What Are Cash And Cash Equivalents?

Cash and cash equivalents are financial assets that are either cash or instantly convertible to a known amount of cash. Cash is precisely that: money in hand. It also refers to money in a savings, checking or brokerage account where it may earn a return or interest.

Cash equivalents are secure, ultrashort-term, and practically risk-free cash or debt instruments that return a fixed or variable interest. That means their issuers have high credit ratings, their durations are less than a year, and they usually guarantee the principal or deposit.

The interest cash and cash equivalents return depends on the prevailing inflation and interest rates. The higher those are, the higher the interest cash equivalents will pay.

Cash and cash equivalents are low-risk and low-return assets, but only when inflation is not rising. When inflation rises, they lose value (or purchasing power) as they’re worth increasingly fewer goods and services. That said, their value is stable, and they are a great vehicle to carry your emergency fund or money you need for upcoming expenses like saving for a wedding in a few months.

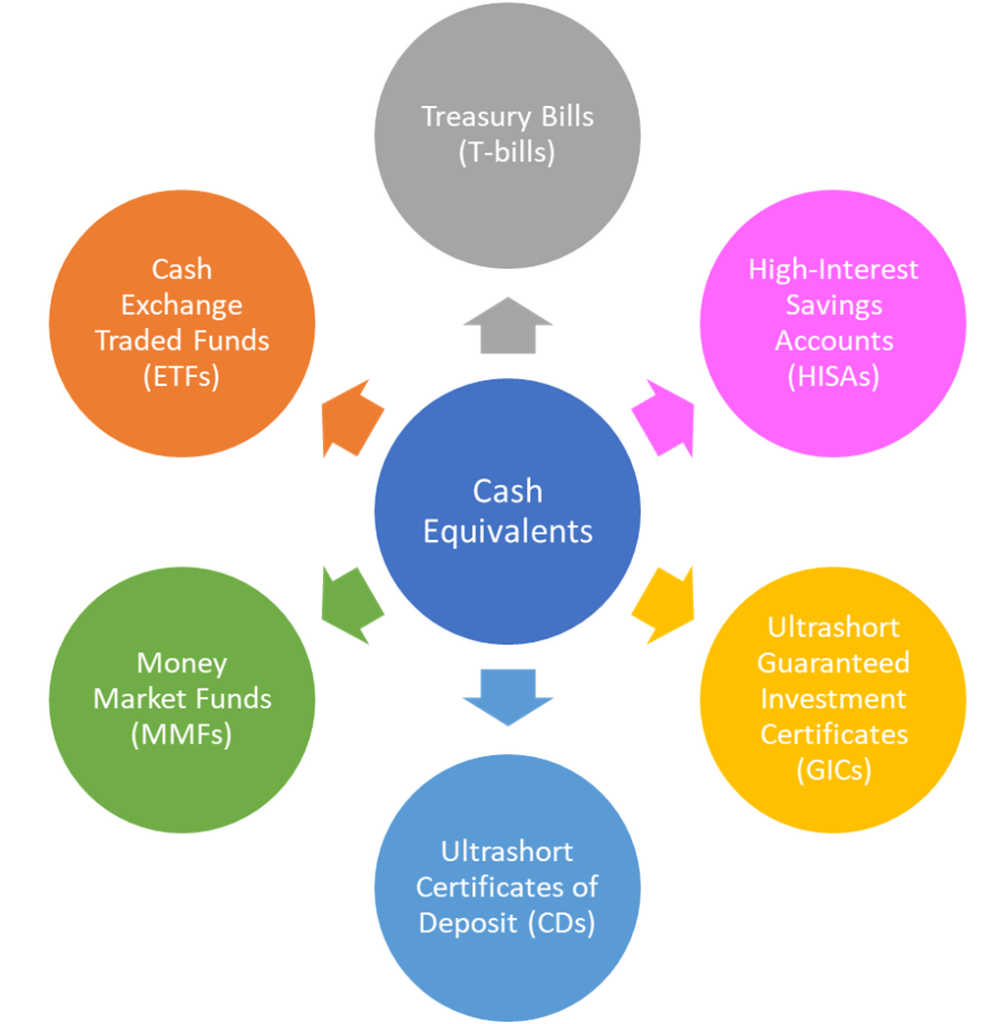

Cash equivalents include:

- Treasury bills or T-bills;

- High-Interest Savings Accounts or HISAs;

- Ultrashort-term, Cashable or Redeemable Guaranteed Investment Certificates or GICs in Canada;

- Ultrashort-term, Cashable or Redeemable Certificates of Deposit or CDs in the U.S.;

- Money Market Funds or MMFs;

- Cash Exchange Traded Funds or ETFs.

Let’s take a closer look at each of these.

Treasury Bills

Treasury Bills or T-bills are ultrashort-term, zero-coupon government debt that the public buys at a discount directly from the government or financial institutions. The issuing government guarantees the buyer’s principal and interest with its full faith and credit and taxation powers.

The interest is the discount on the T-bill’s face value that the government offers you to lend money. At maturity, the government pays you the face value of the T-bills. For instance, you spend $95 after a 5% discount for a $100 T-bill and get $100 when it matures. So, you earn a 5.26% effective interest rate on your $95 investment.

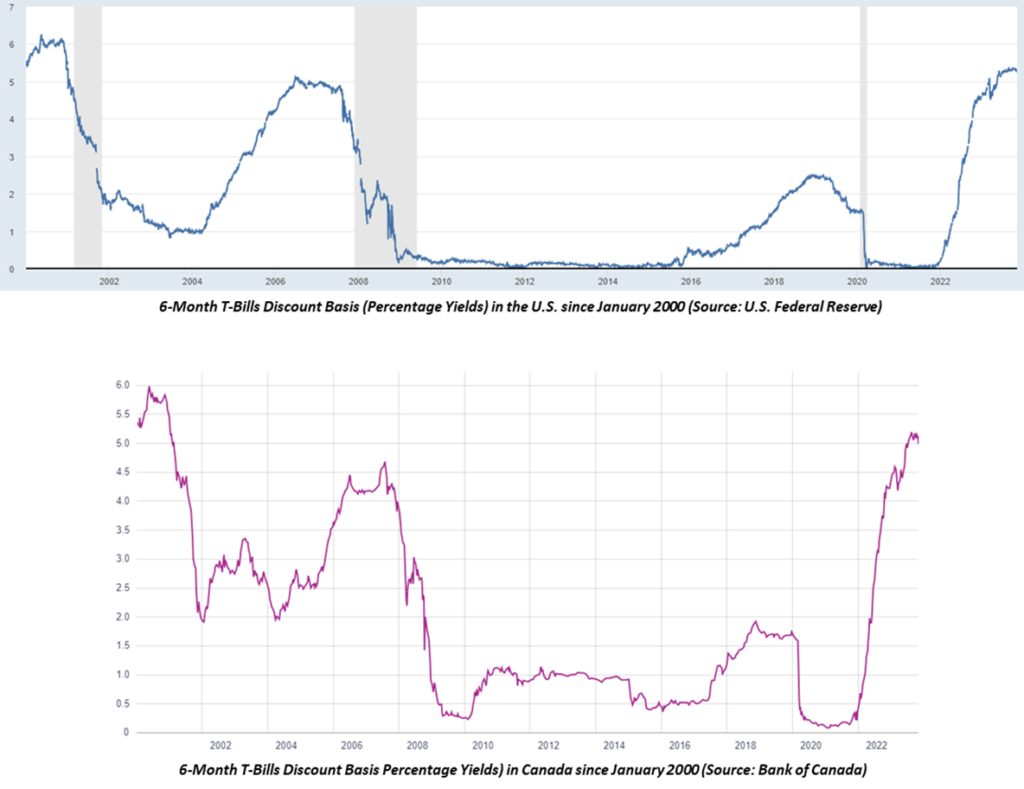

Moreover, unlike all other cash equivalents we’ll look at, the interest from T-bills is only subject to federal taxes, not state or provincial taxes. The charts below show that the U.S. Federal Reserve and the Bank of Canada offer a 5% discount on T-bills as of February 2024.

High Interest Savings Accounts

High Interest Savings Accounts (or HISAs) are savings accounts with higher interest rates than regular ones. They are offered to depositors by banks or discount brokerages.

In Canada, HISA deposits are usually guaranteed by the Canada Deposit Insurance Corporation (CDIC) up to $100,000. In the U.S., the Federal Deposit Insurance Corporation (FDIC) does the same but insures up to $250,000 of deposits.

HISAs, being savings accounts, do not have meaningful fees linked with owning them. But like most bank accounts, they usually have a small account maintenance fee.

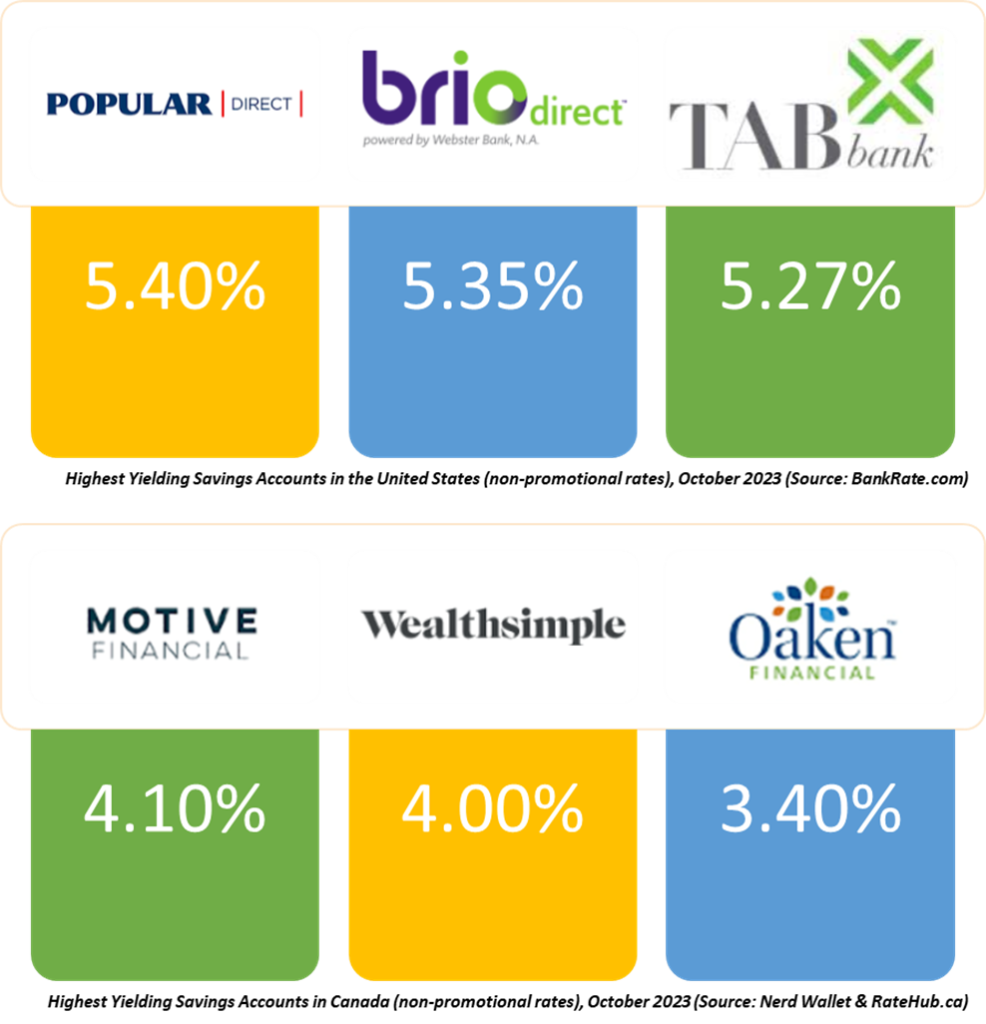

This graphic shows the top three highest HISA rates currently offered by the financial institutions in Canada and the United States. Comparing this to the T-bill discount charts we saw earlier, you can say that investing in T-bills over HISAs in Canada and HISAs over T-bills in the U.S. is probably better.

Guaranteed Investment Certificates (GICs) and Certificates of Deposit (CDs)

Guaranteed Investment Certificates (GICs) are Canadian fixed or floating interest rate term deposits. Ultrashort-term, cashable or redeemable, and fixed interest rate GICs are cash equivalents:

- Ultrashort-term means a GIC’s duration is one year or less;

- Cashable means a GIC allows early withdrawals at any time without penalties and;

- Redeemable means a GIC allows but penalizes early withdrawals and only allows them after a holding period.

GICs are offered to depositors by Canadian banks, Trust companies, and brokerages, and their principals or deposits are usually guaranteed by the Canada Deposit Insurance Corporation (CDIC) or other provincial deposit insurance programs.

Certificates of Deposit or C.D.s are the U.S. version of GICs issued by banks, credit unions, or brokerages to depositors. The Federal Deposit Insurance Corporation or FDIC typically insures their principals or deposits.

GICs and CDs do not have any fees linked with owning them, not even the small account maintenance fee that HISAs usually have.

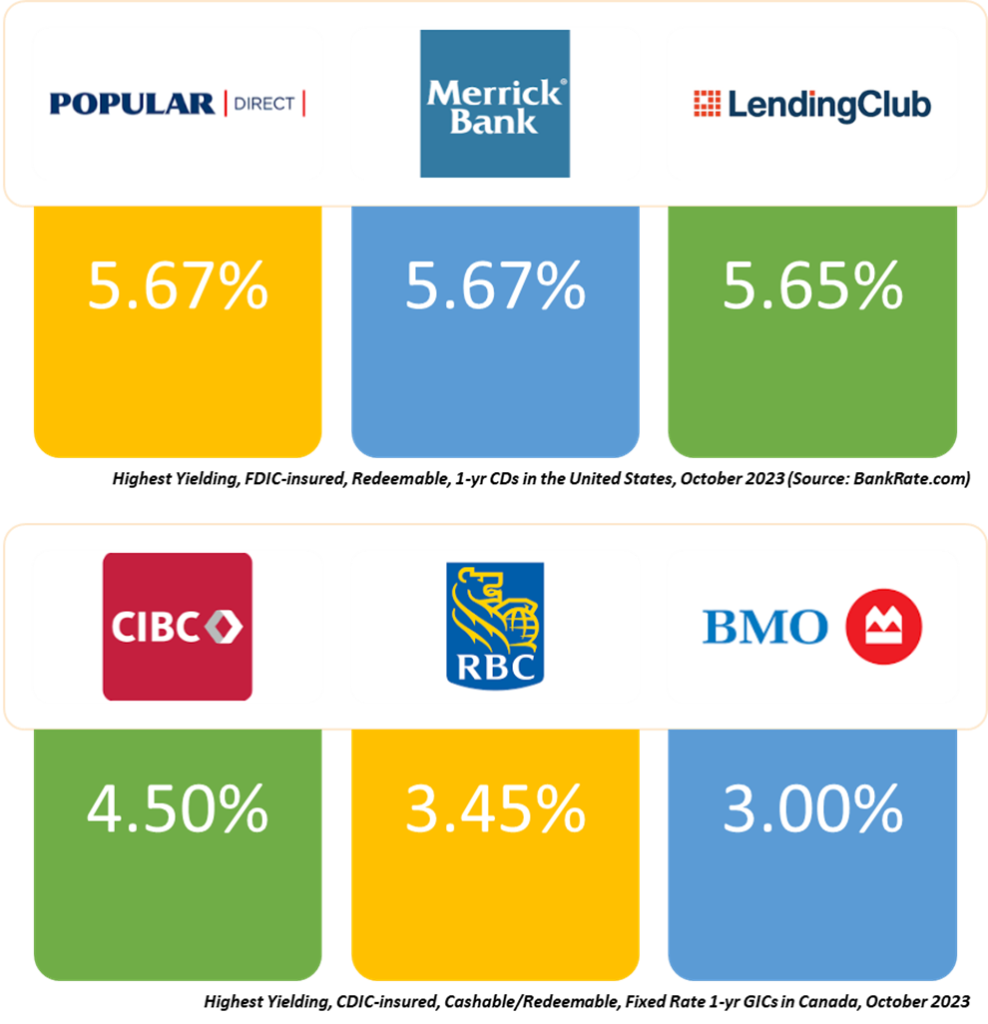

The graphic below shows the top three highest GIC and CD rates financial institutions in Canada and the United States offer. Comparing this to the T-bill discount charts we saw earlier, we know that investing in T-bills over GICs in Canada and CDs over T-bills in the U.S. is better.

Money Market Funds

Money Market Funds are mutual or exchange traded funds or ETFs with at least 95% of their holdings in other cash equivalents with an average duration of less than a year. Mutual fund firms, banks, wealth managers, and brokerages offer them and function like savings accounts. But unlike savings accounts, their returns fluctuate daily, and their principals are not CDIC or FDIC-insured.

Aside from their uninsured principals and variable yields, their management expense ratios (MERs) and fees impact their returns. However, this is more of an issue in Canada, where these fees are much higher than in the U.S.

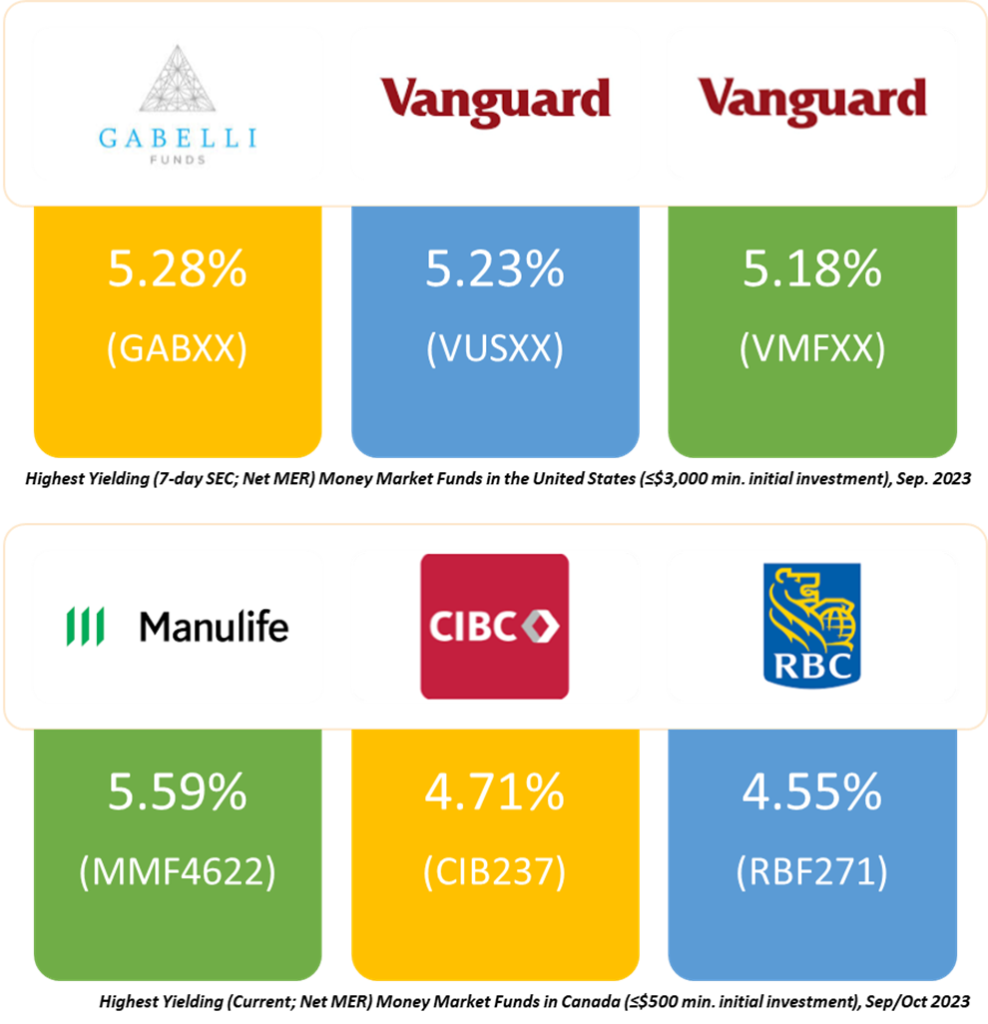

This graphic shows the top three highest money market fund rates currently offered by financial institutions in Canada and the United States. Comparing this to the T-bills discount charts we saw earlier, you can say that it’s a toss-up between investing in T-bills or money market funds in Canada and the U.S.

To get a sense of how bad Canadian mutual fund fees are, the Gabelli U.S. Treasury Money Market Fund Class AAA (ticker, GABXX) has an MER of 0.08%, the Vanguard Treasury Money Market Fund (ticker, VUSXX) has an MER of 0.09%, and the Vanguard Federal Money Market Fund (ticker, VMFXX) has an MER of 0.11%.

Meanwhile, in Canada, the Manulife Money Market Fund Series F (MMF4622) has an MER of 0.46%, the CIBC Money Market Fund Class F (CIB237) has an MER of 0.28%, and the RBC Canadian Money Market Fund Series A (RBF271) has an MER of 0.35%.

The fees in Canada are at least triple what you get in the United States. I am not sure why that is the case.

Cash Exchange Traded Funds (ETFs)

Cash Exchange Traded Funds (or Cash ETFs) are ETFs whose daily traded shares represent its investors’ pooled capital that the fund manager deposits in High Interest Savings Accounts at major financial firms, usually at higher negotiated interest rates than individual depositors can get with regular HISAs.

Cash ETFs are offered by mutual fund firms, banks, wealth managers, and brokerages, and their shares are traded on stock exchanges. And like money market funds, they return variable yields or dividends and do not guarantee their investors’ principal, unlike T-bills and most HISAs, GICs or C.D.s.

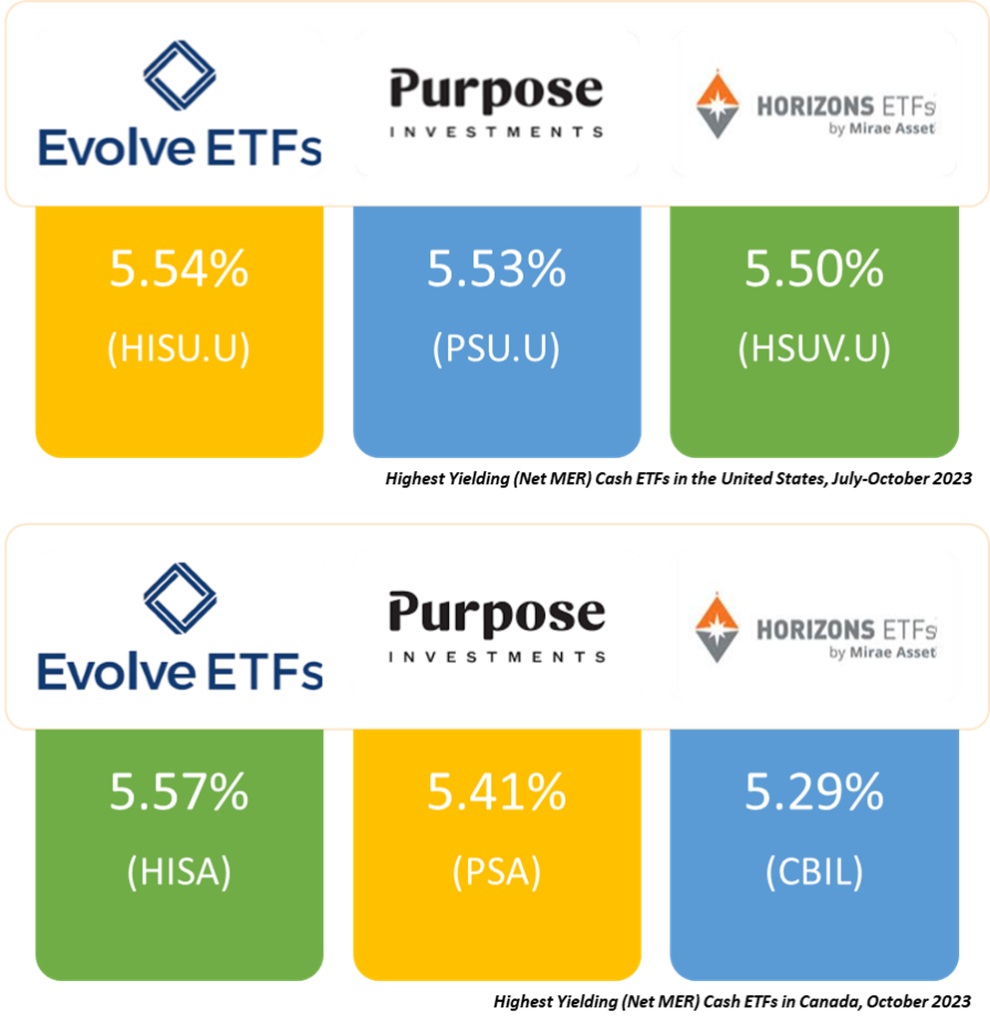

Aside from their uninsured principals and variable yields, their returns are also impacted by various costs like stock exchange fees, brokerage trading commissions, and fund management fees. But unlike what we’ve seen for mutual funds, the total expense of holding these assets in Canada and the U.S. is comparable.

This graphic shows the top three highest cash ETF yields in Canada and the United States. Comparing this to the T-bill discount charts we saw earlier, you can say that investing in cash ETFs over T-bills in Canada and the U.S. is probably better.

Right! That does it for cash and cash equivalents. You may want to explore equities or stocks, fixed income or bonds, real estate, commodities, and alternative asset classes.