What Is A Commodity?

Commodities are goods with the same use and quality, regardless of their source. For instance, no one cares where a gold bar came from, but everyone recognizes its value. On the other hand, the market differentiates between diverse brands of electric cars. However, they all use nickel and lithium in their batteries, and no one cares where those come from.

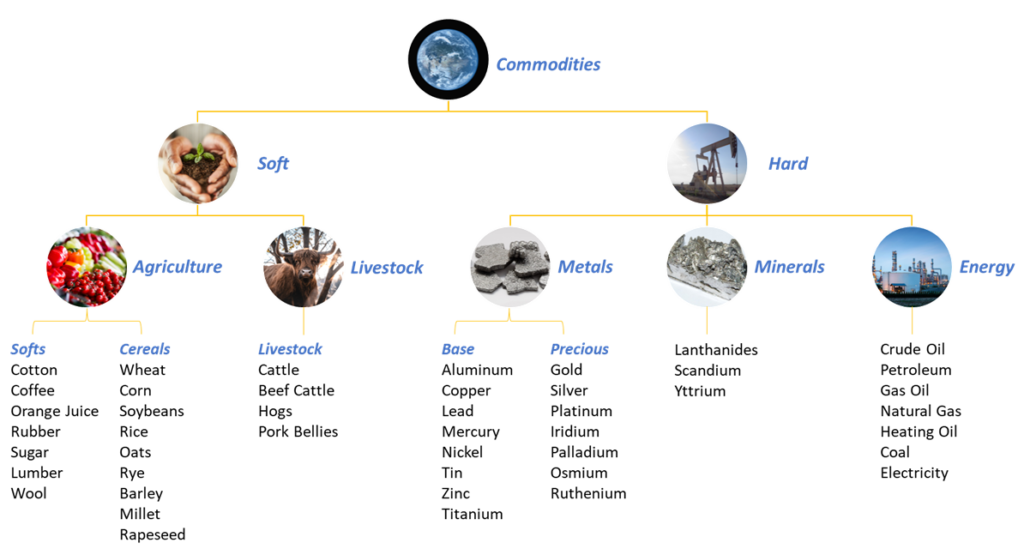

Commodity Classes

So, commodities are the raw materials and goods from which more complex products are made. They are classified as either soft or hard. Soft commodities are grown and include agricultural produce and livestock. On the other hand, hard commodities are mined and include metals, minerals, and energy.

Agricultural produce is grouped into softs and cereals. Softs include cotton, coffee, orange juice, rubber, sugar, lumber, and wool. Meanwhile, cereals include wheat, corn, soybeans, rice, oats, rye, barley, millet, and rapeseed. Moreover, livestock includes cattle, beef cattle, hogs, and pork bellies.

Metals are grouped into base or industrial metals and precious metals. Base metals include aluminum, copper, lead, mercury, nickel, tin, zinc, and titanium. Meanwhile, precious metals include gold, silver, platinum, iridium, palladium, osmium, and ruthenium.

Minerals include the rare earth minerals of the fifteen lanthanides on the periodic table, plus scandium and yttrium. Lastly, energy comprises crude oil, petroleum, gas oil, natural gas, heating oil, coal, unleaded gasoline, and electricity.

How To Invest In Commodities

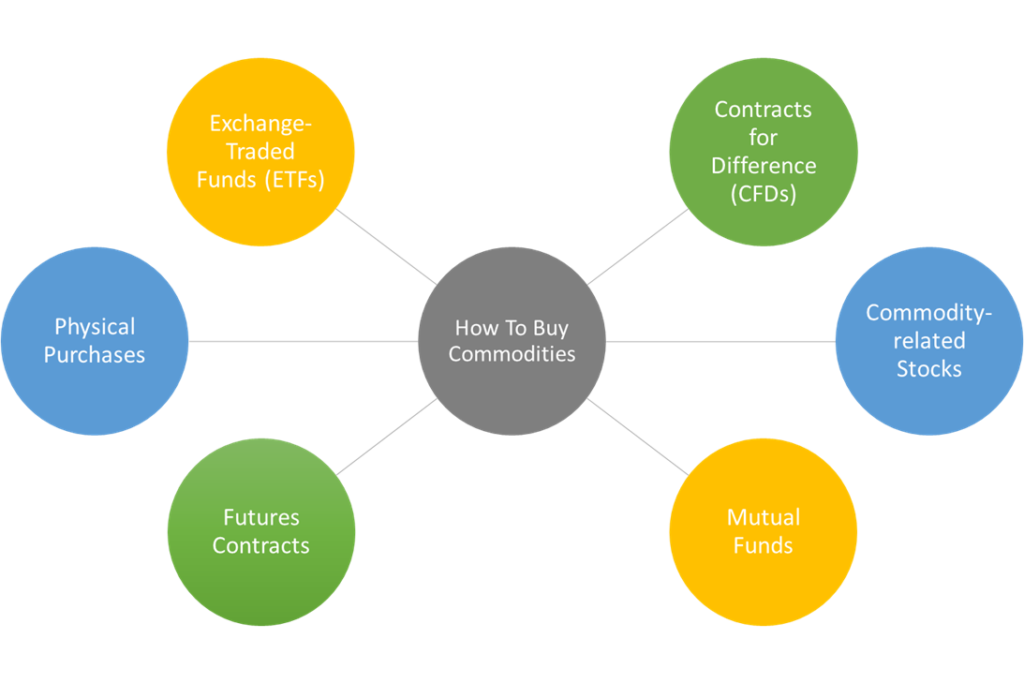

Directly owning commodities involves buying and storing the physical commodity. But the logistics of an individual doing this is challenging. Just imagine transporting and storing a barrel of oil all by yourself. A more practical and indirect way to own commodities is by buying:

- Commodity-related Equities;

- Commodity Futures Contracts;

- Commodity CFDs (i.e., Contracts-for-Difference);

- Commodity ETFs (i.e., exchange-traded funds) or;

- Commodity Mutual Funds.

Commodity-related Equities

Commodity-related Equities are shares of companies in the materials equity sector (e.g., Newmont Corporation, Corteva, Inc., and Yili Group). A downside of this approach is that the share price of these firms may not correlate with real-time or spot commodity prices due to the businesses’ financial structure, the health of unrelated businesses, and any futures contracts the companies have.

Futures Contracts

Futures Contracts are agreements to buy a certain amount of a commodity in the future at a price set in the past. If the commodity’s price rises in the future, the existing futures contract to buy it at a lower price becomes more valuable, and vice versa.

These contracts are usually out of reach for individual investors due to the significant cash commitment needed and what that means for their portfolio allocations. For example, a gold contract could involve buying 100 troy ounces of gold, amounting to a $200,000 commitment.

Commodity CFDs (Contracts For Difference)

Contracts-for-Difference or CFDs are derivative products, or financial contracts, that pay the difference in price between the open and closing trades. When you enter a CFD, you are speculating on the future price movements of the underlying commodity without actually owning it.

Most commodity CFDs use leverage, which can be a boon or a bust for smaller investors as it increases their exposure to the volatile commodity markets using borrowed money.

Commodity ETFs (Exchange-Traded Funds) And Mutual Funds

Commodity Exchange Traded Funds or ETFs are ETFs that hold physical commodities (e.g., SPDR Gold Shares and iShares Silver Trust), commodity-related equities, futures contracts (e.g., Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF, First Trust Global Tactical Commodity Strategy Fund, and Invesco D.B. Commodity Index Tracking Fund), or CFDs.

The ETF’s investors buy fund shares representing units of the ETF’s total holding of its constituent commodity-related physical or financial assets. Commodity Mutual Funds are mutual fund equivalents of commodity ETFs. Examples include the BlackRock Commodity Strategies Fund (BICSX) and the Invesco Balanced-Risk Commodity Strategy Fund Class A (BRCAX).

What Drives Commodity Prices?

Real assets like commodities are governed by supply and demand and increase in value with rising inflation (i.e., positively correlated). When demand for finished products exceeds supply, their costs increase. That’s because the demand and price for the commodities needed to produce them spike.

On the other hand, bonds and stocks, valued on discounted future cashflows (earnings or interest payments), decrease in value as inflation rises (i.e., negatively correlated). That’s because their future returns are worth less with rising inflation.

So, in addition to diversifying investment portfolios, commodities offer inflation protection. However, their heavy supply and demand dependency means they lose value during economic slowdowns, periods of disinflation, deflation and demand decline, and supply limitations.

Such periods are often caused by unfavourable market, political, and regulatory conditions. Moreover, natural disasters (e.g., droughts, hurricanes, earthquakes, and viral outbreaks) and deflationary new technologies also lead to such scenarios. For instance, the anticipated E.V. revolution is wreaking havoc on palladium prices. This graphic from Technopedia shows the significant factors that affect commodity prices.

Commodities, Volatility, And A Winning Investing Strategy

Since the factors affecting commodity prices are unpredictable, commodities are a highly volatile asset class. They are just about as volatile as equities. However, the high volatility in commodities can be mitigated by holding a diverse basket.

This strategy takes advantage of the fact that there is a low correlation between the prices of different commodities, so the total returns should be less volatile than they would be for an individual commodity. The basket should be benchmarked against a diversified index like the Bloomberg Commodity Index.

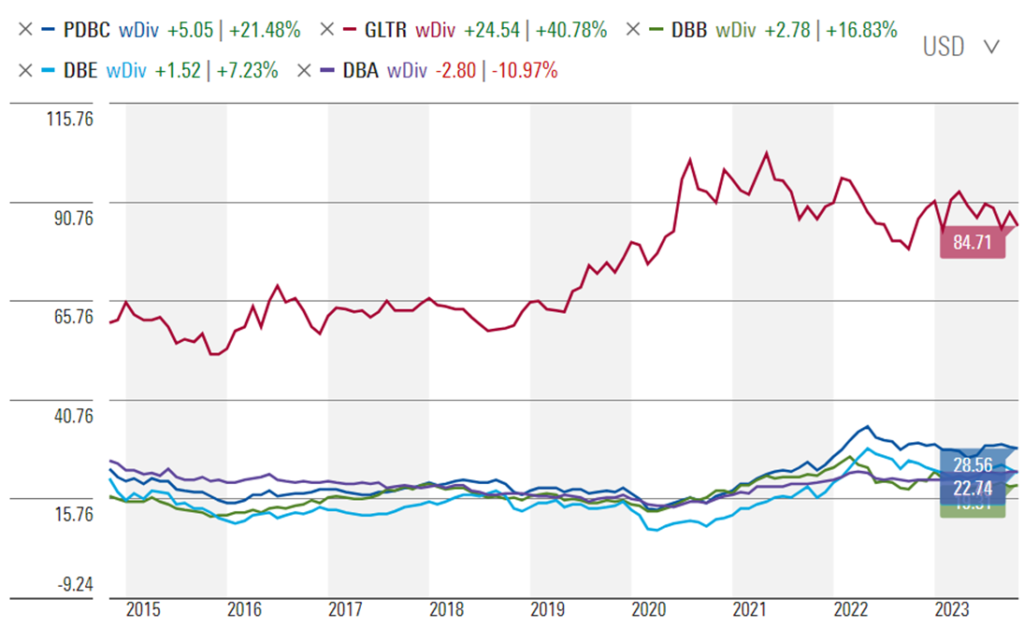

The performance charts of the five commodity ETFs below, with and without dividends, demonstrate the benefits of a diversified commodity basket since 2015. The ETFs charted are:

- PDBC: Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF

- GLTR: Aberdeen Physical Precious Metals Basket Shares ETF

- DBB: Invesco D.B. Base Metals Fund ETF

- DBE: Invesco D.B. Energy Fund ETF

- DBA: Invesco D.B. Agriculture Fund ETF

Looking at these charts, you could see that rather than being down 11% if you only owned the agriculture ETF, you’d be up 21% if you owned the basket ETF. However, you would not have performed as well as the gold ETF’s 40% total returns. That’s the gift and the curse of volatility, and we want to walk the middle path.

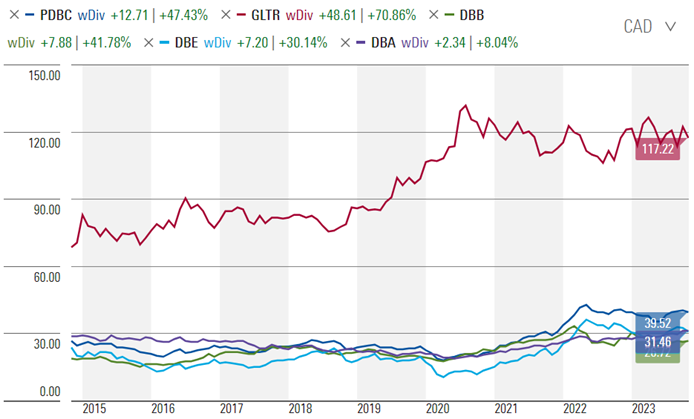

The impact of currency exchange rates can be dramatic since most commodities are traded in U.S. Dollars. For example, in Canadian dollar terms, none of these U.S. dollar-based ETFs have negative total returns as the U.S. dollar strengthens.

Right! That does it for the commodity asset class. You may want to explore equities or stocks, fixed income or bonds, cash and cash equivalents, real estate, and alternative asset classes.