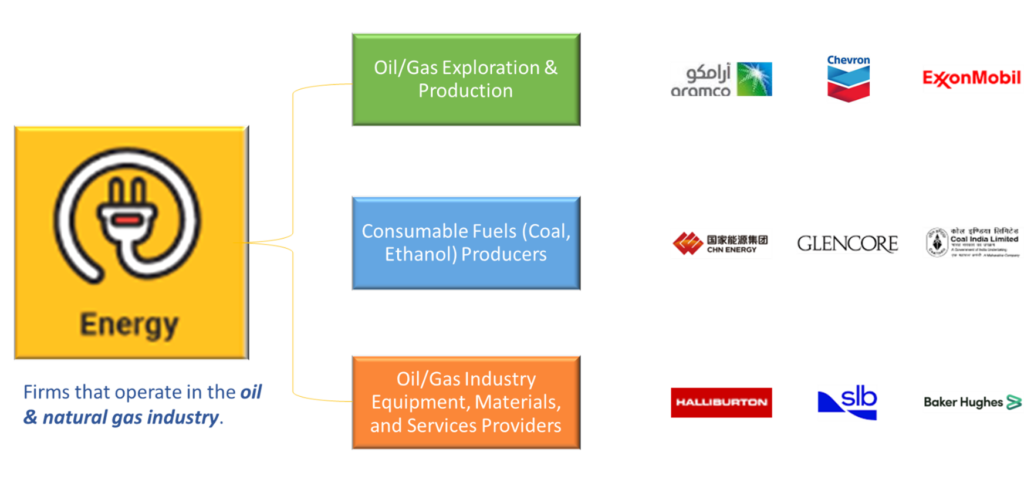

Energy

The Energy sector includes businesses operating in oil and natural gas. The sector consists of industries like:

- Oil and Gas Exploration and Production;

- Consumable Fuels Production;

- Oil and Gas Industry Equipment, Materials, and Services Provision.

You’ll notice that it doesn’t include renewable energy companies, as those are considered utilities.

Looking into these industries globally, we see that:

- The largest Oil and Gas Exploration and Production firms are Saudi Arabian Oil Company, Exxon Mobil Corporation, and Chevron Corporation;

- China Shenhua Energy Co. Ltd., Coal India Ltd., and Glencore Plc. are the biggest Consumable Fuels Producers;

- Lastly, the leading Oil and Gas Industry Equipment, Materials, and Services Providers are Schlumberger Ltd., the Halliburton Company, and the Baker Hughes Company.

Businesses in the energy sector are sensitive to fluctuations in energy prices, energy fuels supply and demand, energy conservation legislation, discovery of new energy source (i.e., successful exploration projects), and tax and other government regulations.”

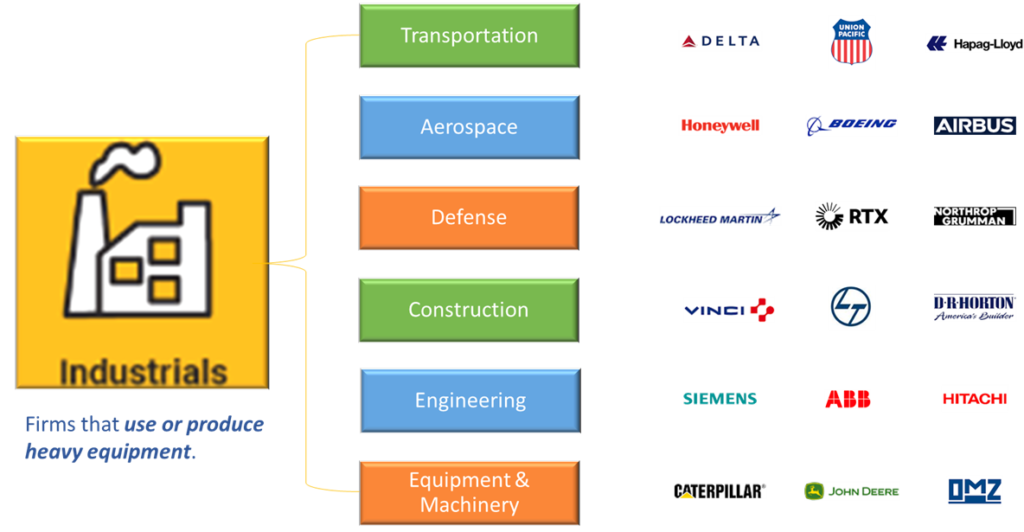

Industrials

The Industrials sector covers a variety of businesses that utilize heavy equipment. The sector includes industries like:

- Transportation;

- Aerospace;

- Defence;

- Construction;

- Engineering, and;

- Equipment and Machinery Manufacturing.

Looking into these industries globally, we see that:

- The largest Transportation companies are airliner Delta Air Lines, Inc., railroader Union Pacific Corporation, and logistics firm Hapag-Lloyd;

- Honeywell International Inc., The Boeing Company, and Airbus S.E. are the biggest Aerospace firms;

- The leading Defence companies are Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation;

- Vinci SA, Larsen & Toubro Ltd., and D.R. Horton Inc. are the largest Construction businesses;

- The biggest Engineering firms are Siemens AG, ABB Ltd., and Hitachi Ltd.;

- Lastly, Caterpillar Inc., Deere & Company, and United Heavy Machinery are the largest Equipment and Machinery Manufacturers.

Businesses in the industrial sector are sensitive to the health of the overall economy, fluctuations in consumer sentiment and spending, commodity prices and volatility, and legislation. Their valuations are also vulnerable to government spending and regulations, import controls, global supply competition and resource depletion (of input materials), environmental damage costs, and mandatory safety and pollution control costs.

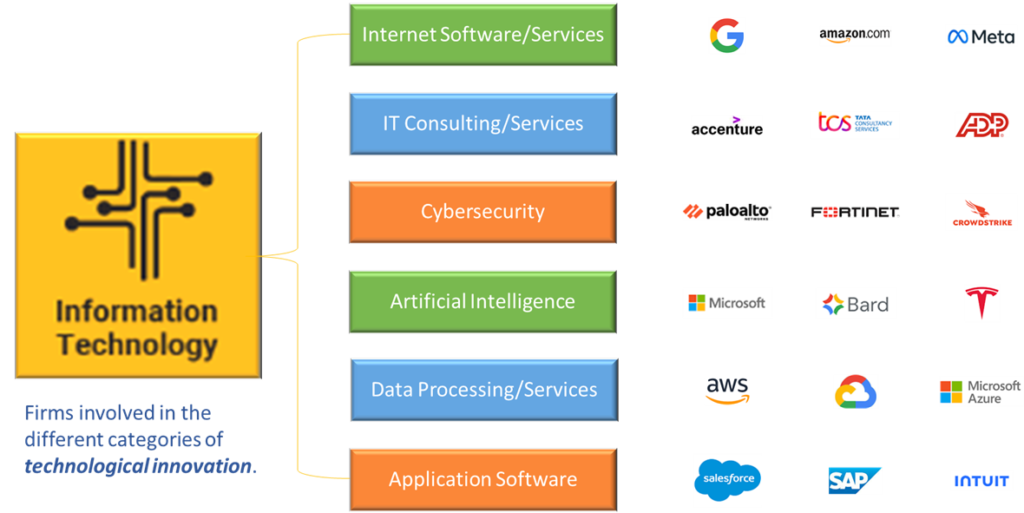

Information Technology

The Information Technology sector includes companies involved in different aspects of technological innovation. It is the largest among the eleven GICS equity sectors and includes industries such as:

- Internet Software and Services;

- I.T. Consulting and Services;

- Cybersecurity;

- Artificial Intelligence;

- Data Processing and Services;

- Application Software;

- Database Management;

- Home Entertainment Software;

- Consumer Electronics;

- Computer Hardware;

- Scientific and Technical Instruments;

- Electronic Component Manufacture;

- Semiconductor Manufacture;

- Electronics and Computer Distribution;

- Semiconductor Equipment and Materials Production;

- Solar Energy Technology.

Looking into these industries globally, we see that:

- The largest Internet Software and Services companies are Alphabet Inc., Amazon.com Inc., and Meta Platforms Inc.;

- Accenture plc, Tata Consultancy Services Limited, and Automatic Data Processing are the biggest I.T. Consulting and Services firms;

- The leading Cybersecurity businesses are Palo Alto Networks, Inc., Fortinet, Inc., and CrowdStrike Holdings, Inc.;

- Microsoft Corporation, Alphabet Inc., and Tesla, Inc. are the largest Artificial Intelligence companies;

- The biggest Data Processing and Services firms are Amazon.com, Alphabet Inc., and Microsoft Corporation;

- Salesforce, Inc., SAP SE, and Intuit Inc. are the leading Application Software businesses.

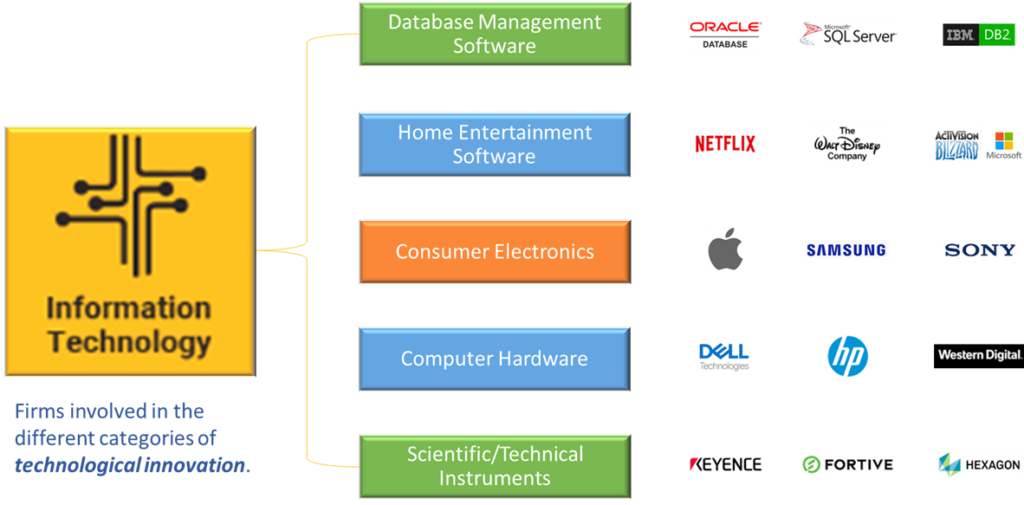

In addition, on a worldwide basis, we find that:

- The leading Database Management firms are Oracle Corporation, Microsoft Corporation, and International Business Machines (IBM) Corporation;

- Netflix, Inc., The Walt Disney Company, and Microsoft’s Activision Blizzard are the largest Home Entertainment Software companies;

- The biggest Consumer Electronics businesses are Apple Inc., Samsung Electronics Co., and Sony Group Corporation;

- Dell Technologies Inc., H.P. Inc., and Western Digital Corporation are the leading Computer Hardware firms;

- Keyence Corporation, Fortive Corporation, and Hexagon AB are the largest Scientific and Technical Instruments firms.

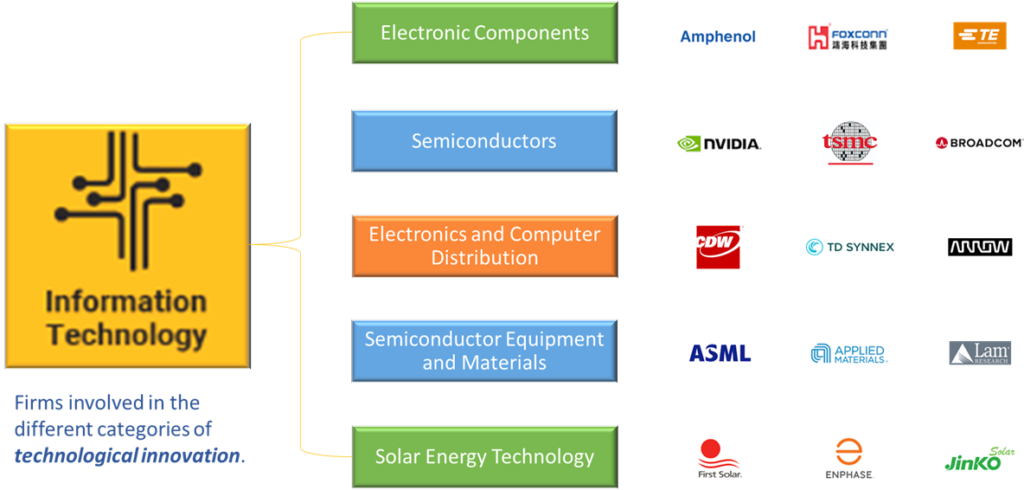

Moreover, on a global level, we see that:

- The largest Electronic Component Manufacturers are Amphenol Corporation, Hon Hai Precision Industry Co., and T.E. Connectivity Ltd.;

- NVIDIA Corporation, Taiwan Semiconductor Manufacturing Company Limited, and Broadcom Inc. are the biggest Semiconductor Manufacturers;

- The leading Electronics and Computer Distributors are CDW Corporation, TD Synnex Corporation, and Arrow Electronics, Inc.;

- ASML Holding N.V., Applied Materials, Inc., and Lam Research Corporation are the largest Semiconductor Equipment and Materials Producers;

- Lastly, the biggest Solar Energy Technology firms are First Solar, Inc., Enphase Energy, Inc., and Jinko Solar Co.

Businesses in the technology sector are sensitive to short product cycles and rapid obsolescence of current innovation, downward pressure on price and profits due to new advances, competition from new market players, and the health of the overall economy.

Classifying Stocks By Market Capitalization

Equities can also be grouped by market capitalization or market cap (i.e., what the market thinks the underlying business is worth). This approach results in five groups – micro cap, small cap, mid cap, large cap, and mega cap stocks.

Micro caps are businesses valued under $250 million, e.g., Semler Scientific, Inc. and Vitalhub Corp. They are the most volatile, riskiest, and illiquid market cap category (illiquid means it’s not easy selling their shares, usually due to low trading volumes). Moreover, their scarce data makes research difficult, leaving investors vulnerable to fraud and other risks.

Small caps are businesses valued between $250 million and $2 billion, e.g., Agilysys, Inc. and Docebo, Inc. They have historically outperformed larger cap stocks but are more volatile, riskier, and less liquid. Moreover, the same issues plague some as micro-caps, i.e., lack of information and illiquidity.

Mid caps are businesses valued between $2 and $10 billion, e.g., e.l.f. Beauty, Inc. and Descartes Systems Group Inc. As their name implies, they are in the middle of their growth story and are projected to keep growing earnings and market share. They provide diversification in a portfolio by contributing a balance of growth and stability.

Large caps are businesses valued between $10 and $200 billion, e.g., Paycom Software, Inc. and Manulife Financial Corporation. They dominate global market benchmark indexes (e.g., the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite in the United States). These firms are usually transparent, making sufficient data publicly available and easing investors’ research. Moreover, they are typically blue-chip companies at peak business cycle phases, producing established and stable revenue and earnings with lower volatility and often paying dividends. As a result, they usually form the core of most investors’ long-term strategy.

Mega caps are businesses valued over $200 billion, e.g., Microsoft Corporation and Alphabet Inc. These goliaths sell tons of goods and services in any reporting period and have an outsized influence in the industries in which they operate. That’s a double-edged sword because the broader market could be heavily affected if these firms experience a persistent slump. So, while mega-caps share a lot of benefits with large-caps, e.g., transparency, data availability, stable returns, and lower volatility, they come with concentration risk.

Classifying Stocks By Market Location

Equities can also be grouped by Market classification or location (i.e., where the businesses mainly operate). In so doing, we obtain developed and emerging market equities and local or foreign equities.

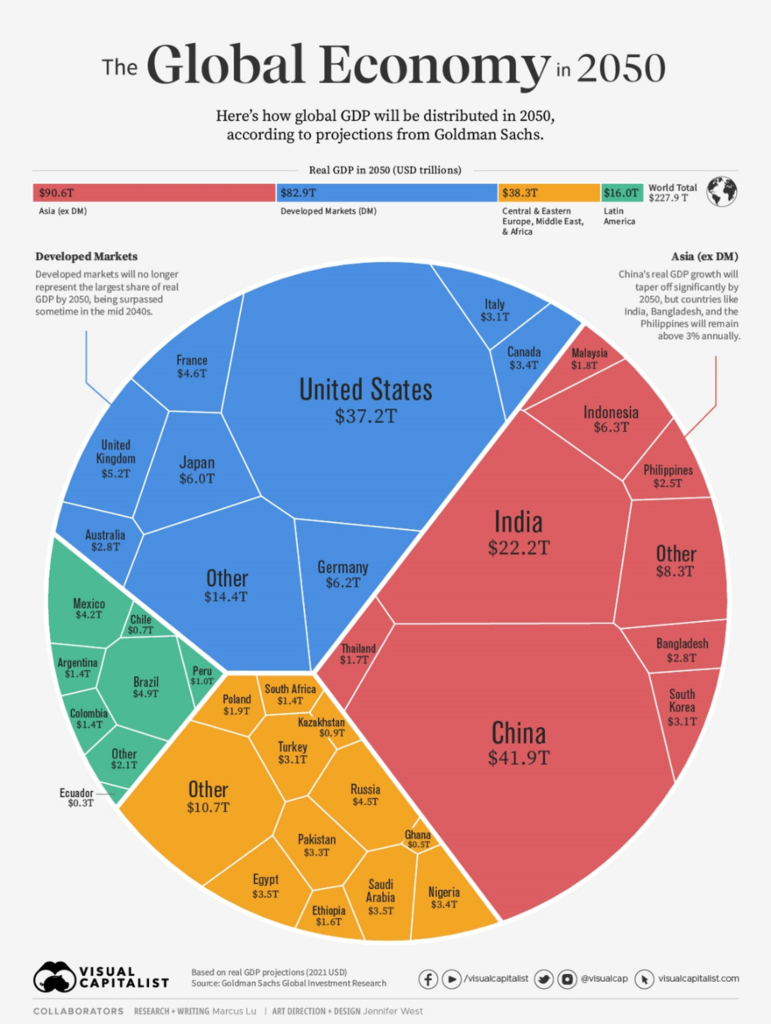

Developed markets have higher household incomes, adequate infrastructure, and mature capital markets (i.e., markets with greater stability, transparency, and liquidity, having well-regulated exchanges, established trading platforms, and investor protection mechanisms). Developed markets are primarily in North America (i.e., the United States & Canada), Western Europe and Australasia (i.e., Australia, New Zealand, Japan, and South Korea).

Emerging markets have rapid economic growth and development driven by younger populations, higher consumption levels, and a strong modernization drive. But they also have lower household incomes, inadequate infrastructure, immature capital markets, and bouts of political and economic instability. Emerging markets mainly include Brazil, Mexico, Saudi Arabia, Russia, India, Indonesia, China, and Taiwan.

As a Canadian, when you buy Canadian stocks, you’re purchasing local equities, but when you buy U.S. stocks, you’re buying foreign equities.

The world doesn’t entirely revolve around the U.S. and the developed markets, and change is the only constant. Current projections see emerging markets outgrowing their developed counterparts by the mid-2040s. Moreover, 2024 earnings growth forecasts show 19% earnings growth for emerging markets, beating the U.S.’ 10% and the developed markets’ 8% earnings growth projections.

Right! That does it for equities. You may want to explore fixed income or bonds, cash and cash equivalents, real estate, commodities, and alternative asset classes.