What Is An Asset?

So, what is an asset? Investing and growing wealth is all about them, so knowing what they are, what types are available, and many other questions you may have is essential. An asset is anything with monetary value that a person, company, or government holds (i.e., owns or controls) and hopes to financially benefit from in the future.

Assets are acquired (usually purchased or created) to increase the acquirer’s worth or provide financial gain now or in the future (e.g., by exchanging it for cash or generating cash flow from it). Think about someone creating an eBook or handcrafting a bracelet they can profitably sell on Amazon.

Companies usually report their assets on balance sheets (usually in current, fixed, financial, and intangible categories). People and households typically list their assets on net worth tracker apps or spreadsheets, along with their liabilities (Mr. Hyde to Assets’ Dr. Jekyll).

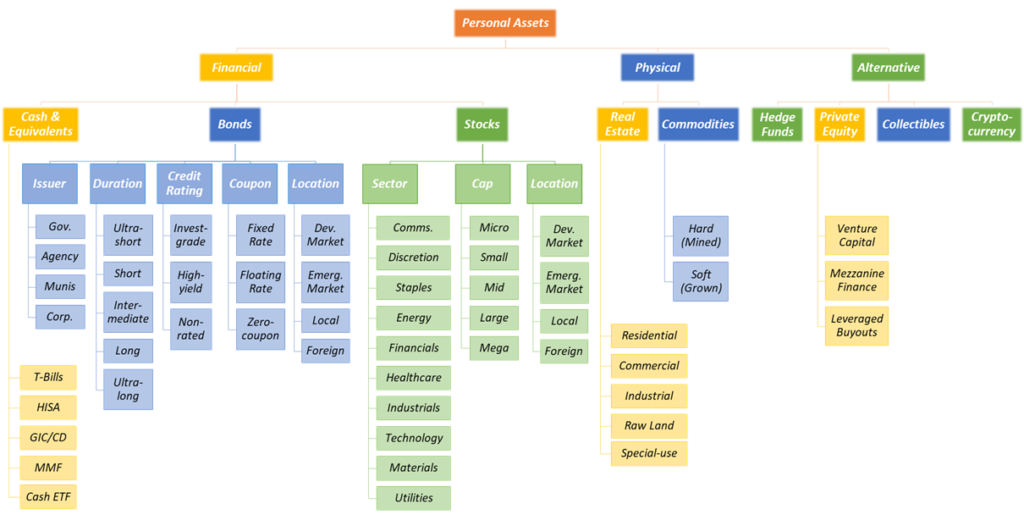

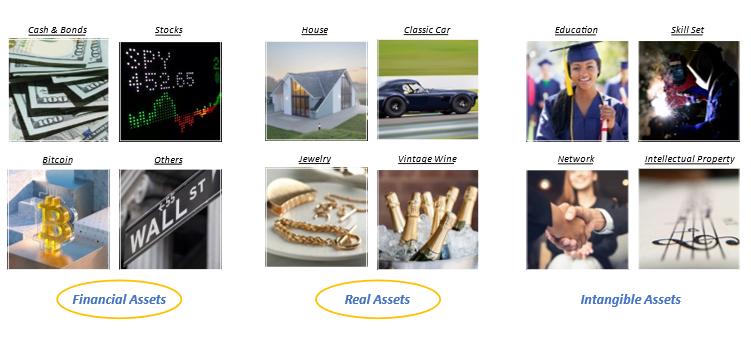

Personal assets, which are things of present or future value owned by an individual or a household, are what I’m referring to when discussing assets. They could be financial, real (or physical), or intangible personal assets.

What Are Financial Assets And Asset Classes?

Personal assets can include financial (e.g., cash in bank accounts and investments), real or physical property (e.g., houses, cars, boats, jewelry, artworks, and bottles of wine) and intangible property (e.g., intellectual property, work experience, education and skills, or a life insurance policy).

I’ll mainly focus on personal financial (and some real) assets here, which most people acquire using the benefits of their intangible property (e.g., salaries from a regular job they got because of their education or skills).

An asset class is an umbrella term for a collection of financial and real assets with similar characteristics and market behaviour. Broadly speaking, these include the following assets (in order of increasing risk or volatility):

- Cash and Cash Equivalents;

- Fixed Income or Bonds;

- Equity or Stocks;

- Commodities;

- Real Estate;

- Alternative Investments (i.e., hedge funds, private equity, cryptocurrency, and collectibles).

Each one of these assets has specific characteristics that influence its value over time. The three primary or traditional financial asset classes are cash and cash equivalents, bonds, and stocks.

Stocks Or Public Equity

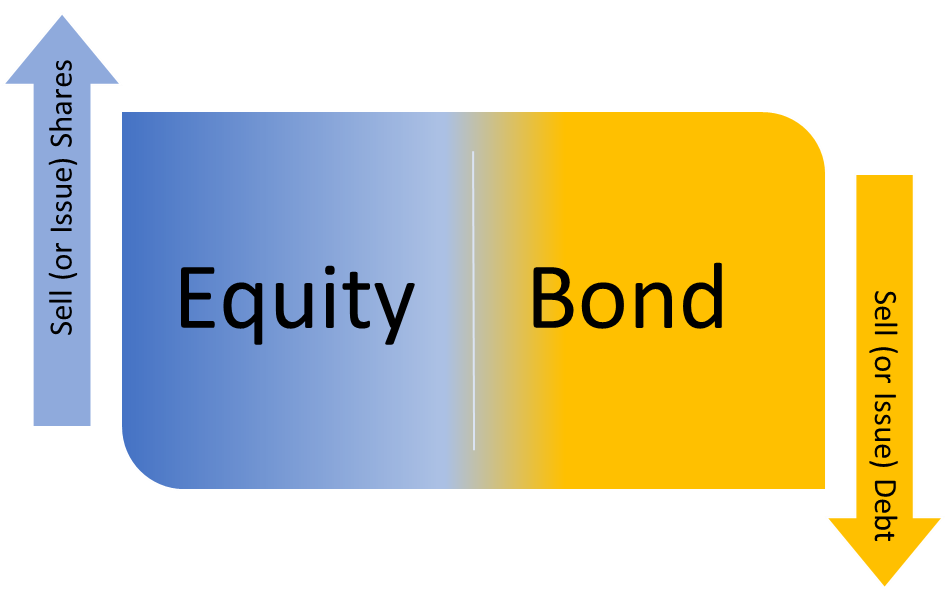

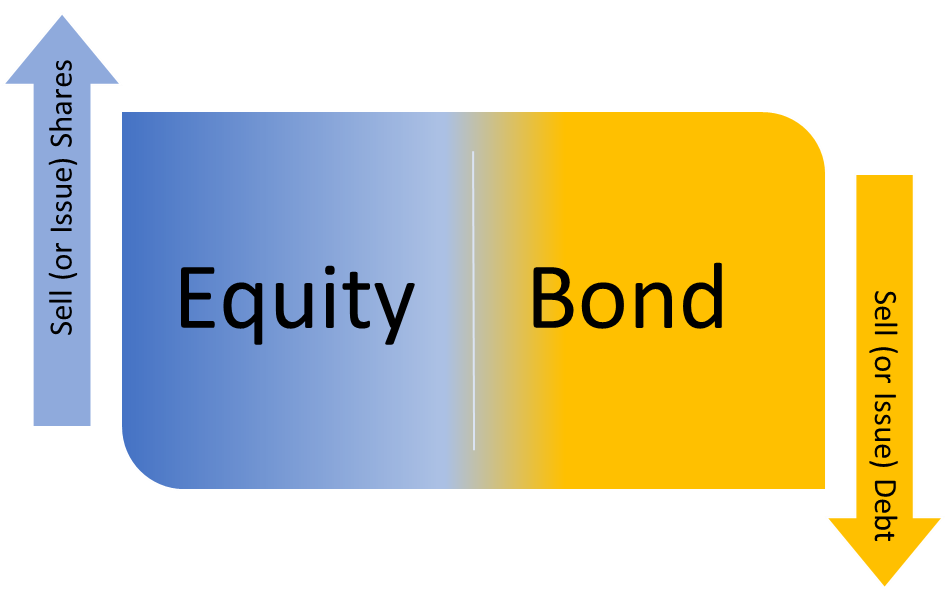

Suppose you own a small business and want to expand, but your ambition outstrips your financial capacity. How do you raise funds? Well, you have two choices. You could:

- Borrow the needed funds from willing lenders with a commitment or bond to repay them with interest, and this means that you issue your lenders debt or bonds or;

- Give up some ownership of the business to keen investors in exchange for the funds, which means you issue your investors equity or stocks.

Let’s explore that second option and peek into the world of the equity asset class.

As the owner of that business, you would list the business on a public stock exchange, like the New York Stock Exchange or the Toronto Stock Exchange. That’s done through an initial public offering, or IPO, which lets you sell slices of ownership in the business to the public.

Those ownership slices are called shares or equity, and the buyers become shareholders or investors in your newly minted, publicly traded company. So, you get the funds you need, the shareholders get a stake in the company in exchange for investing in your vision, and the return on their investment is now linked to the business’s profitability.

Risk And Reward When Investing In Stocks Or Equities

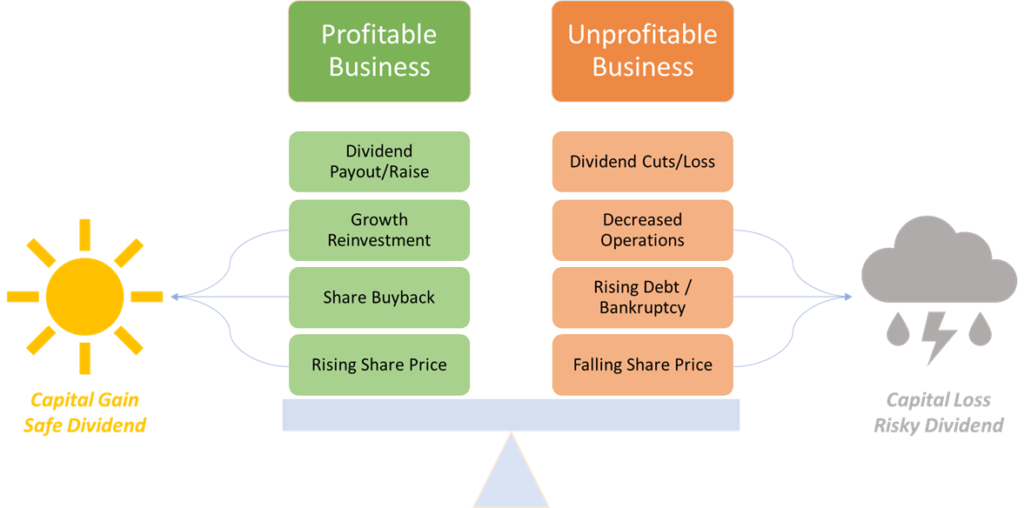

If the business earns a profit, it may pay a portion of that to its shareholders as dividends. Moreover, it could reinvest the profits into growing more value either in-house or by acquiring other businesses. Furthermore, it could buy back some of its shares from the stock market, reducing the supply of tradeable shares and boosting the price of outstanding shares, making its shareholders’ holdings more valuable.

On the other hand, if a business makes a loss, it may cut dividend payments to its shareholders or stop them entirely. It could also be unable to improve or expand operations and acquire assets or other businesses unless it dips into its cash reserves or goes into debt, which could spell more trouble ahead. The same goes for share buybacks. An unprofitable business could do it only by draining cash reserves or borrowing.

The more profitable a business becomes, the more valuable (i.e., in-demand) its shares get in the stock market, which raises its share price. The opposite is true for an increasingly unprofitable business.

So, if long-term shareholders were to sell their shares in a consistently profitable business, they would likely do so at a higher price than they originally paid. In other words, they would gain on their capital or realize a capital gain. So, dividends and capital gains are the two ways to realize an economic benefit from equity assets.

Conversely, if shareholders sell their shares in a consistently unprofitable business, they would likely do so at a lower price than they originally paid. In other words, they would lose part of their capital or realize a capital loss. Moreover, unprofitable businesses eventually go bankrupt, which means total capital loss for shareholders.

As you can see, equity assets are very risky as your principal and return on investment are not guaranteed. Moreover, when a company goes bankrupt, it liquidates its remaining assets by selling them off for cash, and it must settle its debts first before its shareholders get any leftovers.

This point is an excellent segway to talking about the different types of shares and the rights they give to shareholders.

Types Of Shares And Shareholder Rights

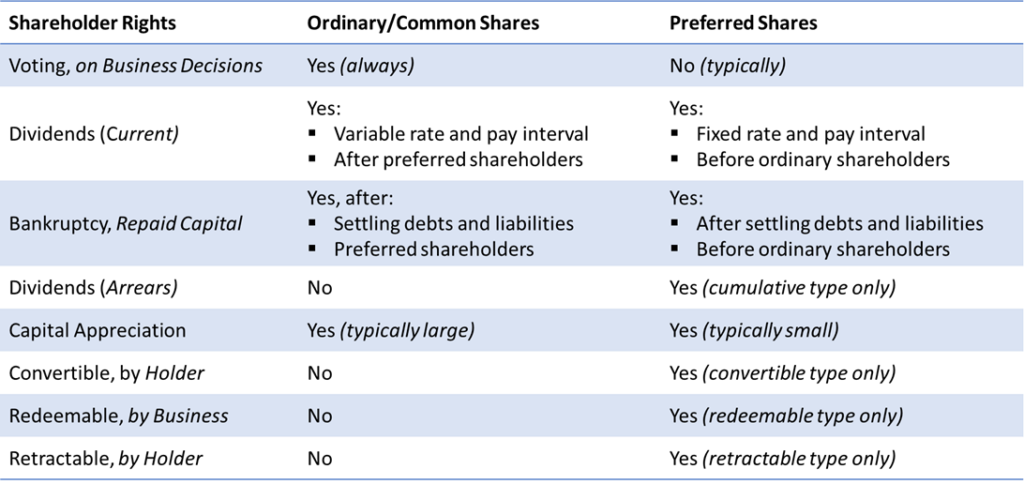

Generally, we have ordinary or common shares and preferred shares. Moreover, preferred shares can be cumulative, convertible, redeemable, or retractable.

Ordinary or common shares grant shareholders voting rights on business decisions. But they come with variable-rate unguaranteed dividends. Also, they have the lowest priority for dividend payment and (in a bankruptcy) capital repayment.

On the other hand, preferred shares do not grant shareholders voting rights on business decisions. However, they grant them fixed-rate guaranteed dividends. Additionally, they have the highest priority for both dividends and (in a bankruptcy) capital repayment.

With cumulative preferred shares, if the business issued dividends but missed paying them in the past, all unpaid dividends accumulate and must be paid to shareholders in the future. On the contrary, with common shares, all missed or unpaid dividends are gone forever.

Common shares usually have more significant capital appreciation or share price growth than preferred shares, where the bulk of the returns are the guaranteed dividends.

With convertible preferred shares, each share is eligible for conversion into a predefined number of common shares at any time the shareholder wants or after a restricted period. Meanwhile, common shares cannot be converted into preferred shares.

For redeemable or callable preferred shares, the business has the right to repurchase the shares from the shareholder at a pre-set price after a pre-set date. On the other hand, common shares belong to the shareholders forever or until they sell them.

With retractable preferred shares, the shareholder has the right to sell the shares back to the company at a pre-set price after a pre-set date. But if they don’t initiate a sale by that date, the business has the right to force them to do so in a hard retraction. In some cases, the business will convert the shares into ordinary shares instead of paying cash to the shareholder in a soft retraction. Conversely, this does not apply to common shares, which the shareholder owns forever or until they sell them.

Let’s see how the equity asset class is further diced and spliced.

Classifying Stocks By Market Sector

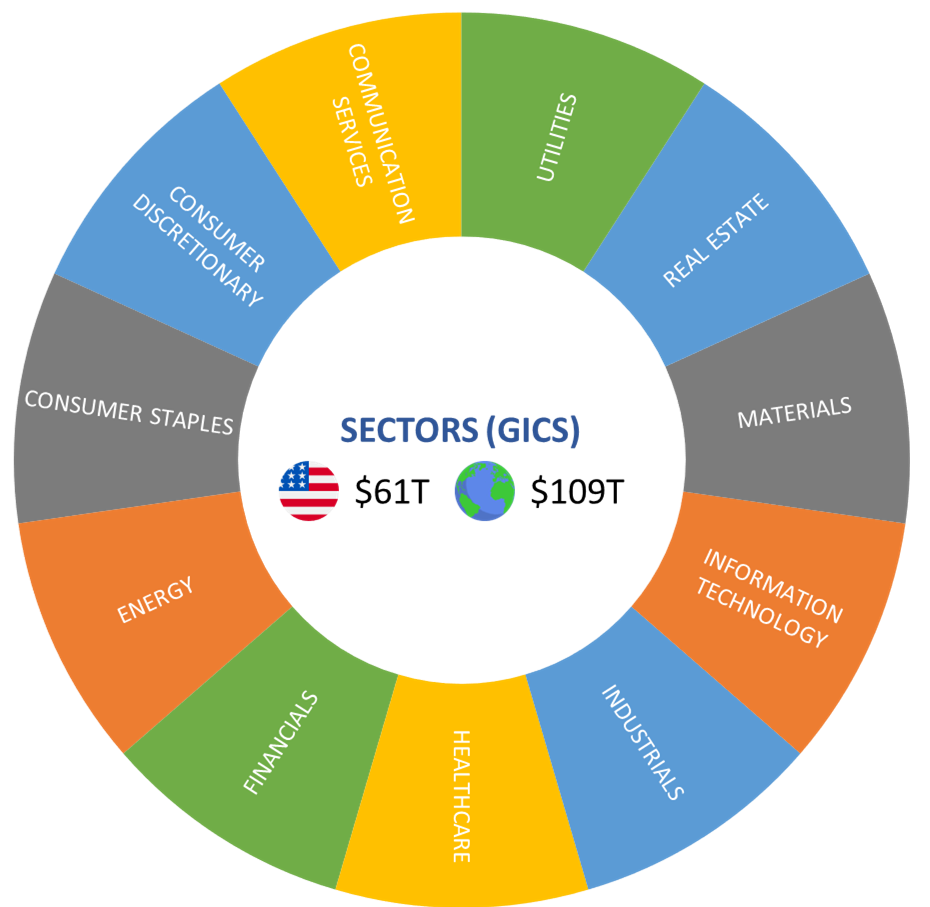

Eleven equity sectors exist per the Global Industry Classification Standard (GICS). They include:

- Communication Services

- Consumer Discretionary (or Consumer Cyclical)

- Consumer Staples (or Consumer Defensive)

- Energy

- Financials

- Healthcare

- Industrials

- Information Technology (or Technology)

- Materials (or Basic Materials)

- Real Estate, and

- Utilities

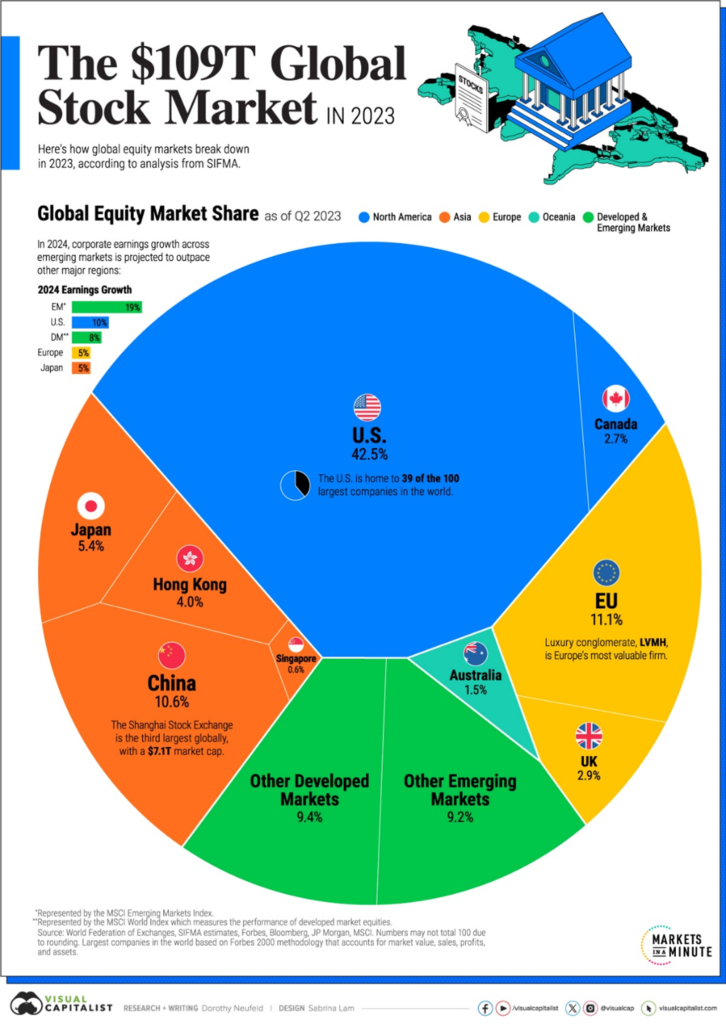

Moreover, the U.S. equity market is the big kahuna, with roughly 60% of the global pie.

These eleven equity sectors can be grouped into defensive, cyclical, and sensitive buckets based on how correlated their performance is with the overall economy.

Equity sectors in the defensive bucket are consumer staples, healthcare, and utilities. Defensive stocks provide consistent dividends and stable earnings regardless of the state of the economy. That’s because there is a constant demand for their products, so they tend to be more stable during different business cycles. This means they have low volatility (or risk), resulting in smaller downsides in economic bursts and upsides in economic booms.

Equity sectors in the cyclical bucket are materials, consumer discretionary, financials, and real estate. Cyclical stocks provide fluctuating dividends and earnings that correlate with the state of the economy. That’s because there is a cyclical demand for their products, with higher demand in economic boom and lower demand in economic burst phases. This means they are more volatile than defensive stocks, with larger downsides in bear markets and upsides in bull markets.

Equity sectors in the sensitive bucket are communication services, energy, industrials, and technology. They are more affected by the economy’s ebb and flow than defensive stocks, but not as much as cyclical stocks.

It’s interesting to note the similarity in the U.S. and global capital allocations to each sector. Still, there is divergence when it comes to:

- Materials and industrials, where the rest of the world allocates more capital than the U.S.;

- Technology and healthcare, where the U.S. allocates more capital than the rest of the world.

Let’s see what defines businesses in each equity sector and identify their largest companies, starting with those in the defensive bucket.

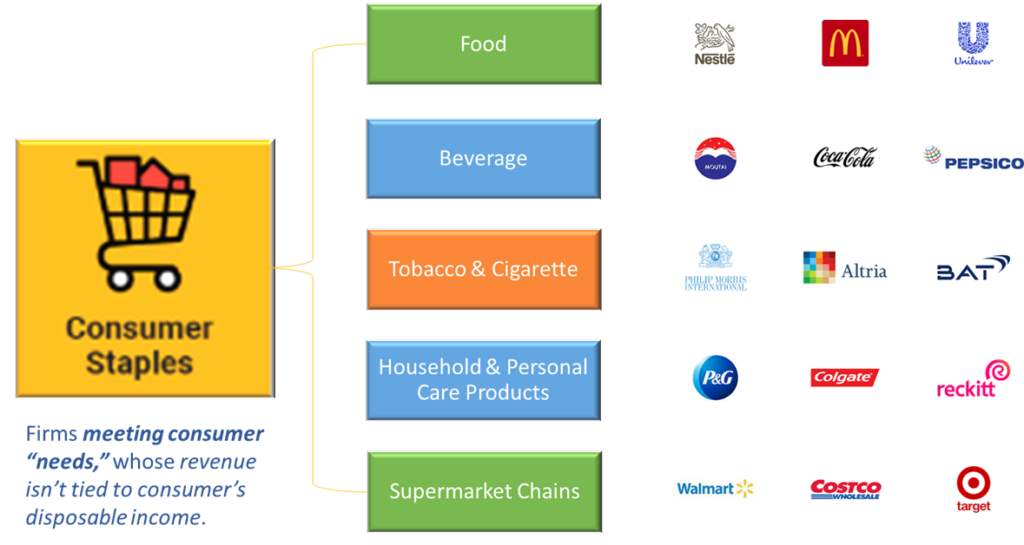

Consumer Staples

The Consumer Staples (or Consumer Defensive) sector includes businesses meeting consumer “needs,” whose revenue is not tied to consumers’ disposable income. The sector covers industries like:

- Food;

- Beverage;

- Tobacco and Cigarette;

- Household and Personal Care Products;

- Supermarket Chains.

Looking into these industries globally, we see that:

- The largest Food companies are Nestlé S.A., McDonald’s Corporation, and Unilever Plc;

- In the Beverage industry, Kweichow Moutai Co. Ltd., The Coca-Cola Company, and PepsiCo Inc. are the biggest businesses;

- Philip Morris International Inc., Altria Group, and British American Tobacco Plc are the leading Tobacco and Cigarette firms;

- In the Household and Personal Care Products industry, The Procter & Gamble Company, the Colgate-Palmolive Company, and Reckitt Benckiser Group Plc are the largest companies;

- Lastly, Walmart Inc., Costco Wholesale Corporation, and Target Corporation run the biggest Supermarket Chains.

Businesses in the consumer staples sector are vulnerable to demographic changes, product trends, price competition, food trends, and competitive marketing. Their valuations are also sensitive to environmental factors, government regulation, the general economy’s health, consumer confidence, and interest rates.

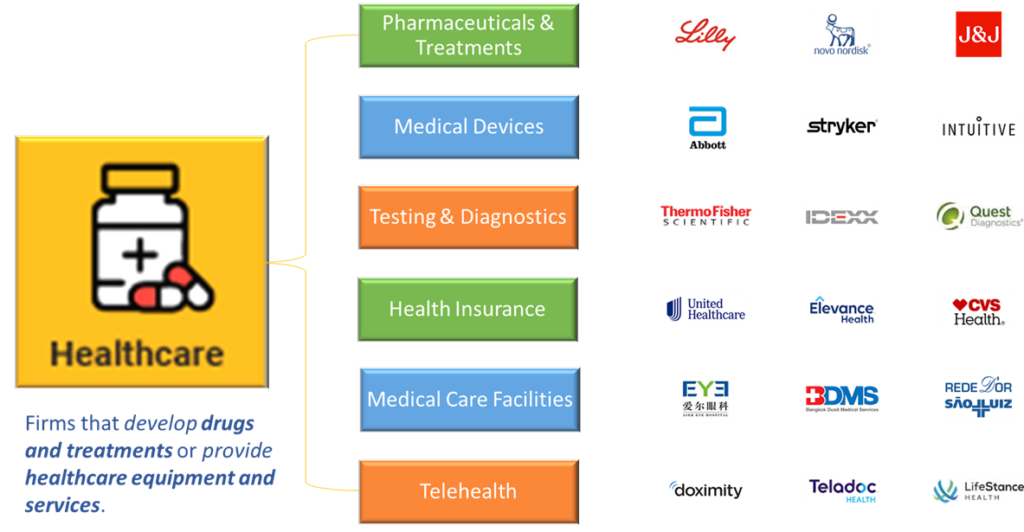

Healthcare

The Healthcare sector covers companies that develop drugs and treatments or provide healthcare equipment and services. The sector includes industries like:

- Pharmaceuticals and Treatments Development;

- Medical Devices Manufacture;

- Testing and Diagnostics;

- Health Insurance;

- Medical Care Facilities;

- Telehealth.

Looking into these industries globally, we see that:

- The largest Pharmaceuticals and Treatments Development firms are Eli Lilly and Company, Novo Nordisk A/S, and Johnson & Johnson;

- Among Medical Devices Manufacturers, Abbott Laboratories, Stryker Corporation, and Intuitive Surgical are the biggest businesses;

- The leading Testing and Diagnostics companies are Thermo Fisher Scientific Inc., IDEXX Laboratories, and Quest Diagnostics;

- The largest Health Insurers are UnitedHealth Group Inc., Elevance Health, and CVS Health;

- AIER Eye Hospital Group Co., Bangkok Dusit Medical Services, and Rede D’Or São Luiz S.A. run the biggest Medical Care Facilities;

- Lastly, the leading Telehealth companies are Doximity, Inc., Teladoc Health, and LifeStance Health Group.

Businesses in the healthcare sector are vulnerable to government regulation, agreed reimbursement rates for newly developed drugs, and the approval of novel products and services. These factors could significantly affect the price and availability of their products and services. Moreover, these firms’ valuations are sensitive to their offerings quickly becoming obsolete and the expiration of their patents.

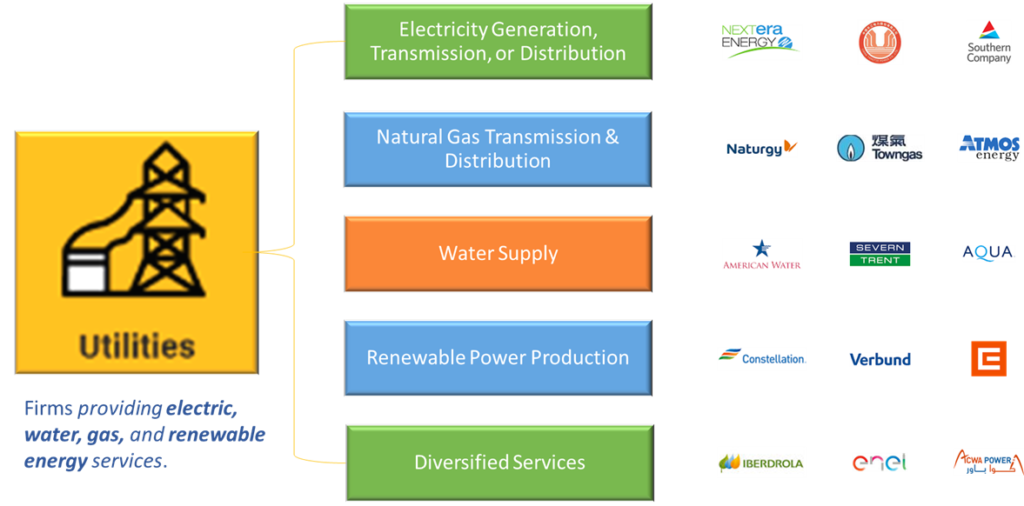

Utilities

The Utilities sector includes companies that provide electric, water, gas, and renewable energy services. The sector covers industries like:

- Electrical Power Generation, Transmission, or Distribution;

- Natural Gas Transmission and Distribution;

- Water Supply;

- Renewable Power Production;

- Diversified Utility.

Looking into these industries globally, we see that:

- The largest Electrical Power Generators, Transmitters, or Distributors are NextEra Energy, Inc., China Yangtze Power Co., and The Southern Company;

- Among Natural Gas Transmitters and Distributors, Naturgy Energy Group, S.A., The Hong Kong and China Gas Company, and Atmos Energy Corporation are the biggest firms;

- American Water Works Company, Severn Trent PLC, and Essential Utilities, Inc. are the largest Water Suppliers;

- The leading Renewable Power Producers are Constellation Energy Corporation, Verbund AG, and CEZ, A.S.;

- Lastly, the largest Diversified Utility companies are Iberdrola, S.A., Enel SpA, and ACWA Power Company.

Businesses in the utilities sector are vulnerable to government regulation, rising borrowing costs (increasing interest rates and excessive debt burden), supply and demand constraints on inputs (i.e., services or fuel), and strict natural resource conservation regimes.

Now, let’s explore the businesses in the cyclical bucket.

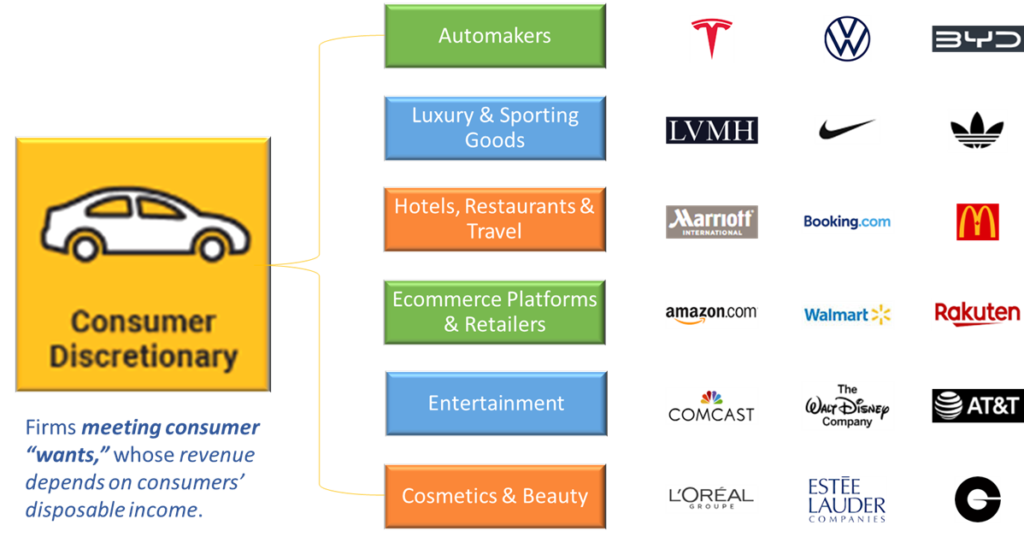

Consumer Discretionary

The Consumer Discretionary (or Consumer Cyclicals) sector includes businesses meeting consumer “wants” whose revenue depends on disposable income. The sector consists of industries like:

- Automotives;

- Luxury and Sporting Goods;

- Hotels, Restaurants and Travel;

- E-commerce and Retail;

- Entertainment;

- Cosmetics and Beauty.

Looking into these industries globally, we see that:

- Tesla, Inc., Volkswagen AG, and BYD Company Limited are the biggest Automakers;

- The largest Luxury and Sporting Goods Makers are Louis Vuitton – Moët Hennessy, NIKE Inc., and Adidas AG;

- Marriott International, McDonald’s Corporation, and Booking Holdings are the leading Hotels, Restaurants and Travel companies;

- The largest E-commerce and Retailer firms are Amazon.com, Inc., Walmart, Inc., and Rakuten Group, Inc.;

- Comcast Corporation, The Walt Disney Company, and AT&T Inc. are the biggest Entertainment firms;

- Lastly, the largest Cosmetics and Beauty firms are L’Oréal S.A., Estée Lauder Companies Inc., and Givaudan S.A.

Businesses in the consumer discretionary sector are vulnerable to the general economy’s health, interest rates, and price competition. Their valuations are also sensitive to consumer confidence, spending, tastes, and demographic changes.

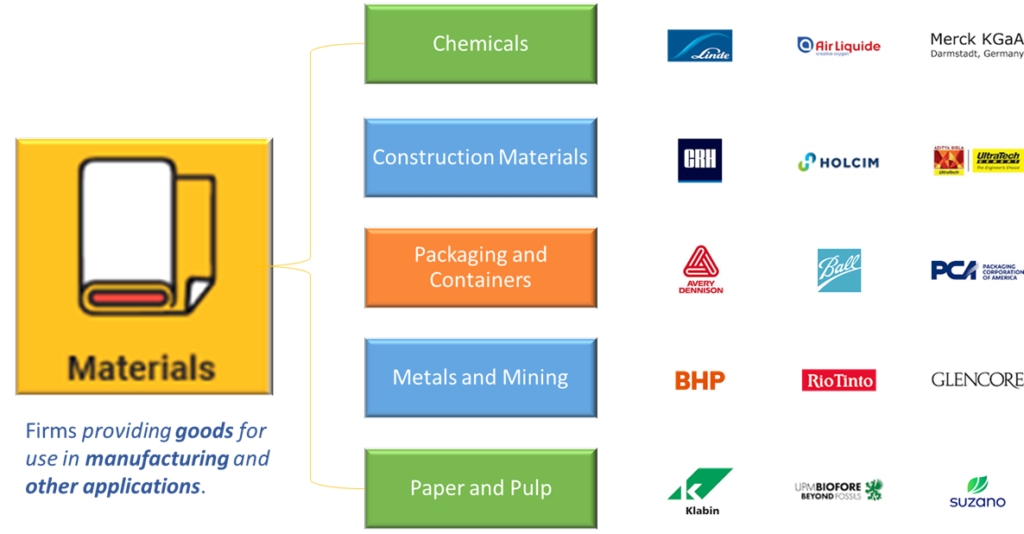

Materials

The Materials (or Basic Materials) sector covers companies providing various goods for manufacturing and other applications. The sector includes industries like:

- Chemicals;

- Construction Materials;

- Packaging and Containers;

- Metals and Mining;

- Paper and Forest Products.

Looking into these industries globally, we see that:

- The largest Chemicals companies are Linde Plc, Air Liquide, and Merck KGaA;

- Cement Roadstone Holding, Holcim S.A., and UltraTech Cement are the biggest Construction Materials businesses;

- The leading Packaging and Containers firms are Avery Dennison Corporation, Ball Corporation, and Packaging Corporation of America;

- BHP Group Ltd, Rio Tinto, and Glencore are the largest Metals and Mining companies, and;

- Lastly, Klabin S.A., UPM-Kymmene, and Suzano S.A. are the biggest Paper and Forest Products firms.

Businesses in the materials sector are vulnerable to commodity prices and price volatility, the strength of the U.S. dollar, import controls, global supply competition, costs related to environmental damage, resource depletion, and mandatory safety and pollution control costs.

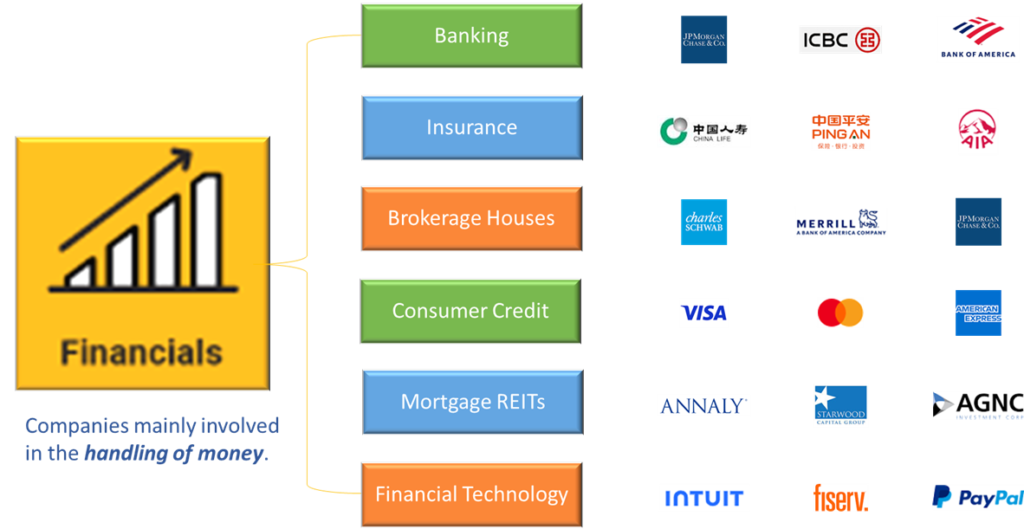

Financials

The Financials (or Financial Services) sector covers companies that mainly handle money. The sector includes industries like:

- Banking;

- Insurance;

- Brokerage;

- Consumer Finance;

- Mortgage-related Real Estate Investment Trusts (REITs);

- Financial Technology or Fintech.

Looking into these industries globally, we see that:

- JPMorgan Chase & Co., Industrial and Commercial Bank of China, and Bank of America are the largest Banks;

- The biggest Insurance firms are China Life Insurance, Ping An Insurance, and AIA Group;

- The Charles Schwab Corporation, Merrill Lynch, and JPMorgan Chase & Co. are the leading Brokerages;

- The biggest Consumer Finance Providers are Visa, Mastercard, and American Express;

- Annaly Capital Management, Starwood Property Trust, and AGNC Investment Corp. are the largest Mortgage-related REITs;

- Lastly, Intuit Inc., Fiserv Inc., and PayPal Holdings Inc. are the biggest Fintech companies.

Businesses in the financial sector are sensitive to wide-ranging government regulation and service segment overlap (and the relatively rapid change it can bring). They are also vulnerable to the availability and cost of capital funds, interest rate changes, corporate and consumer debt defaults, and price competition.

Real Estate

The Real Estate sector includes property developers, managers, and real estate investment trusts (REITs). The sector consists of industries like:

- Property Management;

- Shopping Malls;

- Public Storage;

- Healthcare Facilities;

- Communications Real Estate;

- Digital Infrastructure;

- Industrial Real Estate.

Looking into these industries globally, we see that:

- The largest Property Managers are CBRE Group, Jones Lang LaSalle, and Colliers International Group;

- Simon Property Group, Realty Income Corporation, and Regency Centers Corporation are the biggest Shopping Mall Owners;

- The leading Public Storage Providers are Public Storage, Extra Space Storage, and CubeSmart;

- Welltower Inc., Ventas, and Healthpeak Properties are the largest Healthcare Facility Owners;

- The biggest Communications REITs are American Tower, Crown Castle, and SBA Communications;

- Equinix, Digital Realty Trust, and Iron Mountain are the leading Digital infrastructure REITs;

- Lastly, the largest Industrial REITs are Prologis, Rexford Industrial Realty, and EastGroup Properties.

Businesses in the real estate sector are sensitive to shifts in property values or the overall economy’s health.

Now, let’s explore the businesses in the sensitive bucket.

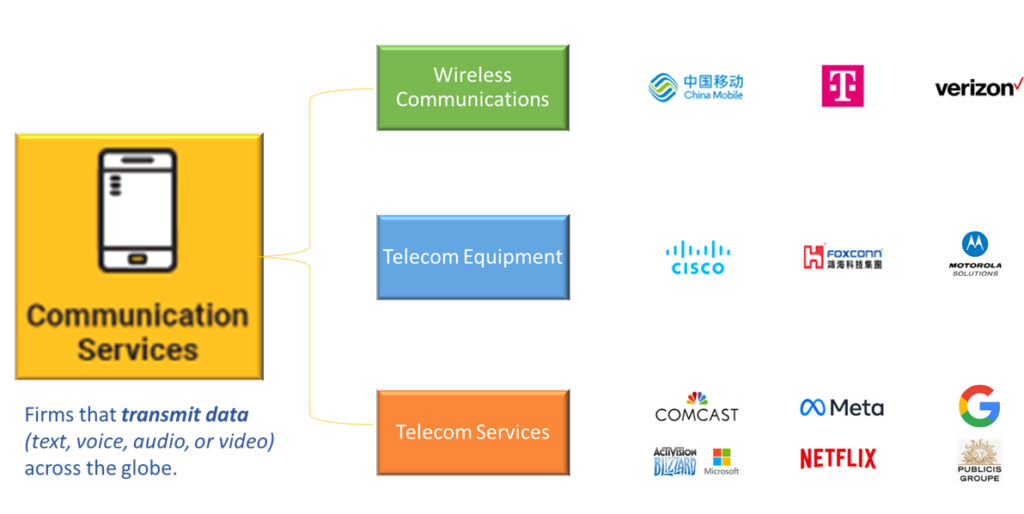

Communications Services

The Communications Services sector covers businesses that transmit data as text, voice, audio, or video across the globe. The sector includes industries like:

- Wireless Communications;

- Telecom Equipment Manufacturing;

- Telecom Services, which covers fields like:

- Internet Services and Traditional T.V.;

- Social Media;

- Internet Search and Digital Advertising;

- Video Games;

- Streaming;

- Traditional Advertising.

Looking into these industries globally, we see that:

- China Mobile Ltd., T-Mobile U.S., Inc., and Verizon Communications Inc. are the largest Wireless Communications firms;

- The biggest Telecom Equipment Manufacturers are Cisco Systems Inc., Foxconn Industrial Internet Co. Ltd., and Motorola Solutions Inc.;

- Lastly, in the Telecom Services industry:

- Comcast Corporation is the largest Internet services and Traditional T.V. company;

- The biggest Social Media business is Meta Platforms Inc. (formerly known as Facebook);

- Alphabet Inc. (or Google) is the leading Internet Search and Digital Advertising firm;

- The largest Video Game Creator is Microsoft’s Activision Blizzard Inc.;

- Netflix Inc. is the biggest Streaming company, and;

- The largest Traditional advertising business is Publicis Groupe S.A.

Businesses in the communication services sector are vulnerable to government regulation, price competition, technological advancements, and the overall economy’s health. They are also sensitive to consumer and business confidence, spending, and shifts in consumer and business requirements and preferences.

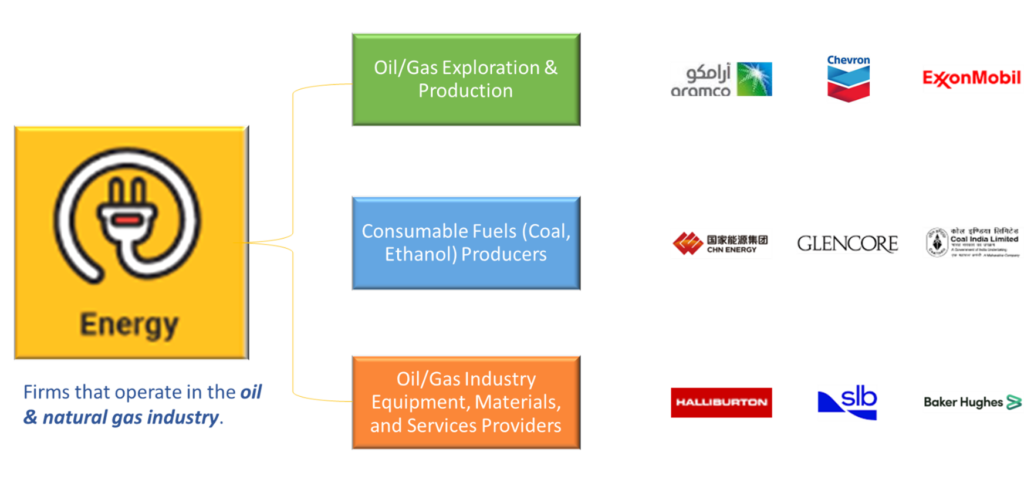

Energy

The Energy sector includes businesses operating in oil and natural gas. The sector consists of industries like:

- Oil and Gas Exploration and Production;

- Consumable Fuels Production;

- Oil and Gas Industry Equipment, Materials, and Services Provision.

You’ll notice that it doesn’t include renewable energy companies, as those are considered utilities.

Looking into these industries globally, we see that:

- The largest Oil and Gas Exploration and Production firms are Saudi Arabian Oil Company, Exxon Mobil Corporation, and Chevron Corporation;

- China Shenhua Energy Co. Ltd., Coal India Ltd., and Glencore Plc. are the biggest Consumable Fuels Producers;

- Lastly, the leading Oil and Gas Industry Equipment, Materials, and Services Providers are Schlumberger Ltd., the Halliburton Company, and the Baker Hughes Company.

Businesses in the energy sector are sensitive to fluctuations in energy prices, energy fuels supply and demand, energy conservation legislation, discovery of new energy source (i.e., successful exploration projects), and tax and other government regulations.”

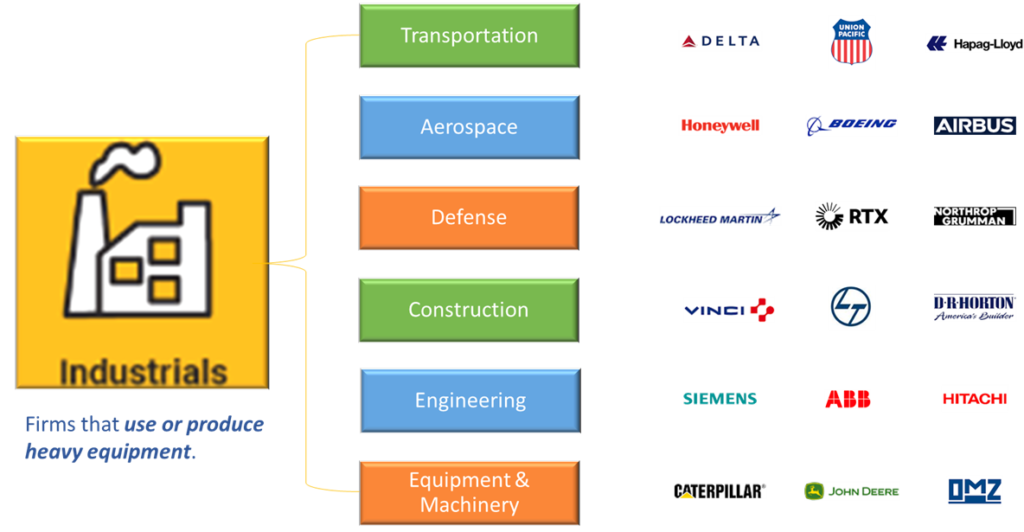

Industrials

The Industrials sector covers a variety of businesses that utilize heavy equipment. The sector includes industries like:

- Transportation;

- Aerospace;

- Defence;

- Construction;

- Engineering, and;

- Equipment and Machinery Manufacturing.

Looking into these industries globally, we see that:

- The largest Transportation companies are airliner Delta Air Lines, Inc., railroader Union Pacific Corporation, and logistics firm Hapag-Lloyd;

- Honeywell International Inc., The Boeing Company, and Airbus S.E. are the biggest Aerospace firms;

- The leading Defence companies are Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation;

- Vinci SA, Larsen & Toubro Ltd., and D.R. Horton Inc. are the largest Construction businesses;

- The biggest Engineering firms are Siemens AG, ABB Ltd., and Hitachi Ltd.;

- Lastly, Caterpillar Inc., Deere & Company, and United Heavy Machinery are the largest Equipment and Machinery Manufacturers.

Businesses in the industrial sector are sensitive to the health of the overall economy, fluctuations in consumer sentiment and spending, commodity prices and volatility, and legislation. Their valuations are also vulnerable to government spending and regulations, import controls, global supply competition and resource depletion (of input materials), environmental damage costs, and mandatory safety and pollution control costs.

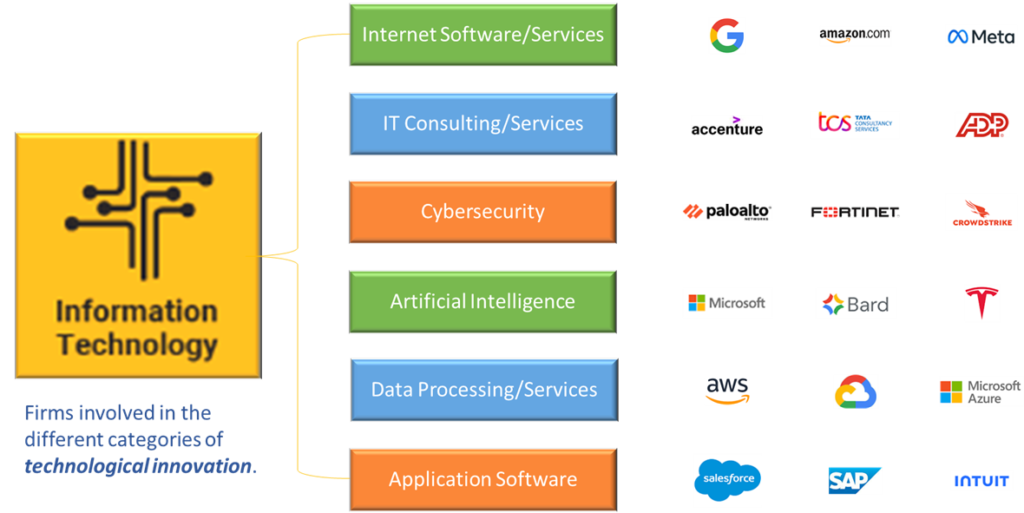

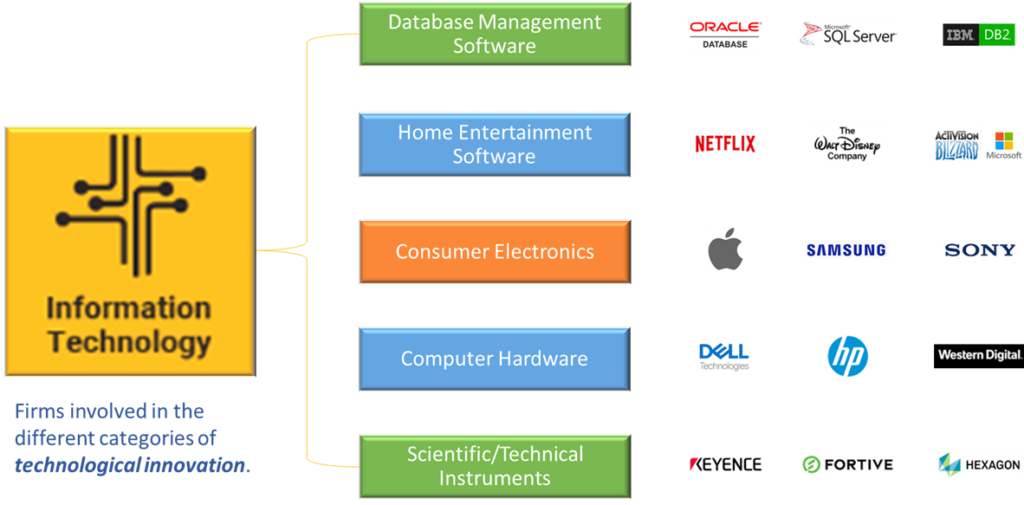

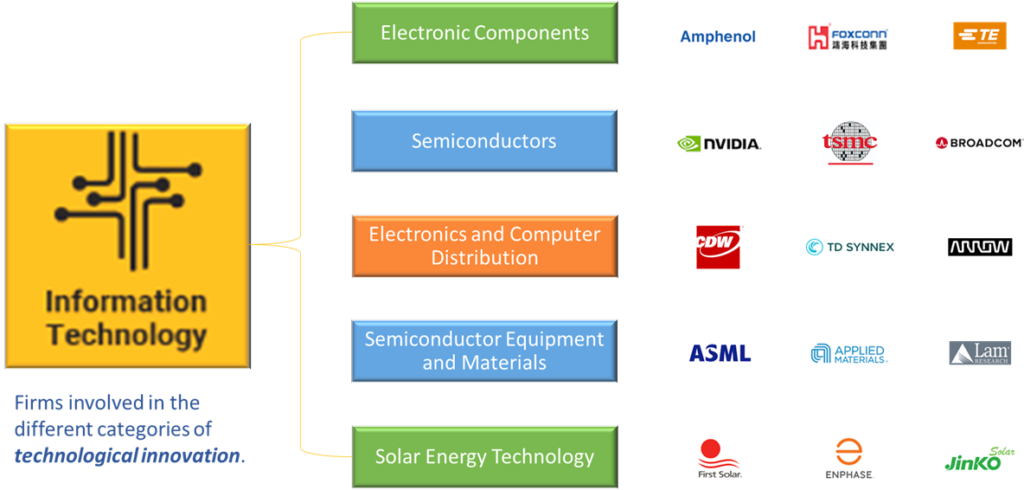

Information Technology

The Information Technology sector includes companies involved in different aspects of technological innovation. It is the largest among the eleven GICS equity sectors and includes industries such as:

- Internet Software and Services;

- I.T. Consulting and Services;

- Cybersecurity;

- Artificial Intelligence;

- Data Processing and Services;

- Application Software;

- Database Management;

- Home Entertainment Software;

- Consumer Electronics;

- Computer Hardware;

- Scientific and Technical Instruments;

- Electronic Component Manufacture;

- Semiconductor Manufacture;

- Electronics and Computer Distribution;

- Semiconductor Equipment and Materials Production;

- Solar Energy Technology.

Looking into these industries globally, we see that:

- The largest Internet Software and Services companies are Alphabet Inc., Amazon.com Inc., and Meta Platforms Inc.;

- Accenture plc, Tata Consultancy Services Limited, and Automatic Data Processing are the biggest I.T. Consulting and Services firms;

- The leading Cybersecurity businesses are Palo Alto Networks, Inc., Fortinet, Inc., and CrowdStrike Holdings, Inc.;

- Microsoft Corporation, Alphabet Inc., and Tesla, Inc. are the largest Artificial Intelligence companies;

- The biggest Data Processing and Services firms are Amazon.com, Alphabet Inc., and Microsoft Corporation;

- Salesforce, Inc., SAP SE, and Intuit Inc. are the leading Application Software businesses.

In addition, on a worldwide basis, we find that:

- The leading Database Management firms are Oracle Corporation, Microsoft Corporation, and International Business Machines (IBM) Corporation;

- Netflix, Inc., The Walt Disney Company, and Microsoft’s Activision Blizzard are the largest Home Entertainment Software companies;

- The biggest Consumer Electronics businesses are Apple Inc., Samsung Electronics Co., and Sony Group Corporation;

- Dell Technologies Inc., H.P. Inc., and Western Digital Corporation are the leading Computer Hardware firms;

- Keyence Corporation, Fortive Corporation, and Hexagon AB are the largest Scientific and Technical Instruments firms.

Moreover, on a global level, we see that:

- The largest Electronic Component Manufacturers are Amphenol Corporation, Hon Hai Precision Industry Co., and T.E. Connectivity Ltd.;

- NVIDIA Corporation, Taiwan Semiconductor Manufacturing Company Limited, and Broadcom Inc. are the biggest Semiconductor Manufacturers;

- The leading Electronics and Computer Distributors are CDW Corporation, TD Synnex Corporation, and Arrow Electronics, Inc.;

- ASML Holding N.V., Applied Materials, Inc., and Lam Research Corporation are the largest Semiconductor Equipment and Materials Producers;

- Lastly, the biggest Solar Energy Technology firms are First Solar, Inc., Enphase Energy, Inc., and Jinko Solar Co.

Businesses in the technology sector are sensitive to short product cycles and rapid obsolescence of current innovation, downward pressure on price and profits due to new advances, competition from new market players, and the health of the overall economy.

Classifying Stocks By Market Capitalization

Equities can also be grouped by market capitalization or market cap (i.e., what the market thinks the underlying business is worth). This approach results in five groups – micro cap, small cap, mid cap, large cap, and mega cap stocks.

Micro caps are businesses valued under $250 million, e.g., Semler Scientific, Inc. and Vitalhub Corp. They are the most volatile, riskiest, and illiquid market cap category (illiquid means it’s not easy selling their shares, usually due to low trading volumes). Moreover, their scarce data makes research difficult, leaving investors vulnerable to fraud and other risks.

Small caps are businesses valued between $250 million and $2 billion, e.g., Agilysys, Inc. and Docebo, Inc. They have historically outperformed larger cap stocks but are more volatile, riskier, and less liquid. Moreover, the same issues plague some as micro-caps, i.e., lack of information and illiquidity.

Mid caps are businesses valued between $2 and $10 billion, e.g., e.l.f. Beauty, Inc. and Descartes Systems Group Inc. As their name implies, they are in the middle of their growth story and are projected to keep growing earnings and market share. They provide diversification in a portfolio by contributing a balance of growth and stability.

Large caps are businesses valued between $10 and $200 billion, e.g., Paycom Software, Inc. and Manulife Financial Corporation. They dominate global market benchmark indexes (e.g., the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite in the United States). These firms are usually transparent, making sufficient data publicly available and easing investors’ research. Moreover, they are typically blue-chip companies at peak business cycle phases, producing established and stable revenue and earnings with lower volatility and often paying dividends. As a result, they usually form the core of most investors’ long-term strategy.

Mega caps are businesses valued over $200 billion, e.g., Microsoft Corporation and Alphabet Inc. These goliaths sell tons of goods and services in any reporting period and have an outsized influence in the industries in which they operate. That’s a double-edged sword because the broader market could be heavily affected if these firms experience a persistent slump. So, while mega-caps share a lot of benefits with large-caps, e.g., transparency, data availability, stable returns, and lower volatility, they come with concentration risk.

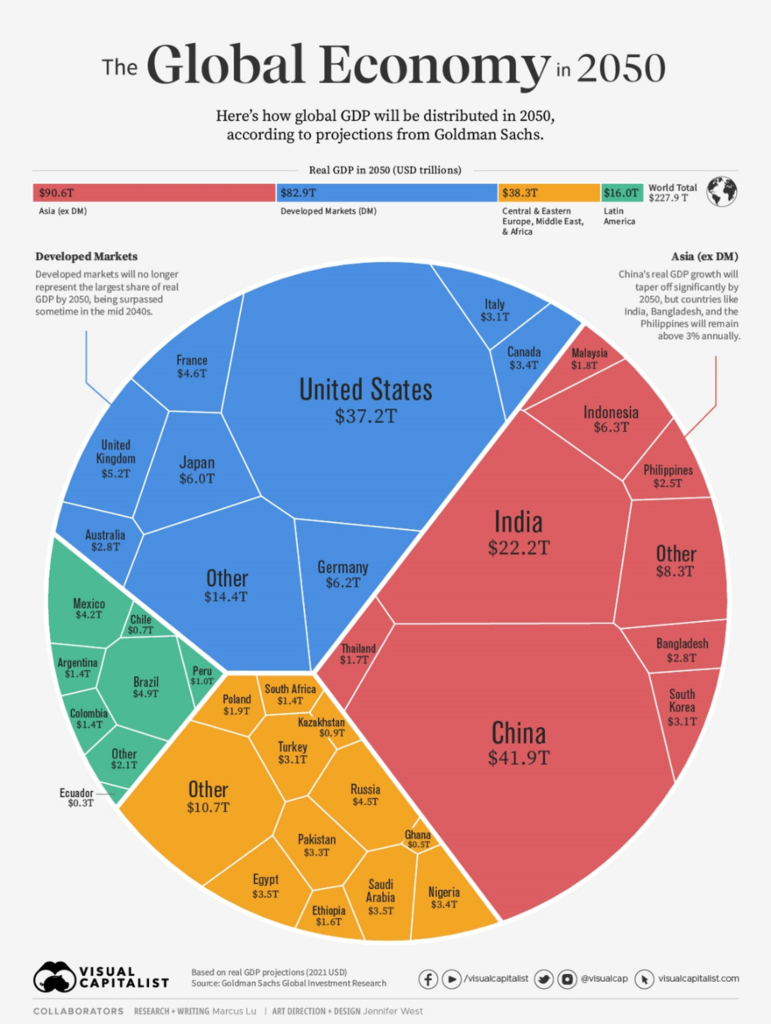

Classifying Stocks By Market Location

Equities can also be grouped by Market classification or location (i.e., where the businesses mainly operate). In so doing, we obtain developed and emerging market equities and local or foreign equities.

Developed markets have higher household incomes, adequate infrastructure, and mature capital markets (i.e., markets with greater stability, transparency, and liquidity, having well-regulated exchanges, established trading platforms, and investor protection mechanisms). Developed markets are primarily in North America (i.e., the United States & Canada), Western Europe and Australasia (i.e., Australia, New Zealand, Japan, and South Korea).

Emerging markets have rapid economic growth and development driven by younger populations, higher consumption levels, and a strong modernization drive. But they also have lower household incomes, inadequate infrastructure, immature capital markets, and bouts of political and economic instability. Emerging markets mainly include Brazil, Mexico, Saudi Arabia, Russia, India, Indonesia, China, and Taiwan.

As a Canadian, when you buy Canadian stocks, you’re purchasing local equities, but when you buy U.S. stocks, you’re buying foreign equities.

The world doesn’t entirely revolve around the U.S. and the developed markets, and change is the only constant. Current projections see emerging markets outgrowing their developed counterparts by the mid-2040s. Moreover, 2024 earnings growth forecasts show 19% earnings growth for emerging markets, beating the U.S.’ 10% and the developed markets’ 8% earnings growth projections.

Right! That does it for equities. Next, we’ll delve into the fixed-income or bond asset class.

Fixed Income or Bonds

Suppose you want to expand the small business you own, but you’re strapped for cash. Yet, you don’t want to sell ownership stakes (i.e., shares), or you’ve already sold all the shares you’re comfortable selling. You could borrow the funds from willing lenders with a commitment to repay with interest, meaning you issue them debt or bonds. Those lenders now own your debt and become bondholders.

Let’s explore how all that works and peek into the world of the fixed income or bond asset class.

Businesses and governments can obtain outside funds by borrowing. They do so by issuing bonds (i.e., selling debt) with a fixed or variable interest, a set payment frequency, and an agreed repayment period to interested lenders. A bond’s interest payment is also called a coupon, and its repayment period is also called its duration.

Bonds reach maturity at the end of their duration. At that time, the borrower, or bond issuer, must return the amount they borrowed, or the principal, back to the lenders or bondholders.

For some bonds, the issuer has the right to pay off or call the debt early and stop making coupon payments to bondholders. These are known as callable or redeemable bonds.

Moreover, a single lender can rarely meet a borrower’s needs. That’s why bonds are usually issued in units, so each lender can buy as many units as they can afford. A bond’s coupon and duration apply equally to each unit sold to the bondholders.

Bond Prices, Inflation And Interest Rates

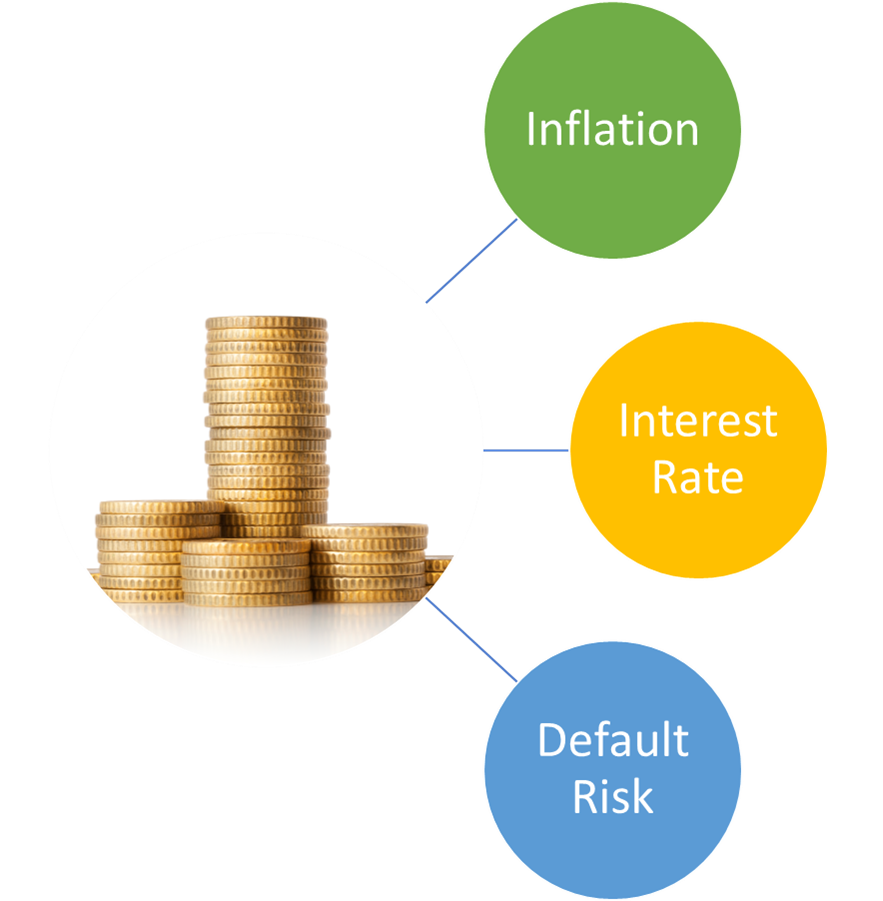

The price of a bond and the coupon paid to lenders depend on prevailing and anticipated inflation and interest rates and the borrower’s likelihood of default. Default occurs when the bond issuer cannot pay the coupon in line with the payment interval or repay the principal at maturity. As the risk of default (i.e., credit risk) rises, so does the coupon the borrower must offer to entice lenders to buy their riskier bond.

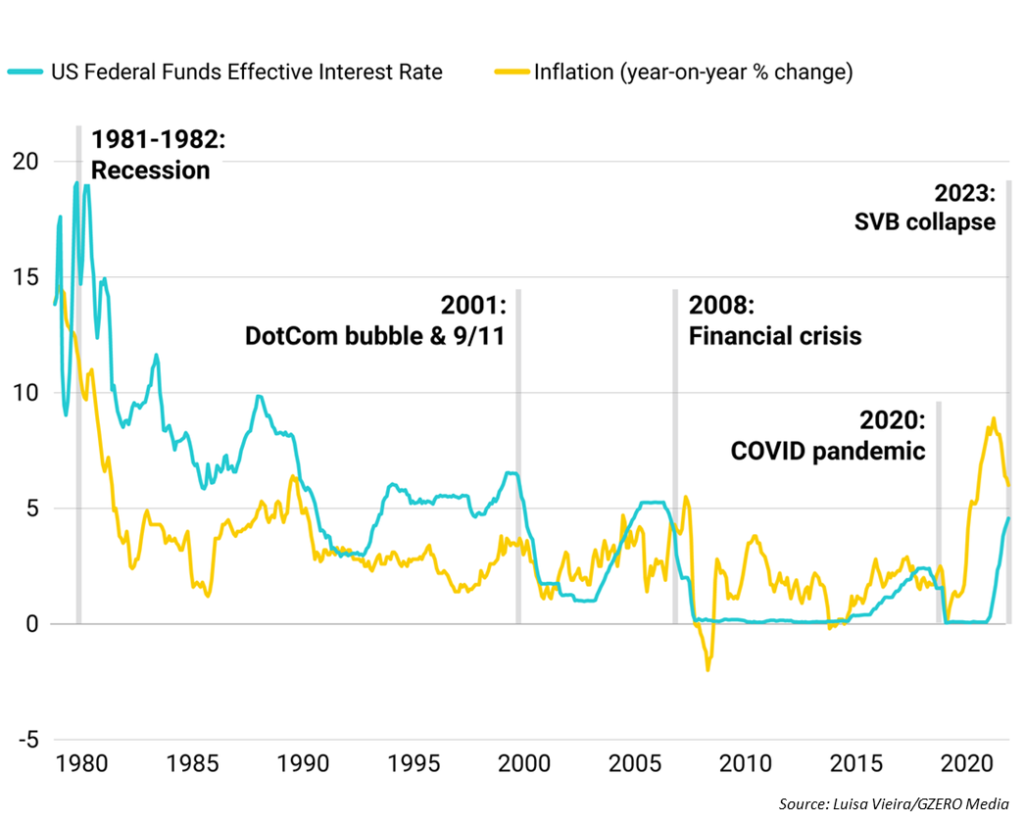

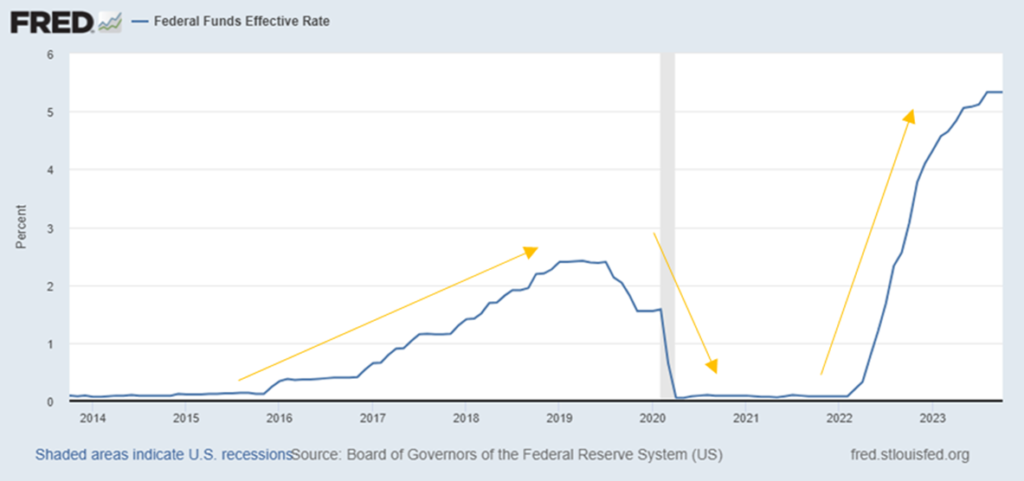

The positive correlation between inflation and interest rates is well established as raising interest rates is central banks’ primary tool to control rising or high inflation. High or rising inflation and interest rates during a bond’s duration means that bondholders’ principal and coupons will be worth less when they receive them in the future.

So, the yield or interest rate on bonds issued in such periods must be high enough to compensate bondholders for the inflation and interest rate risks.

In such times, bond issuers are limited in the asking price they can set for their bonds. That’s because they need to make the bonds more attractive, given the possibility that interest rates will rise during the bond’s duration. Lenders can wait for bonds issued in the future at those higher interest rates instead of buying now, and this lack of demand would further drive down bond prices.

Interest Rates, Bond Prices, And Bond Yields

Bondholders can also resell their bonds to other lenders before maturity. Relative to the bond’s original issue price (i.e., its face value or par), the resale can occur at a:

- Lower price or at a discount to par, and the seller records a capital loss;

- Price equal to par, and the seller recoups the entire principal they invested in the bond, or;

- Higher price or at a premium to par, and the seller records a capital gain.

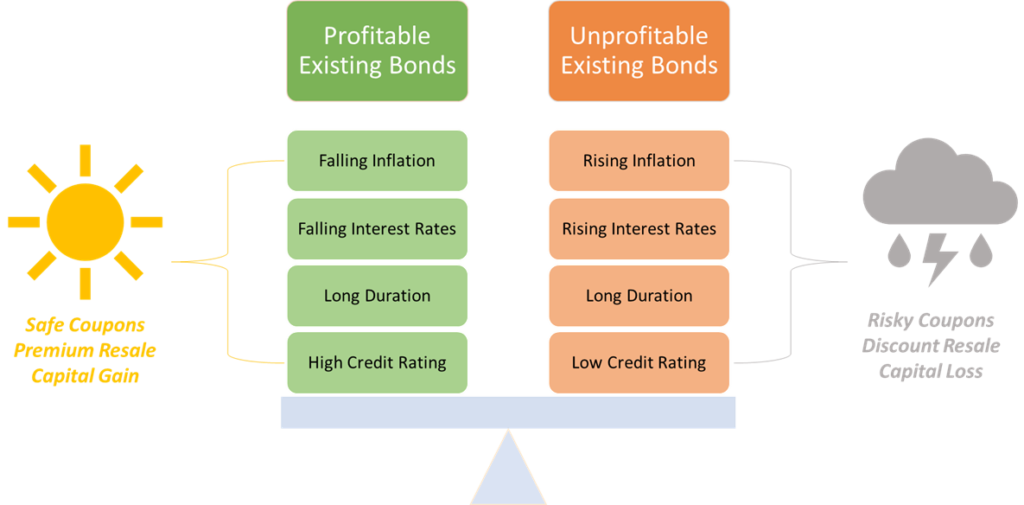

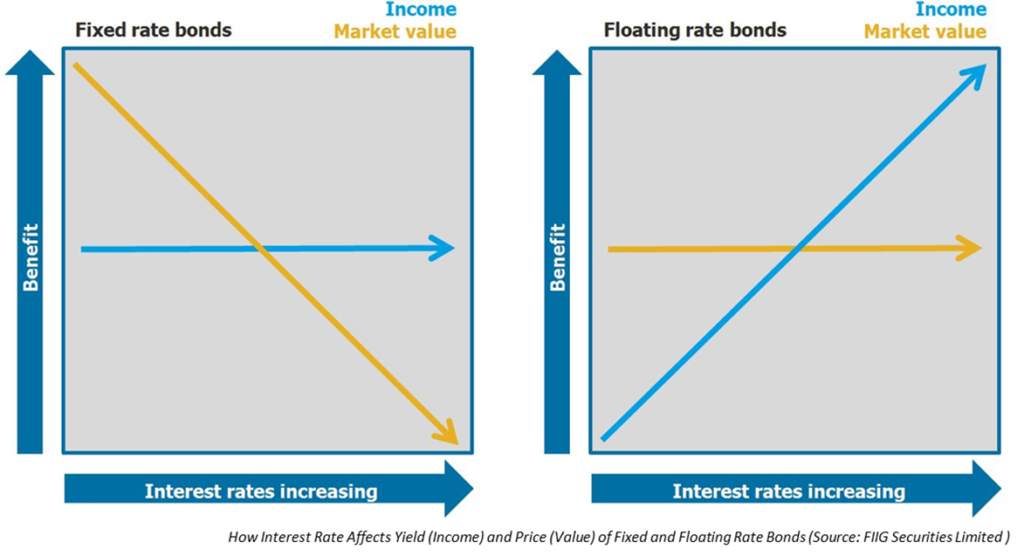

Like the original issue price, the resell price is inversely related to the available interest rates on similar bonds at the time of the resale, and that’s tied to current and expected inflation. So, borrowers or bond sellers sell their bonds at lower prices and offer higher interests or coupons in rising or high inflation and interest rate market phases. The opposite is true in a falling or low inflation and interest rate environment.

Bond Duration, Interest Rate, And Bond Prices

As a rule of thumb, for each percentage rise (or fall) in interest rate, a bond’s price falls (or rises) by the value of its duration expressed as a percentage. So, a 10-year duration bond’s price will fall (or rise) by 10% for each 1% rise (or fall) in interest rates.

This relationship explains why bond issuers pay off redeemable or callable bonds before maturity when inflation and interest rates fall. Bondholders only get the bond’s value at the pre-set call price, which is usually face value, so they get their principal back. But they lose the interest payments for the remaining duration. On the other hand, bond issuers can re-issue the called bonds at a higher price and lower coupon rates.

Default And Creditworthiness

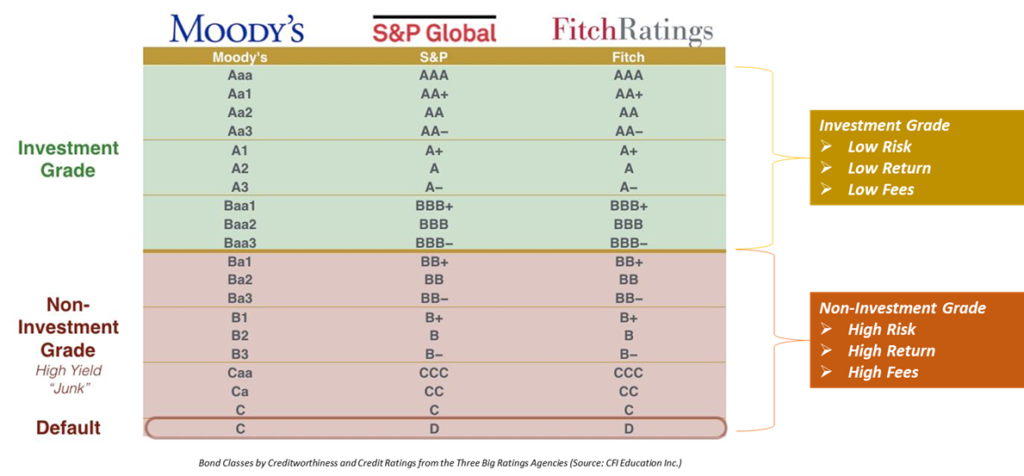

A borrower’s credit risk is summed up in its creditworthiness, like the credit score people get based on their income and loan repayment history. Three leading global credit rating agencies evaluate and publish credit ratings of corporations and governments – Moody’s, Standard & Poor’s (S&P), and Fitch.

For example, Standard & Poor’s rates borrowers on a scale of AAA (strong), A.A. (satisfactory), A (adequate), B (uncertain), C (likely default), and D (in default).

However, these ratings are not faultless, and as John Maxfield wrote for the Motley Fool, “rating agencies are always the last to know” when there’s trouble lurking in a borrower’s books.

For instance, Standard & Poor’s had an ‘A’ credit rating for bonds issued by Lehman Brothers, then the 4th largest U.S. investment bank, when the bank went bankrupt in the 2008 subprime mortgage crisis. Nevertheless, a borrower’s credit rating is essential, and the better it is, the lower the coupon it offers to attract lenders.

Risk And Reward When Investing In Bonds Or Fixed Income

As you probably guessed from the preceding discussion, borrowers’ default is not the only way bondholders can lose money on bonds. That can also happen if borrowers pay their debt early (i.e., call their bonds) or if bondholders resell their bonds at a price below par due to prevailing inflation and interest rates rather than holding them to maturity.

Taking call risk, inflation risk, and interest rate risk with borrowers’ default (or credit risk), it’s clear that although fixed-income assets are significantly less risky than equities, they are not risk-free.

Let’s see how the fixed-income or bond asset class is diced and spliced.

Types Of Fixed Income or Bonds

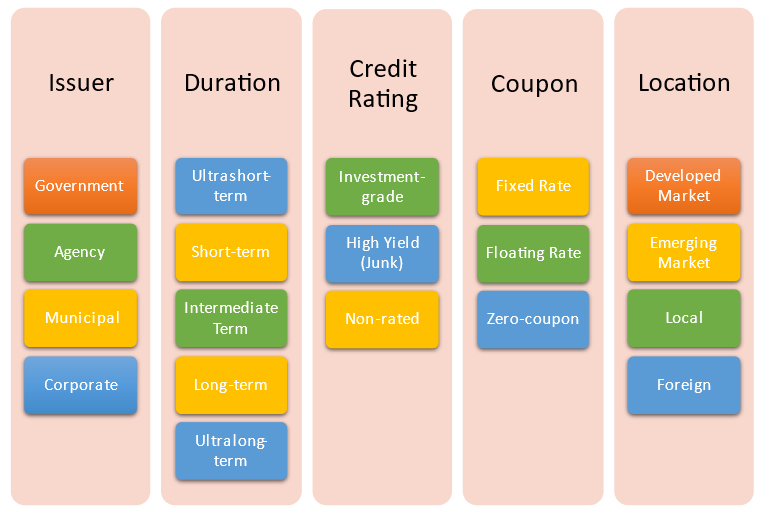

There are five ways bonds can be classified. By:

- Borrower or issuer type;

- Bond duration;

- Borrower creditworthiness;

- Bond coupon type, and;

- Borrower location.

There are four types of bond issuers – national or sovereign governments, government-backed agencies, municipal or local governments, and corporations or businesses in the private sector. Bond durations can be ultrashort, short, intermediate, long, or ultralong term, depending on the number of years to maturity.

Depending on a bond issuer’s credit rating, its bonds are classified as investment-grade, non-investment-grade (high yield or junk), and non-rated bonds. Based on the type of coupon a bond pays, it can be a fixed rate, floating rate, or zero-coupon bond.

Lastly, depending on where a bond issuer is located, its bonds can be developed or emerging markets and local or foreign bonds.

Let’s take a closer look at each of these bond classes.

Classifying Fixed Income Or Bonds By Issuer

Government Bonds

Government (or sovereign) Bonds are issued by Central Banks, like the U.S. Treasury and the Bank of Canada, as Bills with a duration less than or equal to a year, Notes having between one and ten years duration, or Bonds with a duration greater than ten years.

These bonds are backed by the full faith and credit of the issuing governments, and their coupons are serviced by the issuer’s taxation powers, making them the most creditworthy or low-risk but lowest-yielding bonds.

Some notes and bonds, like Canadian Real Return Bonds (RRBs) and U.S. Treasury Inflation-Protected Securities (TIPS), offer inflation protection by altering their principal and coupon rates with changes in the Consumer Price Index and providing a real rate of return.

A remarkable feature of government bonds is that their interest payments are taxable at the federal level but exempt from state and local taxes.

Moreover, some governments also issue small denomination savings bonds to individual investors that pay no coupons but are issued at a discount to their face value and are not subject to state, provincial, or local taxes. The bondholders realize the difference between their discounted price and the face value at maturity, and it acts as a fixed interest over the bond’s duration.

The U.S. Treasury still issues savings bonds like the Series E.E. or I bond. However, the Bank of Canada has stopped doing so. But the Province of Quebec still does.

Agency Bonds

Government-affiliated entities issue agency Bonds. They are either direct obligations of the government or fully guaranteed by the government. Their government backing makes them very creditworthy or low risk but lower yielding.

They offer higher coupons than government bonds while only being marginally riskier. Moreover, agency bonds are exempt from state and local taxes like government bonds.

Canada Mortgage Bonds issued by the Canada Mortgage and Housing Corporation (CMHC) is an example in Canada. Examples in the United States include bonds issued by the Federal National Mortgage Association (FNMA or Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac).

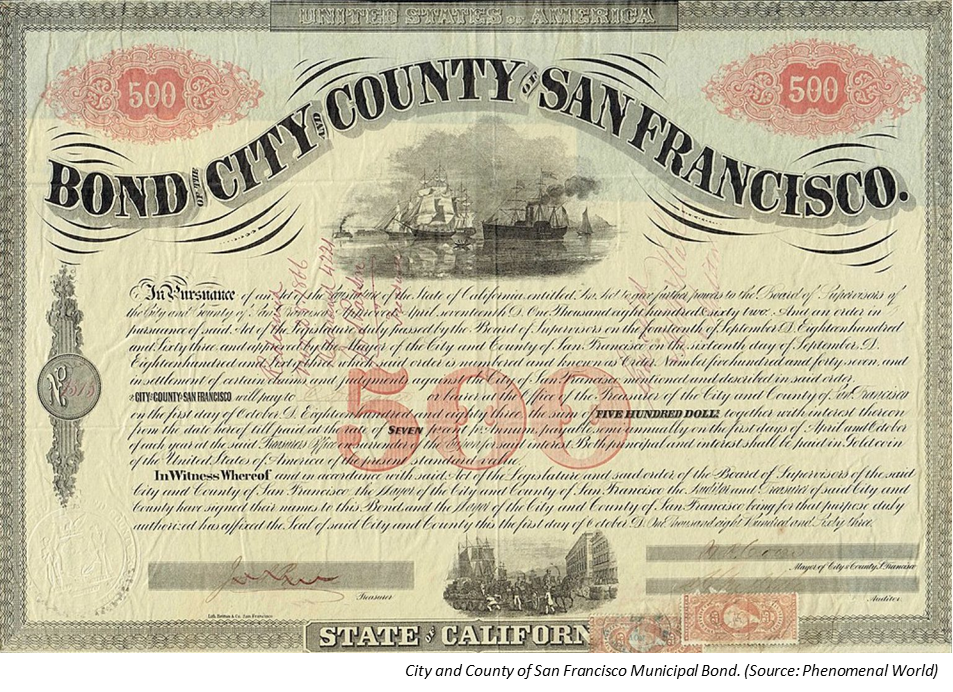

Municipal Bonds

Municipal Bonds (“Munis”) are issued by states, provinces, cities, counties, and other local governments to bankroll daily spending and capital projects like building roads, parks, and schools.

Based on how their principal and coupons are backed, they can be:

- General Obligation bonds – when backed by the taxes the municipality collects from residents;

- Revenue bonds – when backed by the revenue the municipality generates from the capital project (e.g., highway tolls) or;

- Conduit bonds – when backed by a 3rd party on whose behalf the municipality issued the bond (e.g., non-profit colleges or hospitals).

Municipal bond coupons are usually exempt from federal income tax, and they are always exempt from state/local tax if the bondholder lives in the municipality. Considering their tax advantages, municipal bond issuers usually offer lower interest or coupon rates than taxable bonds with similar duration and creditworthiness.

Corporate Bonds

Corporate Bonds are issued by corporations and businesses to raise funds instead of borrowing from banks (at higher interest rates) or issuing new shares (diluting existing shareholders). Companies are usually less creditworthy than governments, government agencies, and municipalities, so corporate bonds offer higher interest rates at higher risk. Moreover, corporate bond coupons are subject to federal and local taxes.

Apple Inc.’s May 2014 bond issuance was an example of a corporate bond. Apple (with AA+ S&P credit rating) issued 1 billion bond units at a 4.45% coupon rate and USD 99.459 face value maturing in 2044 (i.e., 30-year duration). Back then, the U.S. government (with AAA Fitch credit rating) Treasury’s 30-year bond yielded only 3.46%.

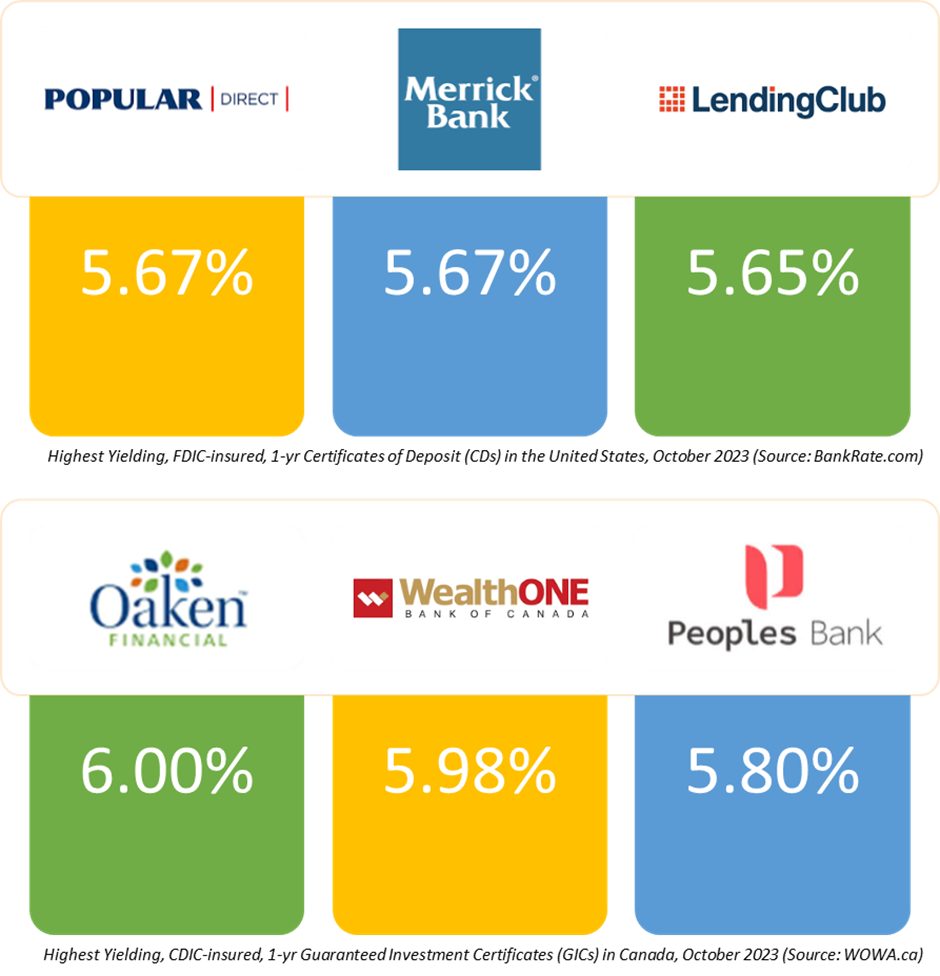

Canadian banks, trust companies, and brokerages issue their depositors Guaranteed Investment Certificates (GICs). In the U.S., banks, credit unions, or brokerages issue depositors Certificates of Deposits (CDs). GICs and CDs are not precisely corporate debt, and their issuers are not government-linked. Still, they offer you guaranteed interest and principal for the opportunity to turn a profit using your deposit.

GICs and CDs are issued with fixed or variable interest rates. Their principals or deposits are usually insured by the Canada Deposit Insurance Corporation (CDIC) or the Federal Deposit Insurance Corporation (FDIC). They are term deposits with a 3-month to 5-year duration and come in three main types – cashable, redeemable, and non-redeemable:

- Cashable ones allow no-penalty, any-time early withdrawals;

- Redeemable ones penalize early withdrawals, and withdrawals are possible only after a holding period;

- Non-redeemable ones do not allow early withdrawals and must be held to maturity.

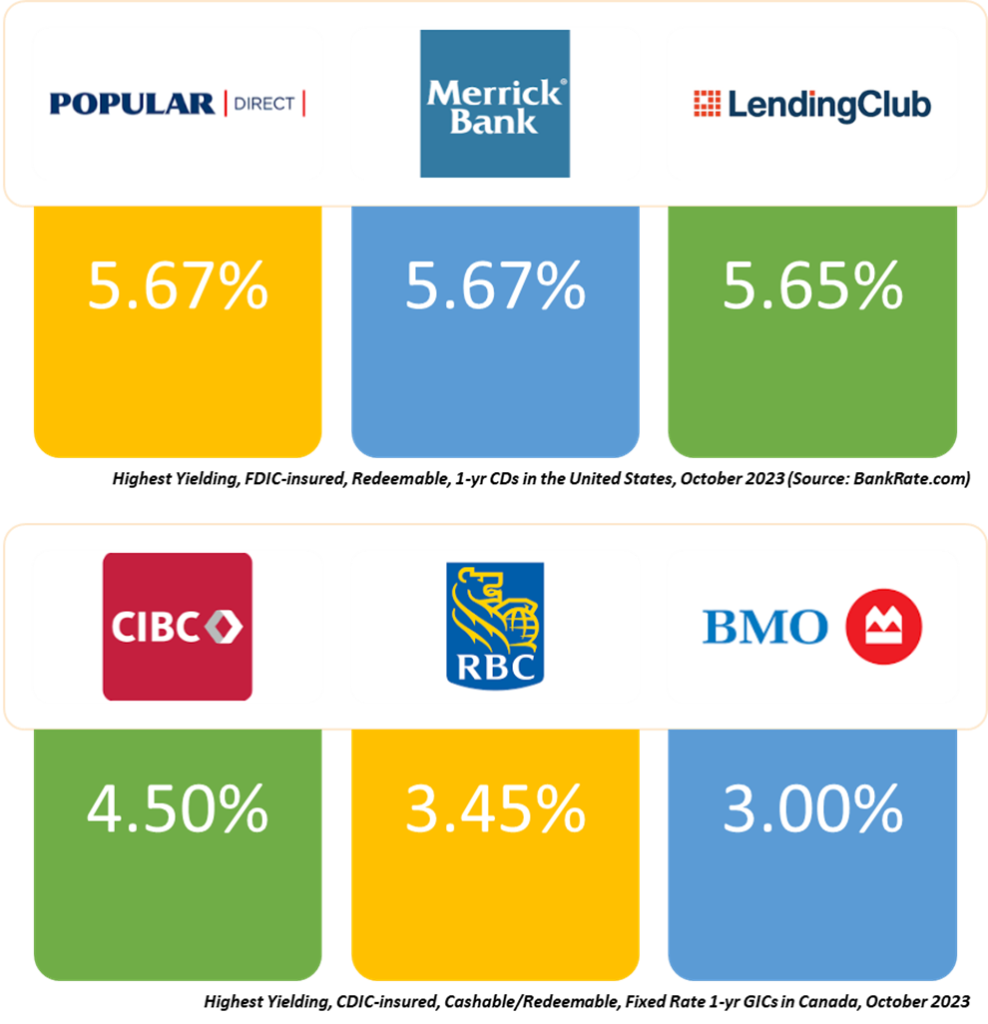

In October 2023, the highest yielding CDIC-insured, 1-yr duration GICs in Canada were from Oaken Financial, WealthOne Bank of Canada, and Peoples Bank. In the U.S., the top three yielding FDIC-insured, 1-yr duration C.D.s were from Popular Direct, Merrick Bank, and the Lending Club.

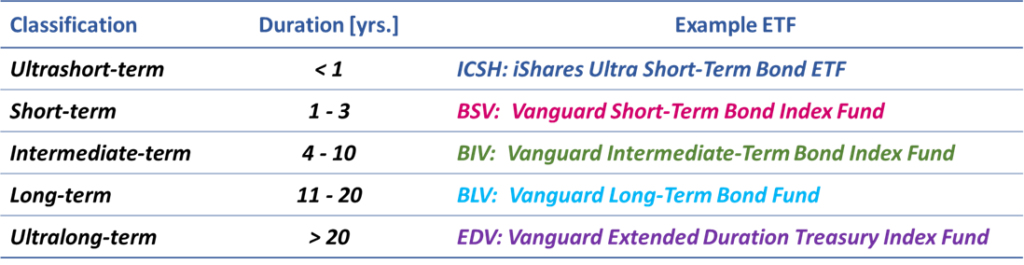

Classifying Fixed Income Or Bonds By Duration

Classifying bonds by duration results in the following:

- Ultrashort-term bonds have a duration of less than one year;

- Short-term bonds have a duration from one to three years;

- Intermediate-term bonds have a duration from four to ten years;

- Long-term bonds have a duration from eleven to twenty years;

- Ultralong-term bonds have a duration of over twenty years.

Any of the bond issuers discussed earlier could issue these bonds. Usually, bonds pay higher interests with increasing duration (i.e., exposure to bond market risks).

We’ve discussed the relationship between bond duration and changes in inflation and interest rates. Let’s see how that looks for bonds of different durations using government-issued bond ETFs as a proxy.

Comparing the bond price and yields of bond ETFs with varying durations over the last decade, we see that falling bond prices and rising bond yields accompany rising interest rates. Also, shorter-duration bonds are best suited to high/rising interest rate environments as their price falls the least while their yield increases quickly.

We can also see that rising bond prices and falling bond yields accompany falling interest rates. And longer duration bonds are best suited to low/falling interest rate environments as their price increases the most while their yield falls slowly.

Classifying Fixed Income Or Bonds By Creditworthiness

Investment-grade bonds are those issued by borrowers to whom the bond market assigns a lower likelihood of default and, as a result, higher credit ratings. Bonds rated Baa and above by Moody’s, or BBB and above by S&P and Fitch, are investment grade.

Since investment-grade bonds have lower default risk, they offer lower coupon rates or yields. Government, agency, general obligation municipal, and some corporate bonds fall into this category.

Non-investment-grade bonds are those issued by borrowers the bond market believes have a higher likelihood of default and, as a result, lower credit ratings. Bonds rated lower than Baa by Moody’s or BBB by S&P and Fitch are non-investment grade. Since non-investment-grade bonds have higher default risk, they offer higher coupon rates or yields. They are commonly called high-yield, speculative, or junk bonds.

Most bonds issued in emerging markets fall into the non-investment-grade category. Some corporate bonds fall into this category in developed markets – usually those issued by startups, capital-intensive firms with high debt-to-equity ratios, and fallen angels. Fallen angels are bond issuers that previously had high credit ratings.

Non-rated bonds are those issued by borrowers whose creditworthiness has not been rated by a reputable credit ratings agency. Revenue and conduit municipal bonds from some states, provinces, cities, and local governments are examples of non-rated bonds.

Classifying Fixed Income Or Bonds By Duration

Fixed-rate bonds pay the same interest or coupon throughout their duration. The decreased interest rate risk usually comes with a lower coupon rate. Examples of fixed-rate bonds are U.S. Certificates of Deposit (or CDs) and Canadian Guaranteed Investment Certificates (or GICs).

Floating-rate bonds pay interest or coupons that vary with market interest rates. Interest rate risk is prominent here, so these bonds make sense when lenders expect market interest rates to rise. Examples of floating rate bonds are Real Return Bonds or RRBs in Canada and Treasury Inflation-Protected Securities or TIPS in the U.S., whose coupon rates adjust to the consumer price index or CPI every six months.

Zero-coupon bonds do not pay coupons. Instead, they offer a discounted purchase price relative to the bond’s face value, and the bondholder gets the face value at maturity. The difference between the discounted price and the face value is the bondholder’s total return, which mimics a fixed rate of return over the bond’s duration. Notably, holders of zero-coupon bonds with multi-year durations must pay taxes yearly even though they do not actually receive any income until the bond matures. Examples of zero-coupon bonds are U.S. Treasury bills.

Classifying Fixed Income or Bonds by Issuer’s Location

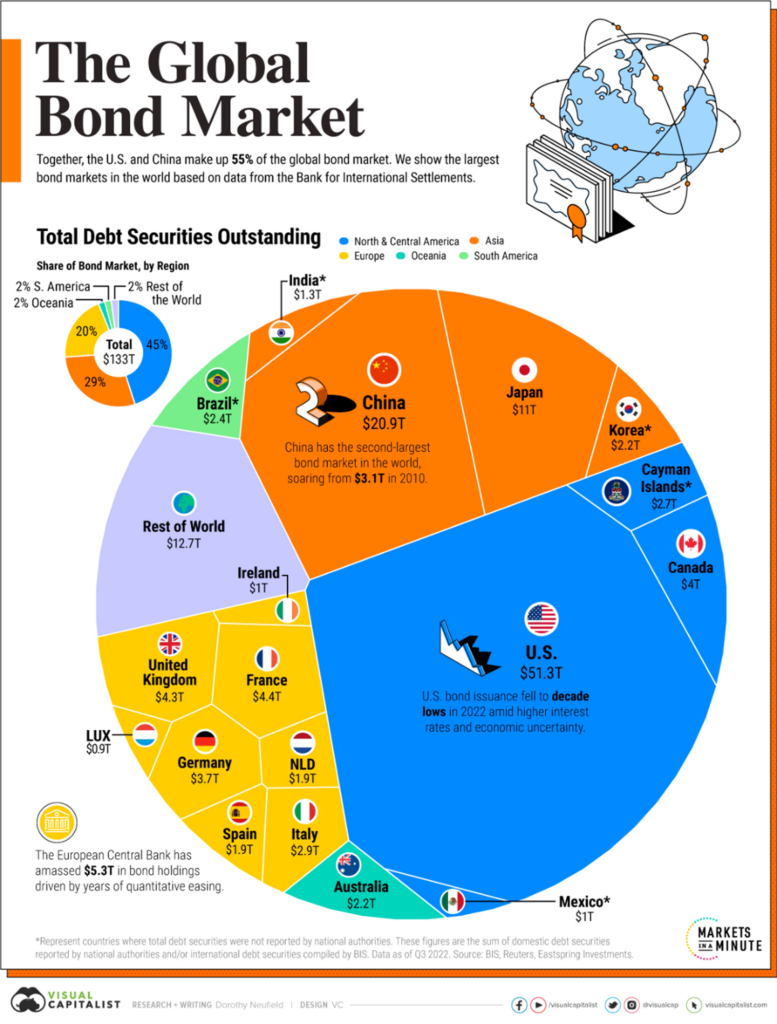

Governments and businesses or corporations issue bonds in countries around the world. As this chart (below) from Visual Capitalist shows, 45% of the global bond market is in the U.S., 29% is in China, and 20% is in the E.U. Suppose your bonds were issued outside your country of residence. In that case, you’ve acquired foreign bonds. Otherwise, you own local bonds.

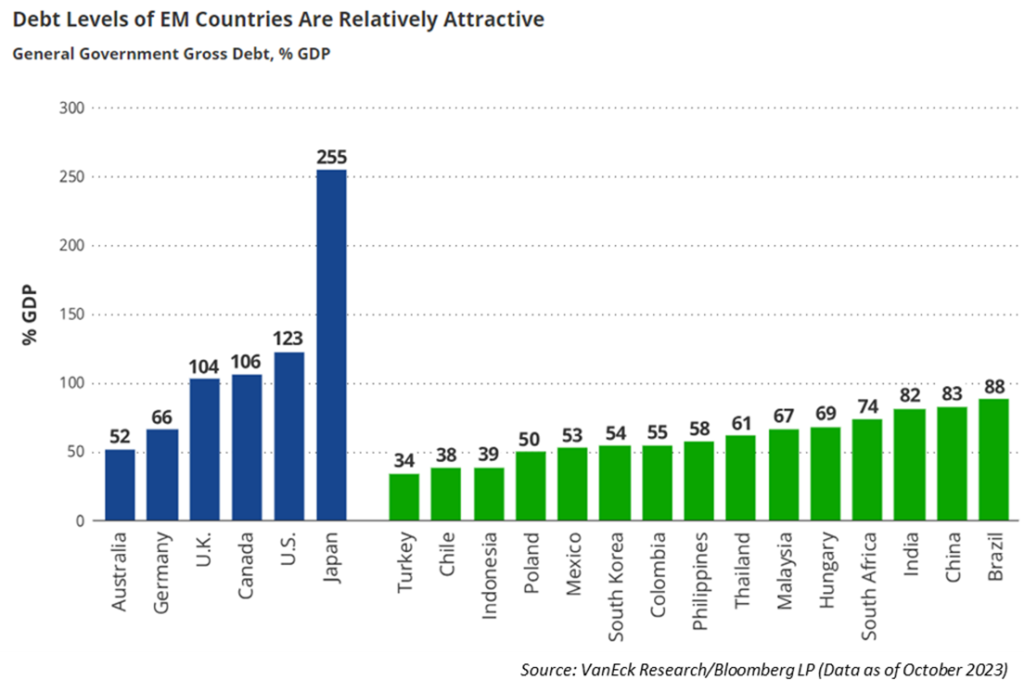

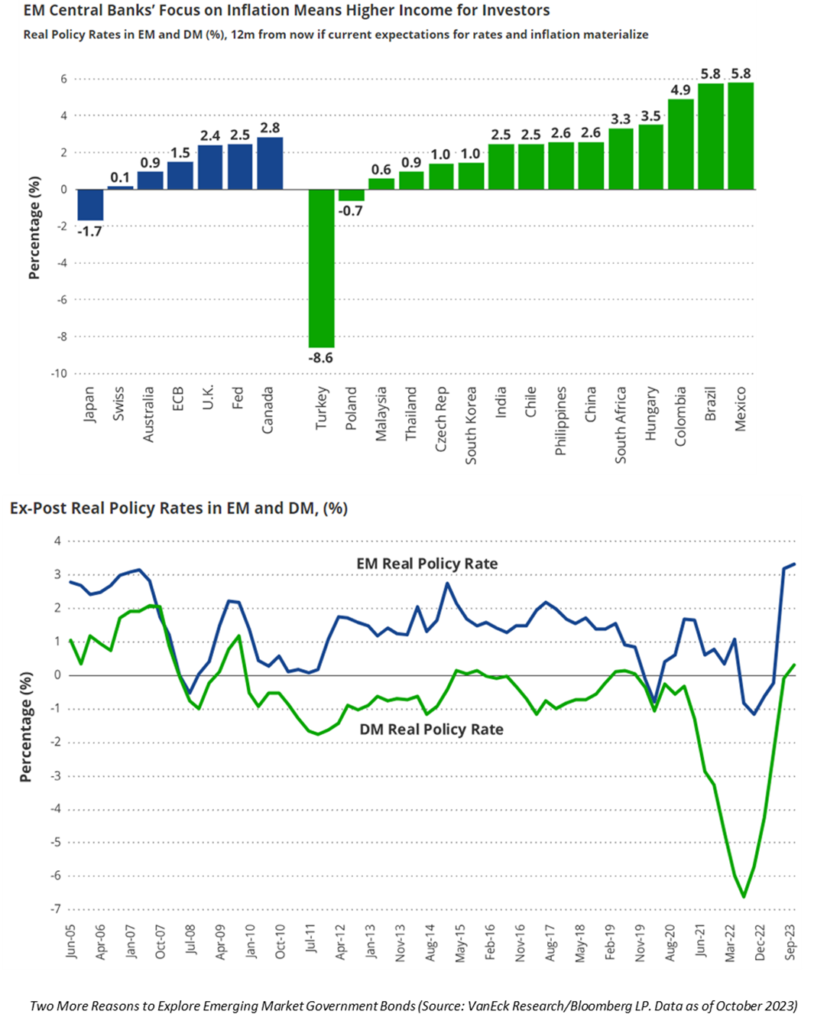

Developed market bond issuers are generally more creditworthy than their emerging market counterparts. However, one reason to be interested in government bonds issued outside of the developed markets is the relatively lower debt-to-GDP ratio of the issuing governments.

Here are two more reasons to explore emerging market government bonds:

- To start with, looking backward, their real rate of return, accounting for inflation, has been higher than those in developed markets;

- In addition, their interest rates are forecast to remain high or rise further.

Currency risk is a huge factor when looking at emerging market government bonds. Still, there are currency hedges available to blunt that risk.

Right! That does it for fixed income. Next, we’ll delve into cash and cash equivalents asset class.

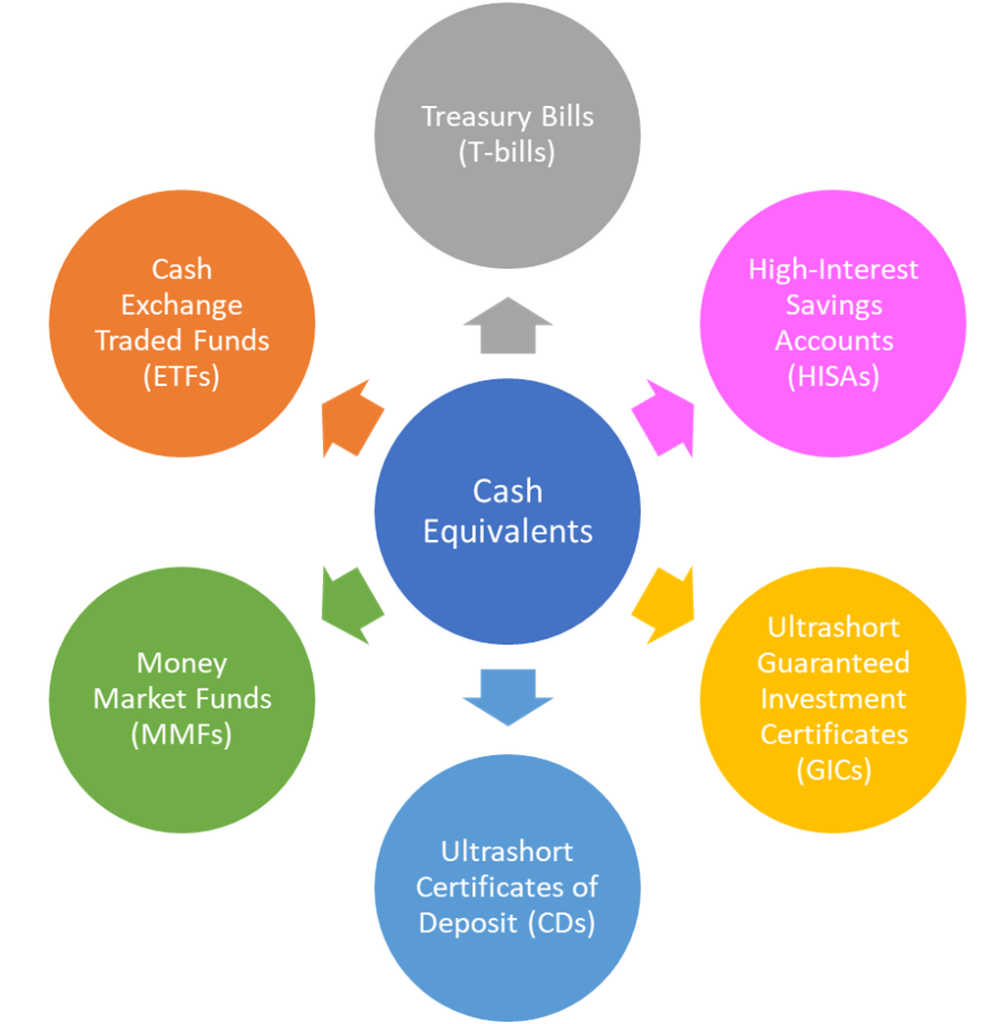

Cash and Cash Equivalents

Cash and cash equivalents are financial assets that are either cash or instantly convertible to a known amount of cash. Cash is precisely that: money in hand. It also refers to money in a savings, checking or brokerage account where it may earn a return or interest.

Cash equivalents are secure, ultrashort-term, and practically risk-free cash or debt instruments that return a fixed or variable interest. That means their issuers have high credit ratings, their durations are less than a year, and they usually guarantee the principal or deposit.

The interest cash and cash equivalents return depends on the prevailing inflation and interest rates. The higher those are, the higher the interest cash equivalents will pay.

Cash and cash equivalents are low-risk and low-return assets, but only when inflation is not rising. When inflation rises, they lose value (or purchasing power) as they’re worth increasingly fewer goods and services. That said, their value is stable, and they are a great vehicle to carry your emergency fund or money you need for upcoming expenses like saving for a wedding in a few months.

Cash equivalents include:

- Treasury bills or T-bills;

- High-Interest Savings Accounts or HISAs;

- Ultrashort-term, Cashable or Redeemable Guaranteed Investment Certificates or GICs in Canada;

- Ultrashort-term, Cashable or Redeemable Certificates of Deposits or C.D.s in the U.S.;

- Money Market Funds or MMFs;

- Cash Exchange Traded Funds or ETFs.

Let’s take a closer look at each of these.

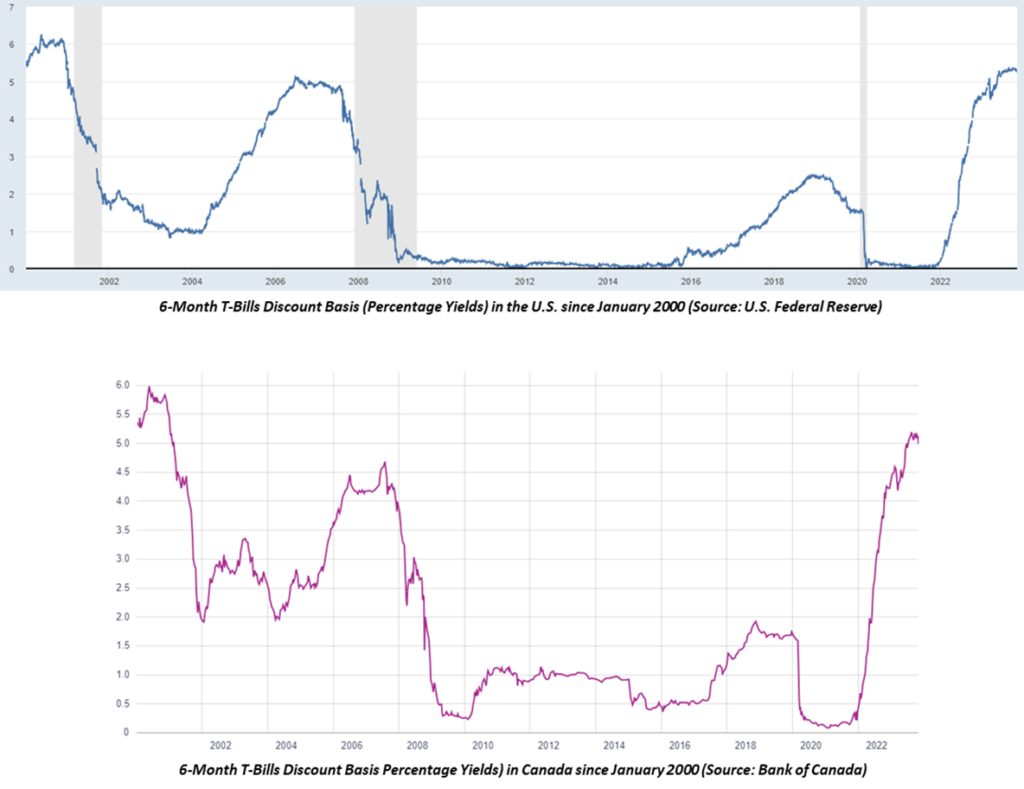

Treasury Bills

Treasury Bills or T-bills are ultrashort-term, zero-coupon government debt that the public buys at a discount directly from the government or financial institutions. The issuing government guarantees the buyer’s principal and interest with its full faith and credit and taxation powers.

The interest is the discount on the T-bill’s face value that the government offers you to lend money. At maturity, the government pays you the face value of the T-bills. For instance, you spend $95 after a 5% discount for a $100 T-bill and get $100 when it matures. So, you earn a 5.26% effective interest rate on your $95 investment.

Moreover, unlike all other cash equivalents we’ll look at, the interest from T-bills is only subject to federal taxes, not state or provincial taxes. The charts below show that the U.S. Federal Reserve and the Bank of Canada offer a 5% discount on T-bills as of February 2024.

High Interest Savings Accounts

High Interest Savings Accounts (or HISAs) are savings accounts with higher interest rates than regular ones. They are offered to depositors by banks or discount brokerages.

In Canada, HISA deposits are usually guaranteed by the Canada Deposit Insurance Corporation (CDIC) up to $100,000. In the U.S., the Federal Deposit Insurance Corporation (FDIC) does the same but insures up to $250,000 of deposits.

HISAs, being savings accounts, do not have meaningful fees linked with owning them. But like most bank accounts, they usually have a small account maintenance fee.

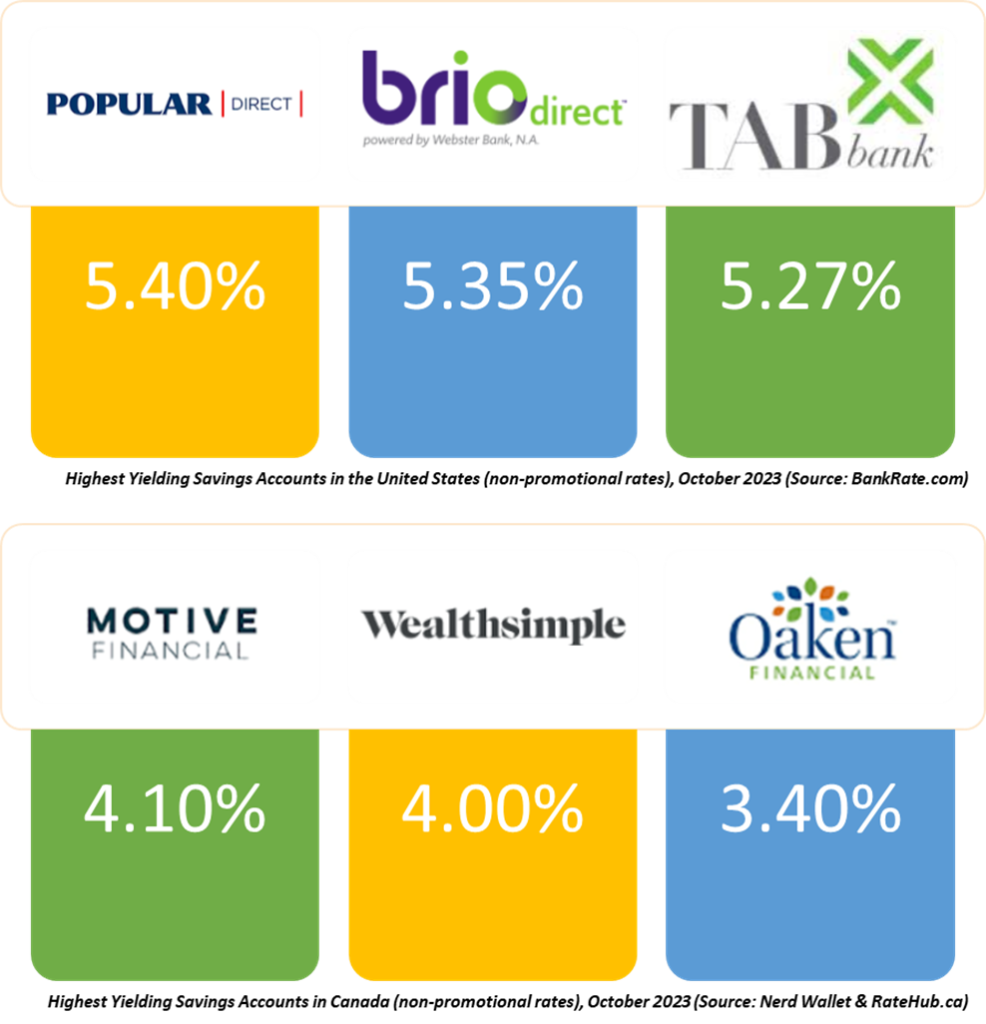

This graphic shows the top three highest HISA rates currently offered by the financial institutions in Canada and the United States. Comparing this to the T-bill discount charts we saw earlier, you can say that investing in T-bills over HISAs in Canada and HISAs over T-bills in the U.S. is probably better.

Guaranteed Investment Certificates (GICs) and Certificates of Deposit (CDs)

Guaranteed Investment Certificates (GICs) are Canadian fixed or floating interest rate term deposits. Ultrashort-term, cashable or redeemable, and fixed interest rate GICs are cash equivalents:

- Ultrashort-term means a GIC’s duration is one year or less;

- Cashable means a GIC allows early withdrawals at any time without penalties and;

- Redeemable means a GIC allows but penalizes early withdrawals and only allows them after a holding period.

GICs are offered to depositors by Canadian banks, Trust companies, and brokerages, and their principals or deposits are usually guaranteed by the Canada Deposit Insurance Corporation (CDIC) or other provincial deposit insurance programs.

Certificates of Deposit or C.D.s are the U.S. version of GICs issued by banks, credit unions, or brokerages to depositors. The Federal Deposit Insurance Corporation or FDIC typically insures their principals or deposits.

GICs and CDs do not have any fees linked with owning them, not even the small account maintenance fee that HISAs usually have.

The graphic below shows the top three highest GIC and CD rates financial institutions in Canada and the United States offer. Comparing this to the T-bill discount charts we saw earlier, we know that investing in T-bills over GICs in Canada and CDs over T-bills in the U.S. is better.

Money Market Funds

Money Market Funds are mutual or exchange traded funds or ETFs with at least 95% of their holdings in other cash equivalents with an average duration of less than a year. Mutual fund firms, banks, wealth managers, and brokerages offer them and function like savings accounts. But unlike savings accounts, their returns fluctuate daily, and their principals are not CDIC or FDIC-insured.

Aside from their uninsured principals and variable yields, their management expense ratios (MERs) and fees impact their returns. However, this is more of an issue in Canada, where these fees are much higher than in the U.S.

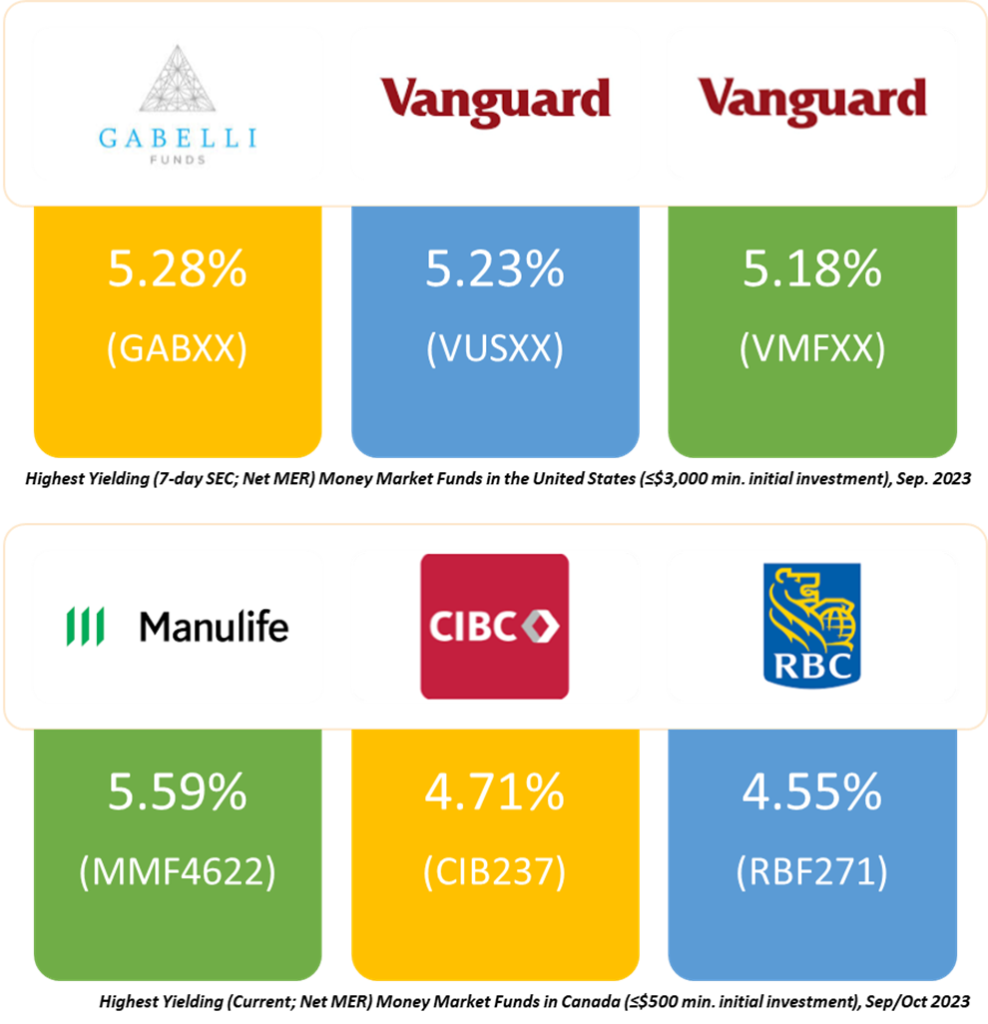

This graphic shows the top three highest money market fund rates currently offered by financial institutions in Canada and the United States. Comparing this to the T-bills discount charts we saw earlier, you can say that it’s a toss-up between investing in T-bills or money market funds in Canada and the U.S.

To get a sense of how bad Canadian mutual fund fees are, the Gabelli U.S. Treasury Money Market Fund Class AAA (ticker, GABXX) has an MER of 0.08%, the Vanguard Treasury Money Market Fund (ticker, VUSXX) has an MER of 0.09%, and the Vanguard Federal Money Market Fund (ticker, VMFXX) has an MER of 0.11%.

Meanwhile, in Canada, the Manulife Money Market Fund Series F (MMF4622) has an MER of 0.46%, the CIBC Money Market Fund Class F (CIB237) has an MER of 0.28%, and the RBC Canadian Money Market Fund Series A (RBF271) has an MER of 0.35%.

The fees in Canada are at least triple what you get in the United States. I am not sure why that is the case.

Cash Exchange Traded Funds (ETFs)

Cash Exchange Traded Funds (or Cash ETFs) are ETFs whose daily traded shares represent its investors’ pooled capital that the fund manager deposits in High Interest Savings Accounts at major financial firms, usually at higher negotiated interest rates than individual depositors can get with regular HISAs.

Cash ETFs are offered by mutual fund firms, banks, wealth managers, and brokerages, and their shares are traded on stock exchanges. And like money market funds, they return variable yields or dividends and do not guarantee their investors’ principal, unlike T-bills and most HISAs, GICs or C.D.s.

Aside from their uninsured principals and variable yields, their returns are also impacted by various costs like stock exchange fees, brokerage trading commissions, and fund management fees. But unlike what we’ve seen for mutual funds, the total expense of holding these assets in Canada and the U.S. is comparable.

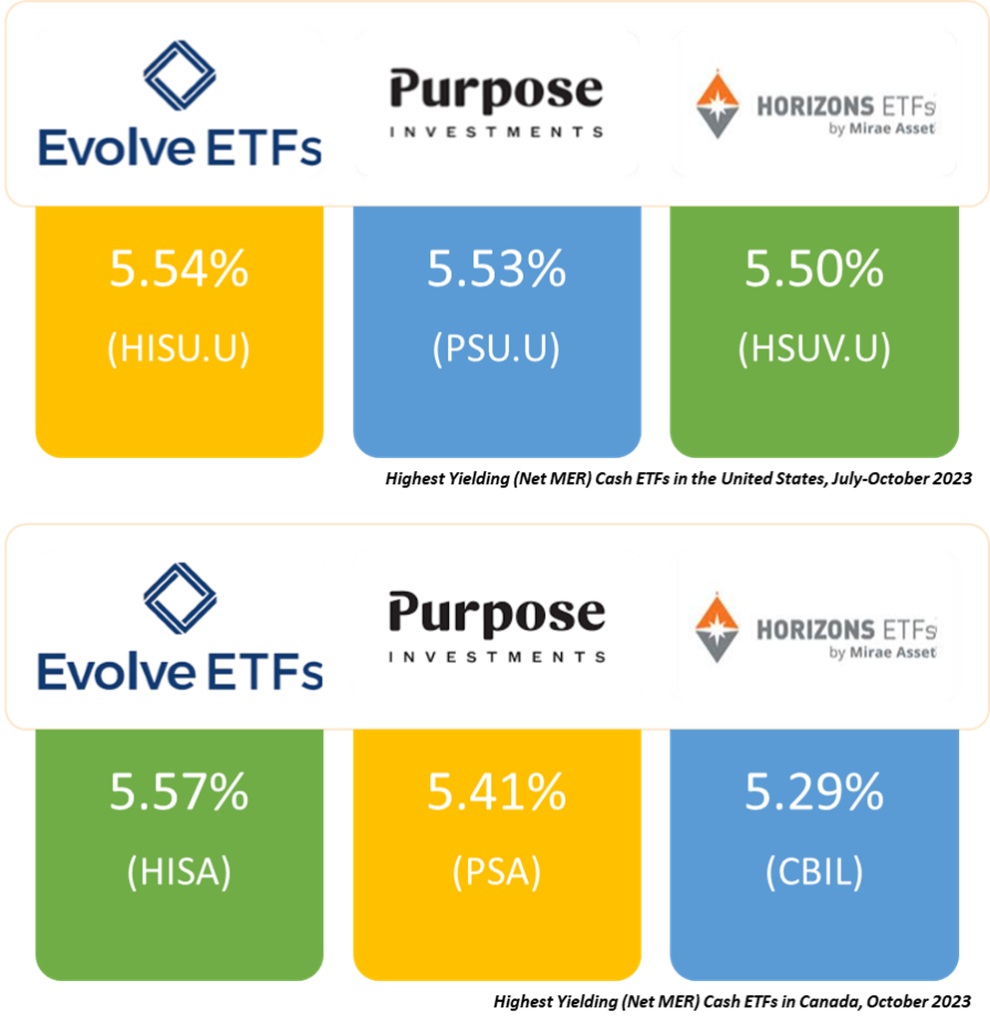

This graphic shows the top three highest cash ETF yields in Canada and the United States. Comparing this to the T-bill discount charts we saw earlier, you can say that investing in cash ETFs over T-bills in Canada and the U.S. is probably better.

Right! That does it for cash and cash equivalents. Next, we’ll delve into the real estate asset class.

Real Estate

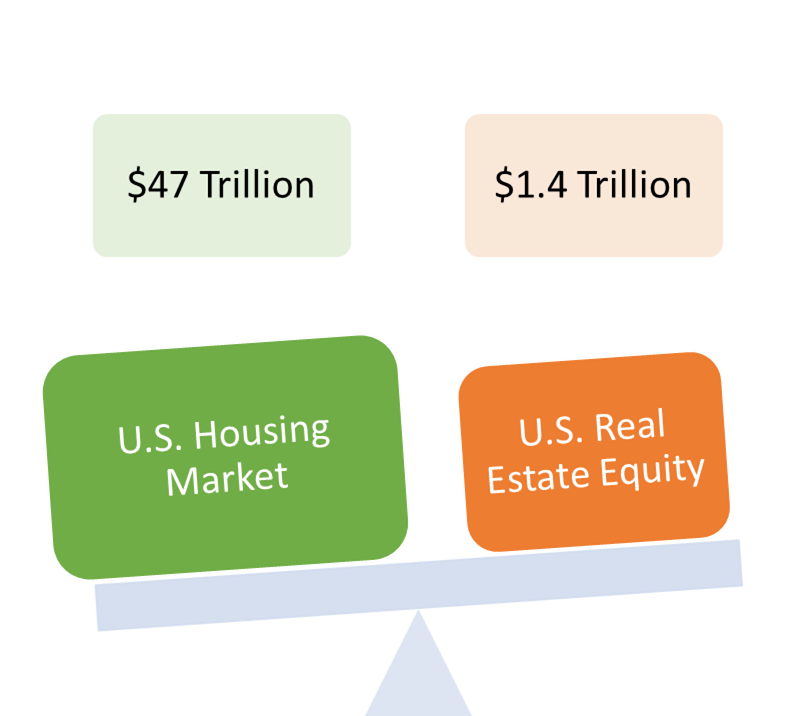

Real estate assets go beyond owning shares in publicly traded real estate businesses. While U.S. financial real estate assets (or the real estate equity sector) were valued at $1.40 trillion in June 2023, the total value of the U.S. housing market (i.e., physical real estate assets of land and permanent structures or improvements, like houses and buildings, that boost the value of raw land) reached an all-time high of USD 47 trillion!

Owning physical real estate assets involves buying a house, rental property, or land. In comparison, owning financial real estate assets involves buying shares of related businesses on the stock market.

Real estate returns come in two forms: regular payments from renters (i.e., rental income) or the surplus of the selling price over the buying price (i.e., capital gains).

Types Of Real Estate Assets (Non-Financialized)

Real estate assets, in the physical and not financial world (i.e., real estate equity sector), fall into five buckets:

- Residential – includes single-family homes, condos, cooperatives, duplexes, townhouses, and multifamily residences;

- Commercial – includes apartment complexes, gas stations, grocery stores, hospitals, hotels, offices, parking facilities, restaurants, shopping centers, stores, and theatres;

- Industrial – includes property used for manufacturing, production, distribution, storage, and research and development;

- Raw land – includes undeveloped property, vacant land, and agricultural lands such as farms, orchards, ranches, and timberland;

- Special-use – includes public-use land like cemeteries, government buildings, libraries, parks, places of worship, and schools.

Factors Influencing Property Valuations

The number of new residential construction or housing starts (U.S. and Canada) is a crucial indicator of the health and direction of the physical real estate market, which is governed by supply and demand.

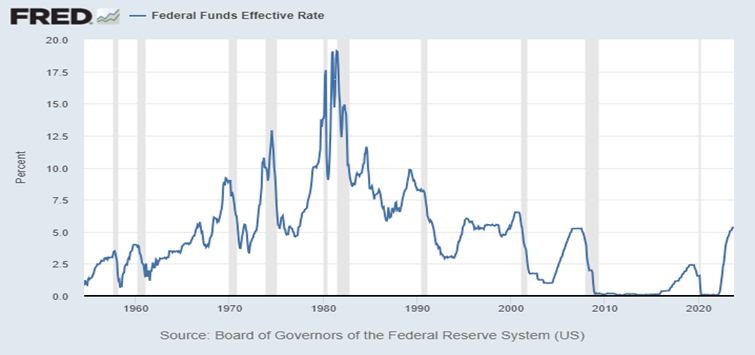

Construction is materials and capital-intensive and usually funded by loans. So, inflation and interest rates significantly impact real estate values, as you can see from the yellow and grey lines on the housing starts and interest rate charts below, both representing recessions.

Rising inflation increases building costs by raising materials and energy prices. It also increases construction workers’ wages, which impacts the overall project cost. Moreover, rising interest rates usually follow rising inflation and increase building projects’ loan costs. These mounting expenses reduce the housing supply and inflate existing and new home values.

Suppose interest rates stay high for too long. It eventually destroys housing demand and cuts existing and new home values as it slows down the overall economy. That’s because an economic slowdown leads to cuts in business borrowing and operations, wages, and jobs. At the same time, it boosts mortgage and rent payment failures or delinquencies, putting a strain on the banking and credit system.

Moreover, location drastically affects real estate values. Factors like employment and crime rates, transport facilities, school quality, municipal services, and property taxes play a huge role in property valuation. Real estate is also illiquid, i.e., it takes time to sell or convert to cash. Also, it often requires debt to buy (i.e., mortgage loans) and is time-consuming and expensive to manage and maintain.

Let’s see how things stand in a few significant economies’ real estate market.

Real Estate Market In The United States And Canada

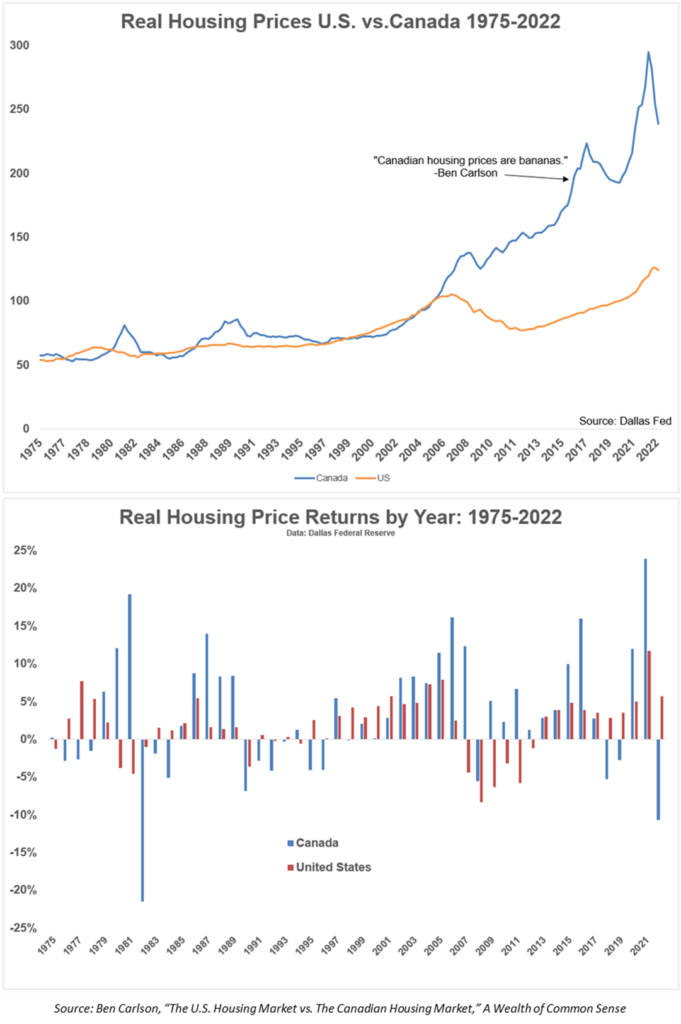

Yes, housing prices surged in the U.S. in the last few years, but have you seen Canada?! These charts by Ben Carlson show that Canadian housing prices have risen 142% since 2005. And that’s after adjusting for inflation. In contrast, real (i.e., accounting for inflation) housing prices in the U.S. have only increased by 26% in the same period, which is pitiful by Canadian standards.

Canadian housing prices would need to collapse by about 40% to get back in line with U.S. real housing price growth. That would be brutal for existing and new homeowners. Moreover, the Canadian housing anomaly is the same year-by-year, where we see more significant gains and losses in Canada compared to the U.S.

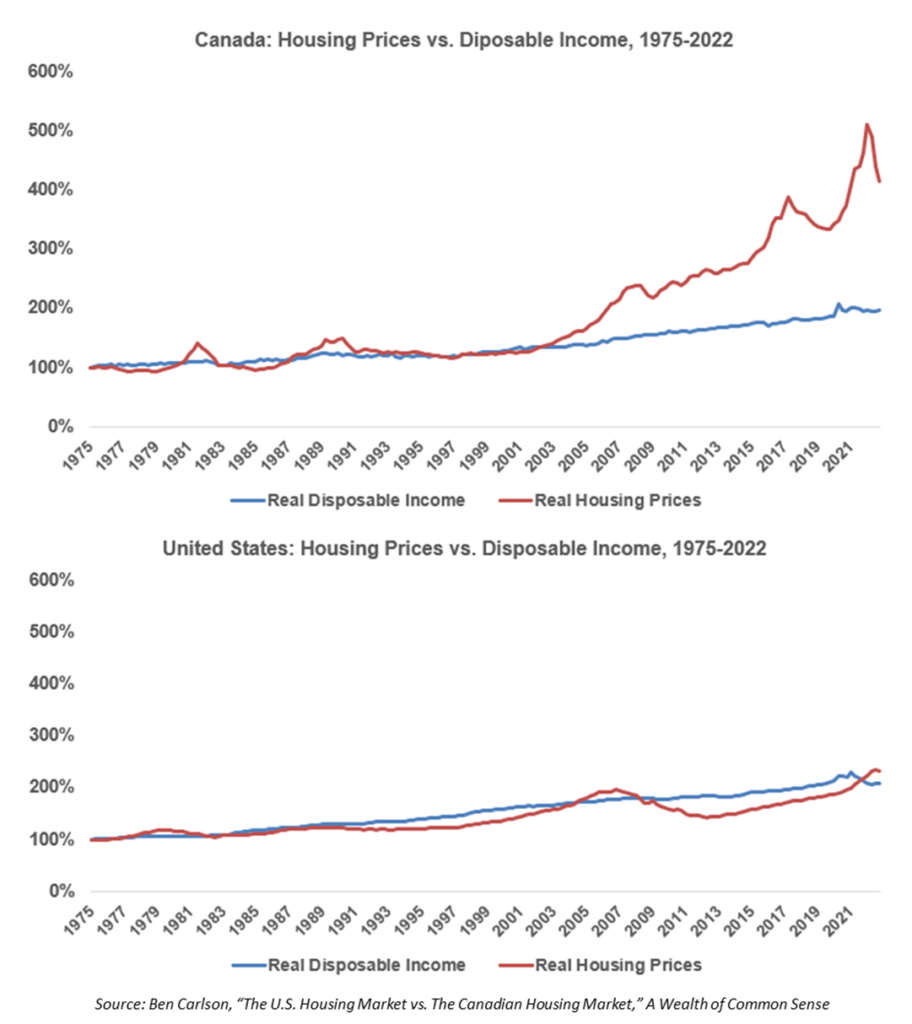

Things get crazier when you pit the real gains in housing prices against the real gains in disposable income since 1975. In the U.S., over the last 50 years, the relationship between incomes and housing prices after accounting for inflation has been close and relatively stable. But the Canadian housing market has gone haywire in the last two decades.

Real Estate Market In Germany (Eurozone)

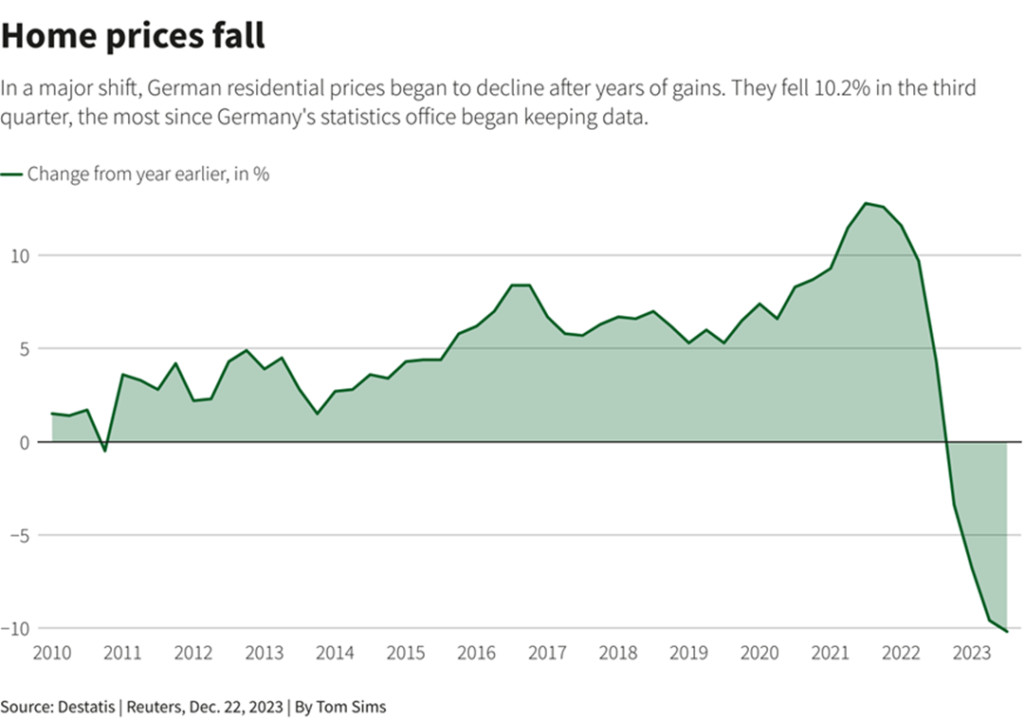

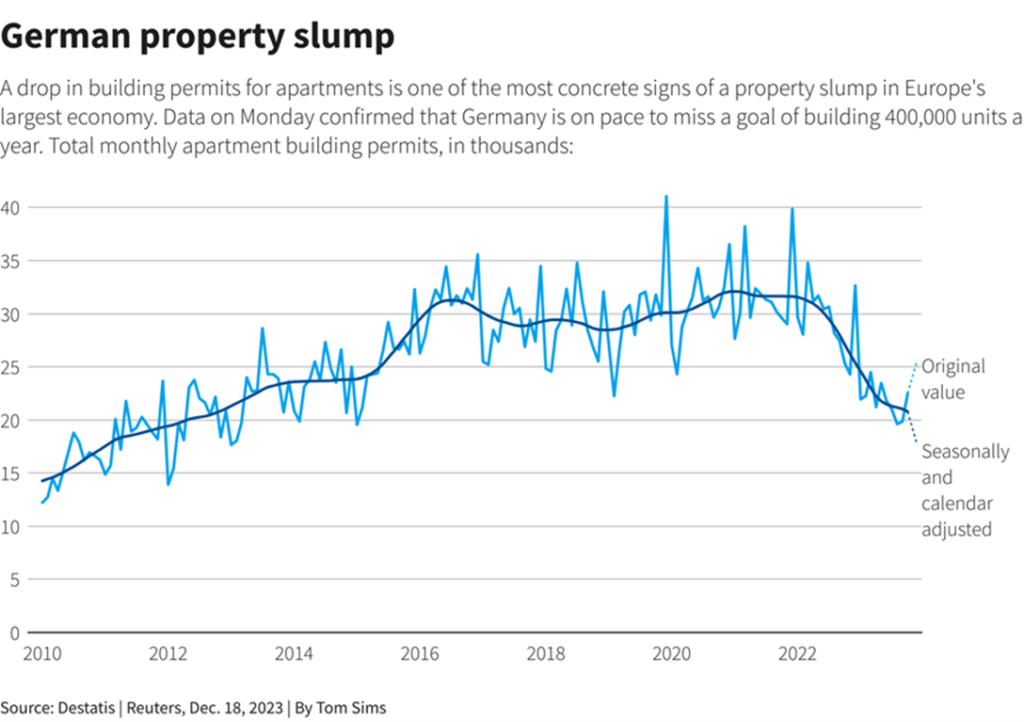

Eurozone interest rates had been near 0% since 2015 but rose rapidly to 4.5% beginning in 2022. One of the results is the bursting of the German residential property bubble, with four consecutive quarters of decline. The last of those quarterly slumps was the most significant since records began in 2000.

The German property crisis has already claimed Austrian property giant Signa. The business had significant operations in Germany and had to file for bankruptcy in November 2023.

As dire as it sounds, this situation may not be a complete disaster for Germany. As more than half of Germans rent, the year-on-year real wage growth is 0.6% (barely positive and is at 2016 levels, but positive nonetheless), and disposable income is healthy and has been rising consistently.

So, many of those renters could step in with their large disposable incomes to buy homes at bargain prices. However, German household debt is 54% of nominal GDP, which could be a showstopper.

Right! That does it for the real estate asset class. Next, we’ll delve into commodity asset class.

Commodity

Commodities are goods with the same use and quality, regardless of their source. For instance, no one cares where a gold bar came from, but everyone recognizes its value. On the other hand, the market differentiates between diverse brands of electric cars. However, they all use nickel and lithium in their batteries, and no one cares where those come from.

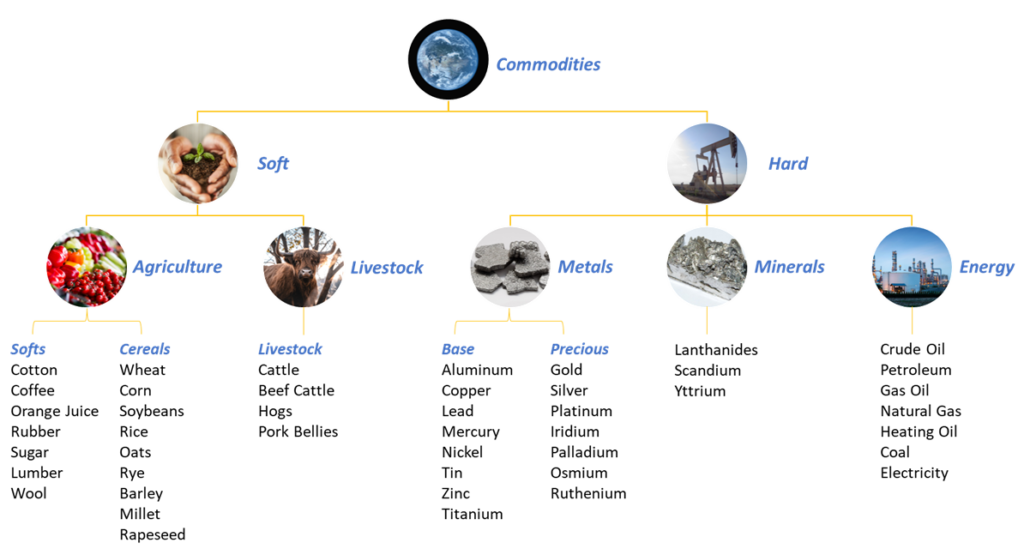

Commodity Classes

So, commodities are the raw materials and goods from which more complex products are made. They are classified as either soft or hard. Soft commodities are grown and include agricultural produce and livestock. On the other hand, hard commodities are mined and include metals, minerals, and energy.

Agricultural produce is grouped into softs and cereals. Softs include cotton, coffee, orange juice, rubber, sugar, lumber, and wool. Meanwhile, cereals include wheat, corn, soybeans, rice, oats, rye, barley, millet, and rapeseed. Moreover, livestock includes cattle, beef cattle, hogs, and pork bellies.

Metals are grouped into base or industrial metals and precious metals. Base metals include aluminum, copper, lead, mercury, nickel, tin, zinc, and titanium. Meanwhile, precious metals include gold, silver, platinum, iridium, palladium, osmium, and ruthenium.

Minerals include the rare earth minerals of the fifteen lanthanides on the periodic table, plus scandium and yttrium. Lastly, energy comprises crude oil, petroleum, gas oil, natural gas, heating oil, coal, unleaded gasoline, and electricity.

How To Invest In Commodities

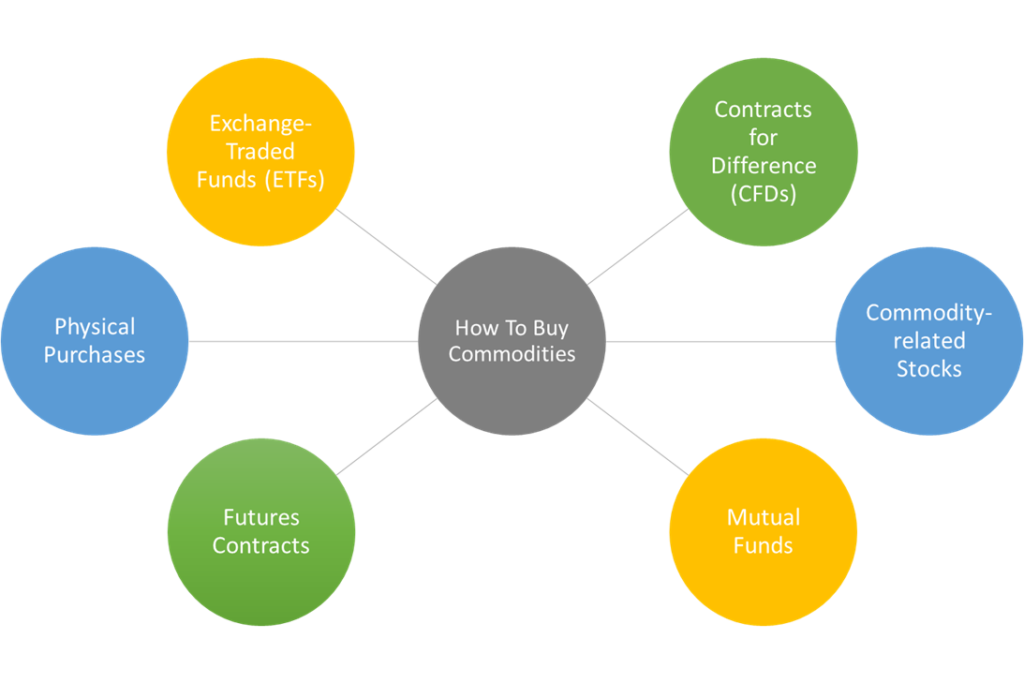

Directly owning commodities involves buying and storing the physical commodity. But the logistics of an individual doing this is challenging. Just imagine transporting and storing a barrel of oil all by yourself. A more practical and indirect way to own commodities is by buying:

- Commodity-related Equities;

- Commodity Futures Contracts;

- Commodity CFDs (i.e., Contracts-for-Difference);

- Commodity ETFs (i.e., exchange traded funds) or;

- Commodity Mutual Funds.

Commodity-related Equities

Commodity-related Equities are shares of companies in the materials equity sector (e.g., Newmont Corporation, Corteva, Inc., and Yili Group). A downside of this approach is that the share price of these firms may not correlate with real-time or spot commodity prices due to the businesses’ financial structure, the health of unrelated businesses, and any futures contracts the companies have.

Futures Contracts

Futures Contracts are agreements to buy a certain amount of a commodity in the future at a price set in the past. If the commodity’s price rises in the future, the existing futures contract to buy it at a lower price becomes more valuable, and vice versa.

These contracts are usually out of reach for individual investors due to the significant cash commitment needed and what that means for their portfolio allocations. For example, a gold contract could involve buying 100 troy ounces of gold, amounting to a $200,000 commitment.

Commodity CFDs (Contracts For Difference)

Contracts-for-Difference or CFDs are derivative products, or financial contracts, that pay the difference in price between the open and closing trades. When you enter a CFD, you are speculating on the future price movements of the underlying commodity without actually owning it.

Most commodity CFDs use leverage, which can be a boon or a bust for smaller investors as it increases their exposure to the volatile commodity markets using borrowed money.

Commodity ETFs (Exchange Traded Funds) And Mutual Funds

Commodity Exchange Traded Funds or ETFs are ETFs that hold physical commodities (e.g., SPDR Gold Shares and iShares Silver Trust), commodity-related equities, futures contracts (e.g., Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF, First Trust Global Tactical Commodity Strategy Fund, and Invesco D.B. Commodity Index Tracking Fund), or CFDs.

The ETF’s investors buy fund shares representing units of the ETF’s total holding of its constituent commodity-related physical or financial assets. Commodity Mutual Funds are mutual fund equivalents of commodity ETFs. Examples include the BlackRock Commodity Strategies Fund (BICSX) and the Invesco Balanced-Risk Commodity Strategy Fund Class A (BRCAX).

What Drives Commodity Prices?

Real assets like commodities are governed by supply and demand and increase in value with rising inflation (i.e., positively correlated). When demand for finished products exceeds supply, their costs increase. That’s because the demand and price for the commodities needed to produce them spike.

On the other hand, bonds and stocks, valued on discounted future cashflows (earnings or interest payments), decrease in value as inflation rises (i.e., negatively correlated). That’s because their future returns are worth less with rising inflation.

So, in addition to diversifying investment portfolios, commodities offer inflation protection. However, their heavy supply and demand dependency means they lose value during economic slowdowns, periods of disinflation, deflation and demand decline, and supply limitations.

Such periods are often caused by unfavourable market, political, and regulatory conditions. Moreover, natural disasters (e.g., droughts, hurricanes, earthquakes, and viral outbreaks) and deflationary new technologies also lead to such scenarios. For instance, the anticipated E.V. revolution is wreaking havoc on palladium prices. This graphic from Technopedia shows the significant factors that affect commodity prices.

Commodities, Volatility, And A Winning Investing Strategy

Since the factors affecting commodity prices are unpredictable, commodities are a highly volatile asset class. They are just about as volatile as equities. However, the high volatility in commodities can be mitigated by holding a diverse basket.

This strategy takes advantage of the fact that there is a low correlation between the prices of different commodities, so the total returns should be less volatile than they would be for an individual commodity. The basket should be benchmarked against a diversified index like the Bloomberg Commodity Index.

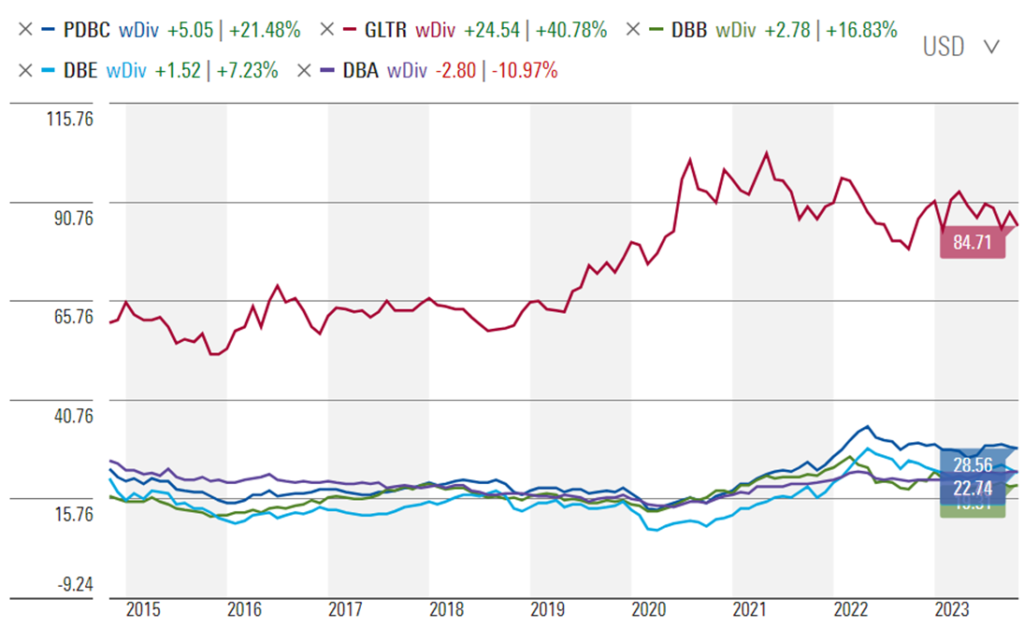

The performance charts of the five commodity ETFs below, with and without dividends, demonstrate the benefits of a diversified commodity basket since 2015. The ETFs charted are:

- PDBC: Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF

- GLTR: Aberdeen Physical Precious Metals Basket Shares ETF

- DBB: Invesco D.B. Base Metals Fund ETF

- DBE: Invesco D.B. Energy Fund ETF

- DBA: Invesco D.B. Agriculture Fund ETF

Looking at these charts, you could see that rather than being down 11% if you only owned the agriculture ETF, you’d be up 21% if you owned the basket ETF. However, you would not have performed as well as the gold ETF’s 40% total returns. That’s the gift and the curse of volatility, and we want to walk the middle path.

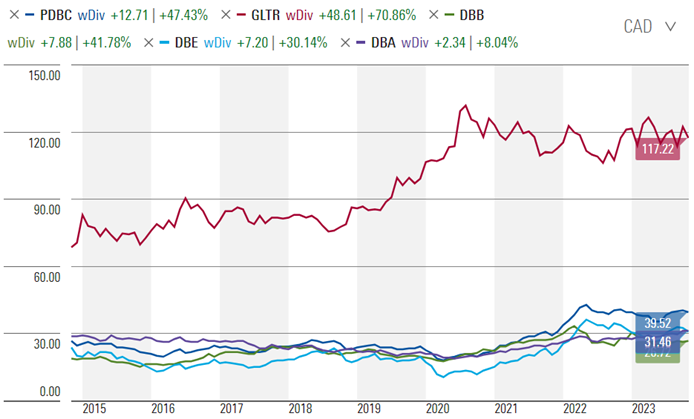

The impact of currency exchange rates can be dramatic since most commodities are traded in U.S. Dollars. For example, in Canadian dollar terms, none of these U.S. dollar-based ETFs have negative total returns as the U.S. dollar strengthens.

Right! That does it for the commodity asset class. Next, we’ll delve into alternative investments.

Alternative Investments

Alternative investments include Hedge Funds, Private Equity, Collectibles, and Cryptocurrency. These assets are characterized by risk profiles that are orders of magnitude larger than cash and cash equivalents, bonds, stocks, real estate, and commodities.

As a result of their risk profiles, owning them requires sophisticated financial knowledge or advice and investing experience. In addition to the enormous profits they could deliver, some of these assets are also non-correlated with stocks and bonds and can help diversify asset portfolios.

Let’s take a closer look at the different alternative assets.

Hedge Funds

Hedge Funds are limited partnerships of private investors whose pooled funds are managed by professional fund managers who employ various risky strategies (e.g., leveraging or trading of non-traditional assets) to pursue above-average returns. They are a risky alternative investment choice and usually require a high minimum investment or net worth.

Hedge fund returns rely on the fund manager’s skill, like the famous Bill Ackman of Pershing Square Capital Management. And they are meant to have little correlation with the stock and bond markets.

So, diversification and outperformance are what hedge funds promise. But do hedge funds consistently keep this promise, on average?

A 2022 study by Javier Estrada showed that straightforward two-fund or two-ETF strategies, based on stocks and bonds, outperformed hedge funds in absolute and risk-adjusted returns over the last 10, 15, and 20 years. Worse still, the study found that hedge funds were highly correlated with equities by up to 89%, 85%, and 83% in the last 10, 15, and 20 years, respectively.

Javier’s research used the HFRI Institutional Equity Hedge Index as a basis for hedge fund performance. It showed that hedge funds may not be the best alternative investment.

Private Equity

Private Equity involves investing in non-publicly traded businesses. It appeals to institutional and high net worth investors as returns are not as volatile as or correlated with those of publicly traded equities whose share price fluctuates daily and can see dramatic changes due to their highly liquid nature.

There are three ways to invest in private equity, through:

- Venture capital;

- Mezzanine finance, and;

- Leveraged buyouts.

Venture capitalists invest in startups that they someday hope to either list on a stock exchange through an initial public offering or profitably sell to another company. Peter Thiel’s early investment in Facebook, now Meta Platforms, is an excellent example.

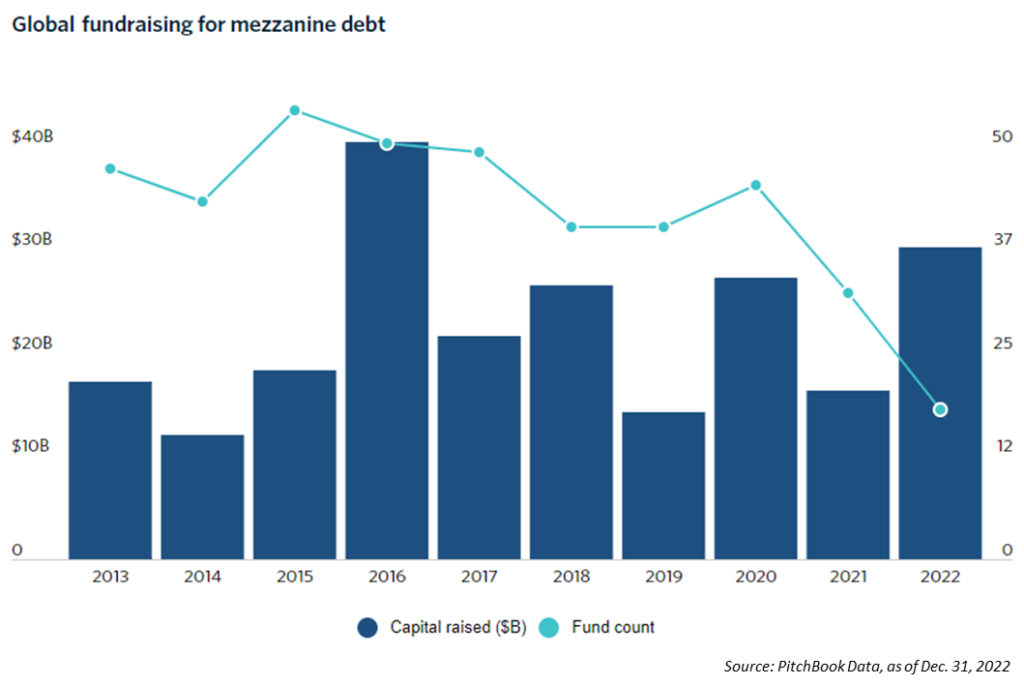

Mezzanine financiers loan funds to late-stage startups or to established private companies that can no longer borrow any more money from their traditional bank credit lines. In exchange, these financiers get the higher coupon rate and subordinated debt of the startup or private firm. This type of financing can be significantly more rewarding than typical corporate debt and often returns between 12% and 20% a year in interest. This chart from the PitchBook shows a renewed interest in mezzanine financing following a slump in 2021.

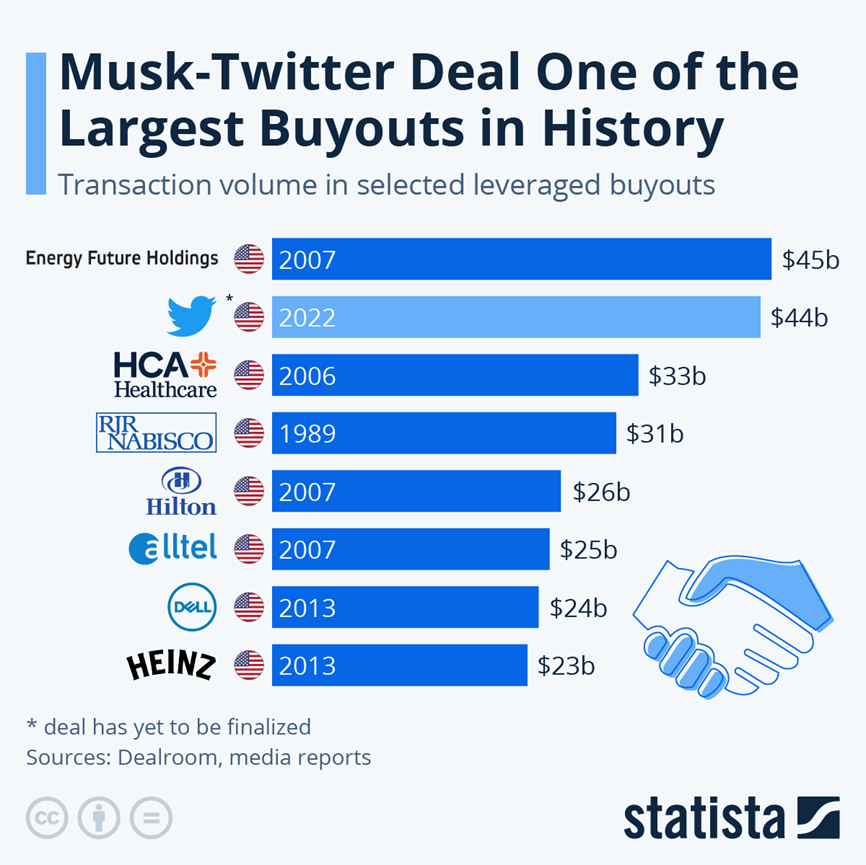

Leveraged buyouts involve taking a publicly traded company private for its stable cash flows. They could also aim to restructure and refloat the acquired business on the public markets at a profit. These deals declined in popularity after the 2008 financial crisis but are becoming more common. Elon Musk’s Twitter acquisition is an excellent example of a recent leveraged buyout.

Collectibles

Collectibles are personal Items worth more now than when they were initially acquired. Examples include artwork, antiques, stamps, coins, trading cards, toys and comic books.

Ideally, collectibles should pique the passion of the collector. The rarer a collectible is, the higher the price it would fetch on the market. Moreover, the value of collectibles tends to increase with time.

They can help diversify portfolios and are fun to hold. For example, driving your vintage car on the weekends as a collector would be thrilling. Besides, they could fetch hefty profits when they are finally sold.

However, investing in collectibles comes with risks:

- Firstly, the collectibles market is plagued by fraud and fakes;

- Secondly, collectibles are fragile, and the slightest damage can wipe out their value;

- Moreover, matching collectibles to buyers who value them as much as you do can be challenging;

- Lastly, storing, securing, and insuring collectibles can be expensive.

Like other asset classes, you profit from collectibles by selling them at a higher price than you originally paid. However, the tax on the sale of collectibles is usually much higher than on stock or bond sales. Plus, you get no dividends or income while holding them for the time they may take to appreciate.

Cryptocurrencies

Cryptocurrencies are digital stores of value or payment systems that don’t rely on central banks or trusted 3rd parties to verify transactions or create new currency units. Instead, they use cryptography to confirm transactions on a publicly distributed ledger called a blockchain.

The first cryptocurrency, Bitcoin, was developed in 2009 by a programmer (or a group of programmers) using the pseudonym Satoshi Nakamoto. Today, over 26,000 different cryptocurrencies publicly trade on exchanges like Binance.

Cryptocurrencies are incredibly volatile. For example, the price of Bitcoin has hit a high of $69,000 and a low of $4,000 in the last five years. So, owning them is not for the faint of heart.

Putting It All Together

Here’s a snapshot of what you now know about asset classes. You can hold many valuable assets, each with a market phase or business cycle where it shines. Nothing should be off the table as long as you look before you leap and do your research and due diligence. If there’s value to exchange and profit to be made, I’m game, and you should feel the same.