What Are Alternative Investments?

Alternative investments include Hedge Funds, Private Equity, Collectibles, and Cryptocurrency. These assets are characterized by risk profiles that are orders of magnitude larger than cash and cash equivalents, bonds, stocks, real estate, and commodities.

As a result of their risk profiles, owning them requires sophisticated financial knowledge or advice and investing experience. In addition to the enormous profits they could deliver, some of these assets are also non-correlated with stocks and bonds and can help diversify asset portfolios.

Let’s take a closer look at the different alternative investments.

Hedge Funds

Hedge Funds are limited partnerships of private investors whose pooled funds are managed by professional fund managers who employ various risky strategies (e.g., leveraging or trading of non-traditional assets) to pursue above-average returns. They are a risky alternative investment choice and usually require a high minimum investment or net worth.

Hedge fund returns rely on the fund manager’s skill, like the famous Bill Ackman of Pershing Square Capital Management. And they are meant to have little correlation with the stock and bond markets.

So, diversification and outperformance are what hedge funds promise. But do hedge funds consistently keep this promise, on average?

A 2022 study by Javier Estrada showed that straightforward two-fund or two-ETF strategies, based on stocks and bonds, outperformed hedge funds in absolute and risk-adjusted returns over the last 10, 15, and 20 years. Worse still, the study found that hedge funds were highly correlated with equities by up to 89%, 85%, and 83% in the last 10, 15, and 20 years, respectively.

Javier’s research used the HFRI Institutional Equity Hedge Index as a basis for hedge fund performance. It showed that hedge funds may not be the best alternative investment.

Private Equity

Private Equity involves investing in non-publicly traded businesses. It appeals to institutional and high net worth investors as returns are not as volatile as or correlated with those of publicly traded equities whose share price fluctuates daily and can see dramatic changes due to their highly liquid nature.

There are three ways to invest in private equity, through:

- Venture capital;

- Mezzanine finance, and;

- Leveraged buyouts.

Venture capitalists invest in startups that they someday hope to either list on a stock exchange through an initial public offering or profitably sell to another company. Peter Thiel’s early investment in Facebook, now Meta Platforms, is an excellent example.

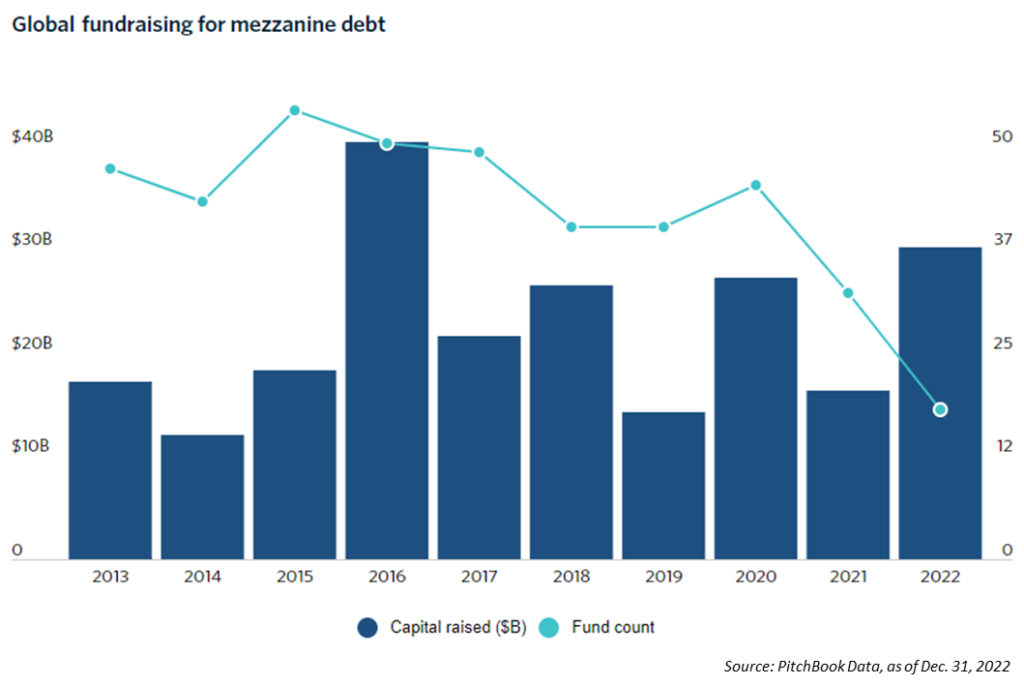

Mezzanine financiers loan funds to late-stage startups or to established private companies that can no longer borrow any more money from their traditional bank credit lines. In exchange, these financiers get the higher coupon rate and subordinated debt of the startup or private firm. This type of financing can be significantly more rewarding than typical corporate debt and often returns between 12% and 20% a year in interest. This chart from the PitchBook shows a renewed interest in mezzanine financing following a slump in 2021.

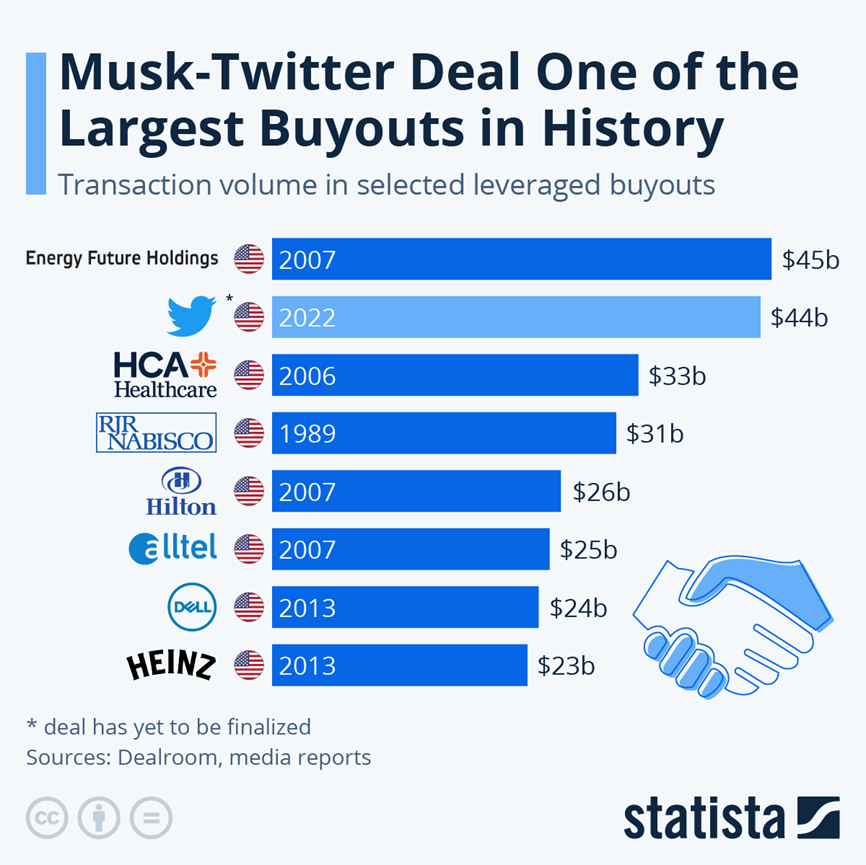

Leveraged buyouts involve taking a publicly traded company private for its stable cash flows. They could also aim to restructure and refloat the acquired business on the public markets at a profit. These deals declined in popularity after the 2008 financial crisis but are becoming more common. Elon Musk’s Twitter acquisition is an excellent example of a recent leveraged buyout.

Collectibles

Collectibles are personal Items worth more now than when they were initially acquired. Examples include artwork, antiques, stamps, coins, trading cards, toys and comic books.

Ideally, collectibles should pique the passion of the collector. The rarer a collectible is, the higher the price it would fetch on the market. Moreover, the value of collectibles tends to increase with time.

They can help diversify portfolios and are fun to hold. For example, driving your vintage car on the weekends as a collector would be thrilling. Besides, they could fetch hefty profits when they are finally sold.

However, investing in collectibles comes with risks:

- Firstly, the collectibles market is plagued by fraud and fakes;

- Secondly, collectibles are fragile, and the slightest damage can wipe out their value;

- Moreover, matching collectibles to buyers who value them as much as you do can be challenging;

- Lastly, storing, securing, and insuring collectibles can be expensive.

Like other asset classes, you profit from collectibles by selling them at a higher price than you originally paid. However, the tax on the sale of collectibles is usually much higher than on stock or bond sales. Plus, you get no dividends or income while holding them for the time they may take to appreciate.

Cryptocurrencies

Cryptocurrencies are digital stores of value or payment systems that don’t rely on central banks or trusted 3rd parties to verify transactions or create new currency units. Instead, they use cryptography to confirm transactions on a publicly distributed ledger called a blockchain.

The first cryptocurrency, Bitcoin, was developed in 2009 by a programmer (or a group of programmers) using the pseudonym Satoshi Nakamoto. Today, over 26,000 different cryptocurrencies publicly trade on exchanges like Binance.

Cryptocurrencies are incredibly volatile. For example, the price of Bitcoin has hit a high of $69,000 and a low of $4,000 in the last five years. So, owning them is not for the faint of heart.

Right! That does it for alternative investments. You may want to explore equities or stocks, fixed income or bonds, cash and cash equivalents, real estate, and commodities asset classes.